State income

Found 9 free book(s)BASES OF STATE INCOME TAXATION OF NONGRANTOR …

www.actec.orgBASES OF STATE INCOME TAXATION OF NONGRANTOR TRUSTS Richard W. Nenno, Esquire Senior Trust Counsel and Managing Director Wilmington Trust Company

2017 M1CR, Credit for Income Tax Paid to Another State

www.revenue.state.mn.us2017 Schedule M1CR Instructions a Minnesota resident by filing that state’s income tax return with that state. However, if you paid 2017 income tax to

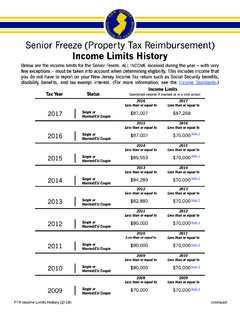

Property Tax Reimbursement Income Limits History

www.state.nj.us1The State Budgets for FYs 2017 and 2018 set the following qualifications for Senior Freeze payments: Applicants were eligible only if their total income was $70,000 or less (the original limit was $87,007), and they met all the other

Washington State Institute for Public Policy

www.wsipp.wa.gov4 II. Early Childhood Education for Low-Income Children The impact of ECE for low-income children has been studied since the 1960s when model

State Income Taxes: Are You Withholding Correctly?

wmac-apa.org3 Multi-State Income Taxation: For Which State Must You Withhold? If your company has operations in more than one state, you may be faced with income

State Income Tax Withholding QUICK REFERENCE For DLJSC ...

www.netxpro.comTRADITIONAL IRA, SEP, SIMPLE, AND ROTH IRA FEDERAL AND STATE INCOME TAX WITHHOLDING INSTRUCTIONS In most cases, federal and state income tax law requires that we withhold tax from your distribution.

STATE PERSONAL INCOME TAXES ON PENSIONS AND ... - …

www.ncsl.orgNational Conference of State Legislatures April 2015 Prevalence of retirement income exclusions Of the 50 states, seven–Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming–do not levy a personal income tax.

Income Tax Fact Sheet 1, Residency - revenue.state.mn.us

www.revenue.state.mn.usThis fact sheet explains Minnesota residency and how income is taxed by Minnesota. Minnesota residents must pay Minnesota tax on taxable income

NJ-WT - New Jersey Gross Income Tax Withholding Instructions

www.state.nj.us5 NJ-WT July 2018 . Generally, if an item is considered employee compensationfor federal Income Tax withholding, it is subject to New Jersey Income Tax withholding.

Similar queries

STATE INCOME TAXATION OF NONGRANTOR, STATE INCOME TAXATION OF NONGRANTOR TRUSTS, Income, State, Property Tax Reimbursement Income Limits History, State Income Taxes: Are You Withholding Correctly, State income, State Income Tax Withholding QUICK, STATE INCOME TAX WITHHOLDING, New Jersey, New Jersey Income