Search results with tag "Transfer tax"

Real Estate Customs by State Yes No Customary Standard Fee ...

www.republictitle.comLocal Transfer Tax Transfer Tax Recordation Tax Real Estate Transfer Tax must be accompanied by Real Estate Transfer Tax Declaration Form State Conveyance Tax Certificate Form must accompany Deeds, Leases & Assignments thereof, and Agreements of Sale Documentary Stamp Tax plus surtax (in Miami-Dade County) State, County and in some …

NCSL TABLE REAL ESTATE TRANSFER TAXES - MidPoint

midpointtitle.comimplements a transfer tax can have a tax rate that is half of the county rate, $.275/$500, and the city tax can be applied as a credit against the county tax. Real estate instrument recording fee: up to $10 Transfer tax: $.01/$100 0.01% TABOR prohibits new or increased local transfer tax rates that were not in existence prior to Jan. 14, 1993.

Mauritius Highlights 2020 - Deloitte

www2.deloitte.comPayroll tax – There is no specific payroll tax, but employers must withhold tax from employees’ salaries under the PAYE system. Capital duty – There is no capital duty. Real property tax – Mauritius does not levy real property tax. Transfer tax – Transfer taxes may apply on the transfer of certain assets.

SDAT Agricultural Transfer Tax - Maryland

dat.maryland.govAgricultural Transfer Tax Statement provides the total amount that will be due upon transfer. The tax is collected by the local County Finance or Treasurer’s Office. State Law (Sections §13-301 through §13-308 of the Tax-Property Article) provides the statutory framework for the Agricultural Transfer Tax and Surcharge.

Controlling Interest Transfer Tax - New Jersey

www.state.nj.usControlling Interest Transfer Tax A new tax was enacted in July, 2006 imposing a transfer tax of 1% on certain transfers of controlling interest

Information Sheet TRANSFER TAX EXEMPTIONS UNDER …

ccr.saccounty.govInformation Sheet TRANSFER TAX EXEMPTIONS . UNDER REVENUE & TAXATION CODE . Following is a list of real estate transactions that are exempt from documentary transfer tax under sections 11911-11930 of the Revenue and Taxation (R&T) Code. When a transaction is exempt, the reason for the exemption must be noted on the document.

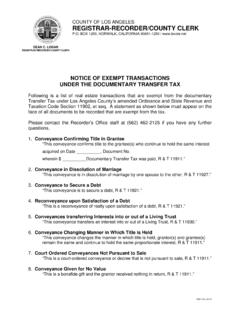

Documentary Transfer Tax Statutes - Los Angeles County ...

www.lavote.netUNDER THE DOCUMENTARY TRANSFER TAX Following is a list of real estate transactions that are exempt from the documentary Transfer Tax under Los Angeles County’s amended Ordinance and State Revenue and Taxation Code Section 11902, et seq. A statement as shown below must appear on the face of all documents to be recorded that are exempt from the ...

NYC-RPT / Real Property Transfer Tax Return

www.judicialtitle.comNYS REAL ESTATE TRANSFER TAX PAID NYC RPT NEW YORK CITY DEPARTMENT OF FINANCE REAL PROPERTY TRANSFER TAX RETURN (Pursuant to Title 11, Chapter 21, NYC Administrative Code) TYPE OR PRINT LEGIBLY If the transfer involves more than one grantor or grantee or a partnership, the names,

US estate and gift tax rules for resident and nonresident ...

www2.deloitte.comUS estate and gift tax rules for resident and nonresident aliens 9 Generation-skipping transfer tax (GST tax), if applicable, is imposed in addition to estate or gift taxes. It is imposed on US taxable gifts and bequests made to or for the benefit of persons who are two or more generations below that of the donor, such as a grandchild.

Information Sheet TRANSFER TAX EXEMPTIONS UNDER …

www.ccr.saccounty.netADMINISTRATIVE SERVICES COUNTY CLERK/RECORDER Information Sheet TRANSFER TAX EXEMPTIONS . UNDER REVENUE & TAXATION CODE . Following is a list of real estate transactions that are exempt from documentary transfer tax

State and local tax update - EY - United States

www.ey.comPage 1 2015 REIT CFO and Tax Director Roundtable Agenda State income tax considerations State franchise tax considerations State real estate transfer tax considerations

Annual federal limits relating to tax and financial ...

mlaem.fs.ml.comestate, gift & gst tax Annual gift tax exclusion $16,000 Annual non-US citizen spouse gift tax exclusion $164,000 Estate/generation skipping/lifetime gift exemption $12,060,000 Maximum marginal transfer tax rates 40% reportni g levels — foreign gifts received by us person (§6039f) From NRA or foreign estate (see IRS Notice 97-34) $100,000

MAINE REAL ESTATE TRANSFER TAX DECLARATION 00 …

www.maine.govc): If either party is claiming an exemption from the transfer tax, check this box and enter an explanation of the reason for the claim. See 36 M.R.S. § 4641-C for a list of exemptions. Line 7. Date of transfer. Enter the date of the property transfer, which refl ects when the ownership or title to the real property is delivered to the purchaser.

California City Documentary and Property Transfer Tax Rates

www.californiacityfinance.comCalifornia City Documentary and Property Transfer Tax Rates Governance: Per $1000 Rev&Tax Code Per $1000 General Law PropertyValue Sec 11911-11929 PropertyValue

State Real Estate Transfer Tax - michigan.gov

www.michigan.govHomestead Property 32. Is a transfer of principal residence for which a principal residence exemption is claimed under the School Code of 1976 or the State Education Tax Act exempt under MCL 207.526(u) of …

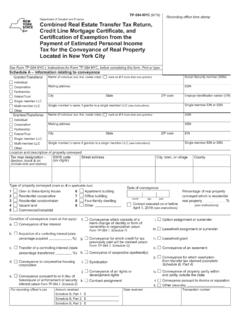

Form TP-584:4/13:Combined Real Estate Transfer Tax Return ...

www.tax.ny.govPage 2 of 4 TP-584 (4/13) Part III – Explanation of exemption claimed on Part I, line 1 (check any boxes that apply) The conveyance of real property is exempt from the real estate transfer tax for the following reason: a. Conveyance is to the United Nations, the United States of America, the state of New York, or any of their instrumentalities,

2796, Application for State Real Estate Transfer Tax ...

www.michigan.govMichigan Department of Treasury 2796 (Rev. 09-18) Application for State Real Estate Transfer Tax (SRETT) Refund Issued under authority of Public Act 330 of 1993.

TP-584 New York State Department of Taxation and …

www.judicialtitle.comNew York State Department of Taxation and Finance Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the

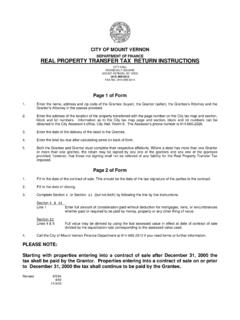

DEPARTMENT OF FINANCE REAL PROPERTY TRANSFER TAX …

cmvny.comcity of mount vernon department of finance city hall roosevelt square mount vernon, ny 10550 real property transfer tax return pursuant to chapter 234 of the code of the city of mount vernon, ny (grantee/buyer)_____|

New York State Department of Taxation and Finance TP …

www.adamslawgroup.comNew York State Department of Taxation and Finance Instructions for Form TP-584 New York State Combined Real Estate Transfer Tax Return and Credit Line Mortgage Certificate

TP-584 New York State Department of Taxation and …

www.judicialtitle.comNew York State Department of Taxation and Finance Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the

Form TP-584-NYC:9/19:Combined Real Estate Transfer Tax ...

www.tax.ny.govPage 2 of 4 TP-584-NYC (9/19) Part 4 – Explanation of exemption claimed on Part 1, line 1 (mark an X in any boxes that apply) The conveyance of real property is exempt from the real estate transfer tax for the following reason: a. Conveyance is to the United Nations, the United States of America, New York State, or any of their instrumentalities,

Indiana County Recorder of Deeds

www.indianacountypa.govOne (1) for the 1% Municipal Transfer Tax, and One (1) for the 1% State Transfer Tax. 13. Any assignment cannot reference more than 10 notations on a single document. 14. A UPI (uniform parcel identifier)number must be on all documents that deal with real estate. This is an 8+digit number Ex. 00-000-000. Uniform Parcel Identifier

SB2 Master - Kern County Assessor

www.assessor.co.kern.ca.usRECORDING REQUESTED BY: This page has been added to provide adequate space for recording information Documentary Transfer Tax $_____ Computer on full value of property conveyed, or

SUPPLEMENT NO. 3 DATED JULY 2, 2018 TO THE …

www.oregoncollegesavings.comFederal Gift, Estate and - Generation-Skipping Transfer Tax Treatment: OREGON COLLEGE SAVINGS PLAN Disclosure Booklet TFI

PENNSYLVANIA DEPARTMENT OF REVENUE …

www.phila.govjune 2009 . pennsylvania department of revenue . realty transfer tax . common level ratio (clr) real estate valuation factors . for . philadelphia county

Transfer Tax Exemptions - Kern County Assessor

www.recorder.co.kern.ca.usDOCUMENTARY TRANSFER TAX EXEMPTIONS FOR KERN COUNTY, CALIFORNIA Kern County Recorder’s Office, 1655 Chester Avenue, Bakersfield, California 93301 – (661) 868-6400. IF NOT COVERED BY AN ACCEPTABLE EXEMPTION, TRANSFER TAX IS DUE

Similar queries

Transfer Tax Transfer Tax, TRANSFER TAX, Capital, Transfer, SDAT Agricultural Transfer Tax, Property, Controlling Interest Transfer Tax, New Jersey, Controlling interest, Information Sheet TRANSFER TAX EXEMPTIONS UNDER, Information Sheet TRANSFER TAX EXEMPTIONS . UNDER REVENUE & TAXATION CODE, ESTATE TRANSFER TAX, Estate, Information Sheet TRANSFER TAX EXEMPTIONS . UNDER REVENUE, State and local tax update, Skipping, MAINE REAL ESTATE TRANSFER TAX DECLARATION, Property transfer, Real, TP-584, Real property, York State Department of Taxation and, York State Department of Taxation, Indiana County Recorder of Deeds, Real estate, OREGON COLLEGE SAVINGS PLAN Disclosure Booklet, Pennsylvania department of revenue, Real estate valuation, TRANSFER TAX EXEMPTIONS