Personal Property Tax Forms And Instructions

Found 7 free book(s)FP-31 District of Columbia Personal Property Tax Instructions

mytax.dc.govThere is no tax due if the value of your personal property is $225,000 or less, however, you still must file the return. _____ Which other DC personal property tax forms may be filed? • Railroad Tangible Personal Property Return, Form FP-32; • Rolling Stock Tax Return, Form FP-34; • Extension of Time to File DC Personal Property TaxReturn ...

Kentucky Inheritance and Estate Tax Forms and Instructions

revenue.ky.govInheritance and Estate Tax Forms and Instructions For Dates of Death on or After January 1, 2005 (Revised February, 2018) ... decedent did not possess any power to appoint any real or personal property or have the use of any qualified terminable interest property, and (6) the decedent had not received any real or personal property from another ...

2020- 540 booklet - CALIFORNIA 540 Forms & Instructions ...

www.ftb.ca.govPersonal Income Tax Booklet 2020 . Page 3. Do I Have to File? Steps to Determine Filing Requirement. Step 1: Is your gross income (all income received from all sources in the form of money, goods, property, and services that are not exempt from tax) more than the amount shown in the California Gross Income chart

Attach one or more Forms 8283 to your tax return if you ...

www.irs.govSee your tax return instructions. Section A. Donated Property of $5,000 or Less and Publicly Traded Securities— List in this section . only . an item (or groups of similar items) for which you claimed a deduction of $5,000 or less. Also list publicly traded securities and certain other property even if the deduction is more than $5,000 (see ...

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govminimum tax of each member of the combined group that is subject to the MTA surcharge that is value of all its real and tangible personal property. In the instance of included on Form CT-3-A, Part 2, line 4b. If line 4 is less than line 7, go to line 13a. If line 4 is greater than or equal to line 7, continue with line 8a.

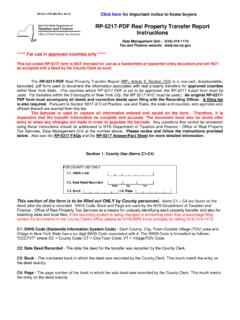

RP-5217-PDF Real Property Transfer Report Instructions

www.tax.ny.govusing these instructions should be addressed to NYS Department of Taxation and Finance - Office of Real Property Tax Services, Data Management Unit at the number above. Please review and follow the instructions provided below. Also see the . RP-5217 FAQs. and the . RP-5217 Answer/Fact Sheet for more detailed information.

Property Tax Credit MI-1040CR Instructions

www.michigan.govproperty taxes any refund of property taxes received in 2020 that was a result of a corrected tax bill from a previous year. Do not include: • Delinquent property taxes (e.g., 2019 property taxes paid in 2020) • Penalty and interest on late payments of property tax • …