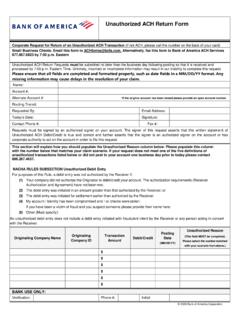

Unauthorized Ach Return Form Corporate

Found 6 free book(s)Unauthorized ACH Return Form - Bank of America

promo.bankofamerica.comUnauthorized ACH Return Form Corporate Request for Return of an Unauthorized ACH Transaction (if not ACH, please call the number on the back of your card) Small Business Clients: Email this form to ACHforms@bofa.com. Alternatively, fax this form to Bank of America ACH Services 877.867.6823 by 7:00 p.m. Eastern

QUICK GUIDE Automated Clearing House (ACH) Rules for …

www.hillcrestbank.comAutomated Clearing House (ACH) Rules for ACH Originators Direct Deposit Payroll Authorizations (Consumer) • Use a direct deposit authorization form that collects employee account information. This form should allow the company to ... ODFI agrees to accept a return of an unauthorized corporate entry after the 24 hour deadline CCD & CTX 24 ...

ACH QUICK REFERENCE GUIDE For ACH Originators

capitalbankmd.comAn exception to the 24-hour rule is consumer unauthorized returns, which may be returned within 60 days of the settlement date. The use of consumer (PPD) or corporate (CCD) entry codes determines the applicable ACH return rules. The ACH Rules require that Originators must cease the origination of any ACH debit

Form W-9 (Rev. October 2018) - IRS tax forms

www.irs.govIf you do not return Form W-9 to the requester with a TIN, you might be subject to backup withholding. See . What is backup withholding, later. Cat. No. 10231X. Form . W-9 (Rev. 10-2018) Form W-9 (Rev. 10-2018) Page . 2 By signing the filled-out form, you: 1. Certify that …

Virginia Tax Electronic Payment Guide

www.tax.virginia.govPrior to initiating an ACH Debit transaction, notify your bank that Virginia Tax is authorized to debit your bank account. Some banks use a "filter", which prevents unauthorized debits against a customer's account. If your bank requests a filter number or Company ID for the debit transactions, call (804) 367-0644 to obtain this number.

Chase Deposit Account Agreement (PDF)

www.chase.comAn automatic electronic deposit made through the ACH network to your account by someone else, such as an employer issuing payroll or a . government paying benefits. Item: Any check, ACH, funds transfer, online banking transaction, wire transfer, teller cash withdrawal, ATM withdrawal, debit card purchase, fee, charge or other instruction for

Similar queries

Unauthorized ACH Return Form, Bank of America, Unauthorized ACH Return Form Corporate, Return, Unauthorized ACH, Form, Bank of America ACH, QUICK GUIDE Automated Clearing House (ACH) Rules, Automated Clearing House (ACH) Rules, Unauthorized corporate, Unauthorized, Corporate, ACH return, IRS tax forms, Return Form, Virginia Tax Electronic Payment Guide, Virginia, Chase