Retirement Plans What To Do

Found 11 free book(s)Income – Retirement Income

apps.irs.govWhat do I need to know about retirement income distributions? Retirement plans are funded by either before-tax or after-tax contributions. “Before-tax” simply means that the employee did not pay taxes on the money at the time it was contributed, i.e., the taxpayer has no cost basis in the plan.

Compensation—Retirement Benefits (Topic 715)

asc.fasb.orgCompensation—Retirement Benefits—Defined Benefit Plans—General Disclosure > Disclosures by Public Entities 715-20-50-1 An employer that sponsors one or mo re defined benefit pension plans or one or more defined benefit other postretirement plans shall provide the following information, separately for pension plans and other postretirement

2022 Form 1099-R - IRS tax forms

www.irs.govGenerally, distributions from retirement plans (IRAs, qualified plans, section 403(b) plans, and governmental section 457(b) plans), insurance contracts, etc., are reported to recipients on Form 1099-R. Qualified plans and section 403(b) plans. If your annuity starting date is after 1997, you must use the simplified method to figure your

CHOOSING A RETIREMENT SOLUTION

www.irs.govretirement depends on the funding of the IRA and the earnings (or losses) on those funds. Defined contribution plans are employer-established plans that do not promise a specific benefit at retirement. Instead, employees or their employer (or both) contribute to employees’ individual accounts under the plan, sometimes at a set rate (such as 5

Business for Small Plans - IRS tax forms

www.irs.govfrom an eligible retirement plan made on or after January 1, 2020, and before December 31, Department of the Treasury Internal Revenue Service Publication 560 Cat. No. 46574N Retirement Plans for Small Business (SEP, SIMPLE, and Qualified Plans) For use in preparing 2020 Returns Get forms and other information faster and easier at: •IRS.gov ...

Employee Benefits in the United States - March 2021

www.bls.gov• Retirement benefits were available to 92 percent of workers, with a take-up rate of 89 percent. Seventy-five percent of workers participated in defined benefit plans and 18 percent participated in defined contribution plans. • Long-term disability benefits were available to 39 percent of workers, with a take-up rate of 97 percent.

FAQs on SSA Potential Private Retirement Benefit Information

www.dol.govrequires that retirement plans fund promised benefits adequately and keep plan assets separate from the employer’s business assets. The funds must be held in trust or invested in an insurance contract. The employers’ creditors cannot make a claim on …

Retirement Improvement and Savings Enhancement (RISE) …

edlabor.house.govNov 05, 2021 · • Allows 403(b) retirement plans to participate in multiple employer plans and pooled employer plans. • Ensures more part-time workers are offered opportunities to join retirement savings plans. • Clarifies rules regarding the recovery of inadvertent overpayments to retirees, minimizing hardships.

TEACHERS’ AND STATE EMPLOYEES’ RETIREMENT SYSTEM

benefits.hr.ncsu.eduThe TSERS is a defined benefit retirement plan established to provide retirement benefits for teachers and state employees in North Carolina. Both the employee and employer share in the cost. A pre-defined formula is used to calculate the retirement benefit amount . Eligibility for retirement is based on age and years of retirement service credit.

Retirement Plans for Small Businesses - DOL

www.dol.govSEP Retirement Plans for Small Businesses is a joint project of the U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) and the Internal Revenue Service. To view this and other EBSA publications, visit the agency’s

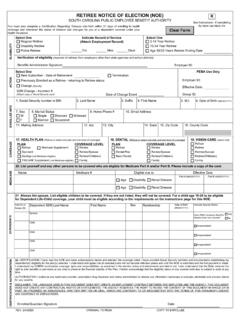

RETIREE NOTICE OF ELECTION (NOE) R SOUTH CAROLINA …

www.peba.sc.govACTION: If you are enrolling as a retiree for the first time, check New Subscriber and enter your date of retirement.If you are already enrolled as a retiree and are making a change, check Change and indicate the type of change and date of the event causing the change.