Reminders Tax

Found 6 free book(s)Instructions for Form N-11 Rev 2021

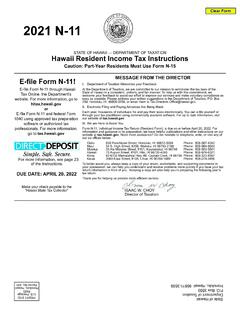

files.hawaii.govImportant Reminders File and Pay on Time • Please fi le your return and pay your taxes by April 20, 2022. ... To request tax forms by mail, you may call 808-587-4242 or toll-free 1-800-222-3229. Page 4 Form N-11 — General Instructions Guidelines for Filling in Scannable Forms

2018 I-111 Form 1 Instructions - Wisconsin Income Tax

www.revenue.wi.govstate tax return online for FREE. Click on WI file to get started! REMINDERS IRS Adjustments – If the IRS adjusted any of your federal income tax returns, you must notify the department within 90 days of any adjustment that affects your Wisconsin income tax returns. See page 8.

Homeowners Information for Tax - IRS tax forms

www.irs.govthe Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instruc-tions, and publications. Don’t send tax ques-

2020 Publication 15-A - IRS tax forms

www.irs.govor the Combined Federal Income Tax, Employee Social Security Tax, and Employee Medicare Tax Withholding Tables. New Form 1099-NEC. There is a new Form 1099-NEC to report nonemployee compensation paid in 2020. The 2020 Form 1099-NEC will be due February 1, 2021. For nonemployee compensation paid in 2019, continue to use

2021 Oregon Income Tax

www.oregon.govFederal tax law No extension to pay. Oregon doesn’t allow an exten-sion of time to pay your tax, even if the IRS allows an extension. Your 2021 Oregon tax is due April 18, 2022. Federal law connection. Oregon has a rolling tie to changes made to the definition of federal taxable income, with the exceptions noted below. For all other

Wisconsin Tax Bulletin - Wisconsin Department of Revenue

www.revenue.wi.gov3 Back to Table of Contents Wisconsin Tax Bulletin 212 – February 2021 • The following sections of Division U of P.L. 115-141: o Section 101(d) relating to bonus depreciation