Re Tirement

Found 9 free book(s)Texas County & District Retirement System (TCDRS) and ...

hrrm.harriscountytx.govpersonal account balance and “multiple matching credit” at re tirement. There is an optional plan provision that would allow “partial” lump-sum distributions in any amount up to the entire balance of your personal account, excluding the “multiple matching credit”, resulting in a lower monthly retirement benefit amount based on the

Purchasing Service Credit Teachers’ Pension and Annuity ...

www.nj.govNote: For PERS and PFRS members, Local Re-tirement System Service is a full-cost purchase. For TPAF members, Local Retirement System Service is a shared-cost purchase. Layoff (PFRS only) Members of the PFRS who were laid off and were in good standing at the time of separation from em-ployment (not released for misconduct or delinquen-

Retirement PERS and TPAF Pension Options Public ... - State

www.state.nj.usefits equal to the amount that you paid into the re-tirement system while you were employed (including interest on those contributions), the balance of your contributions will be paid to your named beneficiary. OPTIONS A, B, C, AND D Under Options A, B, C, or D you receive a smaller monthly benefit than that provided under the Max-

[PUBLISH] In the United States Court of Appeals

media.ca11.uscourts.govqualify as exempt. In reply, Hoffman maintained that all of his re-tirement accounts are legally exempt. Specifically regarding the Roth IRAs, Hoffman asserted that theyeither were excluded from the estate pursuant to .C. 11 U.S§ 541(c)(2), or, if not excluded, 1 One of the many forms a debtor has to complete when filing for bankruptcy

Annuity Plans Tax-Sheltered - IRS tax forms

www.irs.govfor tax-free rollover treatment to an eligible re-tirement plan. You have 3 years from the day af-ter the date you received a qualified COVID-19 distribution to make a repayment. The amount of your repayment can't be more than the amount of the original distribution. Amounts that are repaid are treated as a trustee-to-trustee

(IRAs) Page 1 of 61 7:33 - 3-Jan-2022 to Individual ...

www.irs.govtax-favored withdrawals and repayments from certain re-tirement plans for taxpayers who suffered an economic loss as a result of a qualified disaster. A qualified disaster includes a major disaster that was declared by Presiden-tial Declaration that is dated between January 1, 2020, and up to February 25, 2021. However, in order to qualify

Taxation of - Government of New Jersey

www.nj.govtaxed contributions is determined, in part, by your re - tirement date: If you retired before August 1, 1986 — you were able to fully recover your contributions before hav-ing to pay tax on your benefits. Once you recovered your contributions, your benefits became fully tax-able. The exception is if you did not fully recover your

SUPREME COURT OF THE UNITED STATES

www.supremecourt.governs the conduct of respondents, who administer several re-tirement plans on behalf of current and former employees of Northwestern University, including petitioners. In this case, petitioners claim that respondents violated their duty of prudence by, among other things, offering needlessly expensive investment options and paying exces-

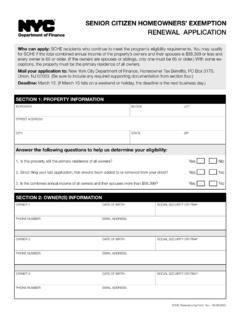

RENEWAL APPLICATION - New York City

www1.nyc.govSep 29, 2020 · but is not limited to, federal or state income tax returns with all schedules, W2s, 1099s, Social Security statements, and re-tirement benefits. 2. Supply the following only if there has been a change since you filed your last application.

![[PUBLISH] In the United States Court of Appeals](/cache/preview/3/2/0/7/4/d/b/c/thumb-32074dbc3002016483617adcd0a73650.jpg)