Tax File

Found 4 free book(s)Handbook for Authorized IRS e-file - IRS tax forms

www.irs.gove-file. Providers of Individual Income Tax Returns replaces the previous edition revised February 2021. This publication continues to address only the rules and requirements for participation in IRS . e-file . by Authorized IRS . e-file. Providers (Providers) filing individual income tax returns and related forms and schedules.

Who Must File You must file a New Jersey income tax return if–

www.nj.govIf New Jersey income tax was withheld from your wages, you must file a New Jersey nonresident return to obtain a refund. To stop the with-holding of New Jersey income tax, complete a New Jersey Certificate of Nonresidence (Form NJ-165) and give it to your employer. You may obtain Form NJ-165 by calling our Tax Hotline.

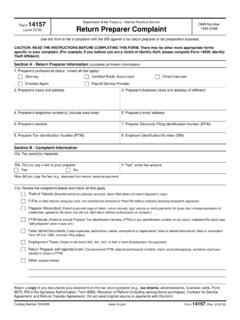

14157 (June 2018) Return Preparer Complaint - IRS tax forms

www.irs.govUse Form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use this form to report events that impact their PTIN or business. Individuals who are paid to prepare federal tax returns must follow ethical standards and guidelines as established in Treasury Department Circular 230.

This form is not yet available for the 202 tax year

www.tax.ny.govThis form is not yet available for the 2021 tax year . Author: a46574 Created Date: 12/2/2020 3:12:23 PM ...