Search results with tag "Liquidating"

Current and Liquidating Distributions - taxtaxtax.com

taxtaxtax.com1 Current and Liquidating Distributions OVERVIEW The basic principle underlying the tax treatment of partnership distributions is that the distribution should be tax ...

Instructions for Form 926 (Rev. November 2018)

www.irs.govliquidating corporations. A domestic liquidating corporation must file a Form 926 with respect to a distribution of property in complete liquidation under section 332 to a foreign distributee corporation that meets the stock ownership requirements of section 332(b). If the distribution qualifies for the exception in Regulations section 1.367(e ...

RLA Article Liquidating a Sole Proprietorship

www.reallifeaccounting.comCopyright © 2008 John W. Day 1 . THEME: Liquidating a Sole Proprietorship By John W. Day ACCOUNTING TERM : Sole Proprietorship A sole proprietorship is an ...

Basel III: Post-Crisis Reforms - Deloitte

www2.deloitte.comliquidating trade letters of credit Direct credit substitutes and other exposures CCF 10% 40% 50% 50% 20% 100% ADC Exposures Risk Weight Loan to Company / SPV 150% Residential ADC Loan 100% Capital Ratios 4.5% 6% 8% 2.5% 2.5% 0% - 2.5% 2.5% 0% - 2.5% 0% - 2.5% Countercyclical Buffer Conservation Buffer Minimum Capital Requirement

Mutual Fund Transfer - T. Rowe Price

www.troweprice.comLiquidating a CD prior to maturity may result in an early withdrawal penalty. In order to transfer at the maturity date, this form must be received 15–30 days prior to maturity. B: Liquidation—Transfer Dollar Amount or Number of Partial Shares Listed Below: 1. Investment Name Account Number/Plan ID: Dollar

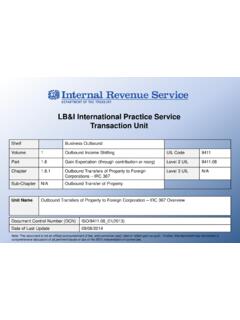

LB&I International Practice Service Transaction Unit

www.irs.govSep 08, 2014 · 1 to USP as a liquidating distribution pursuant to IRC 361(c) as part of the reorganization. USP, the shareholder, exchanges its USS stock (cancelled) for the CFC stock received from USS. USS ceases to exist.

Capital Accounts: 704(b) vs. GAAP vs. Tax Basis, Comparing ...

s3.us-east-1.amazonaws.comJun 01, 2021 · 2. Liquidating distributions made in accordance with positive Section 704(b) Capital Accounts; and 3. In lieu of a DRO, the partnership agreement contains a Qualified Income Offset (“QIO”) provision. Economic Effect Equivalence. Partnership agreement does not satisfy the General or Alternate Test of economic effect.

PAYCHECK PROTECTION PROGRAM (PPP) INFORMATION …

home.treasury.gov• Someone who assists a lender with originating, disbursing, servicing, liquidating, or . litigating SBA loans; • A loan broker; or • Any other individual or entity representing an applicant by conducting business with the SBA. How will agents be compensated? Agent fees will be paid out of lender fees. The lender will

Structuring Redemptions of Partnership and LLC Interests ...

media.straffordpub.comJun 14, 2017 · Structuring Redemptions of Partnership and LLC Interests: Navigating Issues Unique to Liquidating Distributions IRC 754 Elections, Section 736(b) Payments, Character and Timing of Gain, Installment Sales, and More ... Sale of an interest in a partnership owning real estate will trigger unrecaptured

1035 exchange, rollover or transfer - John Hancock Financial

www.johnhancock.comCurrent year’s required minimum distribution calculated by previous carrier: $ 4. Special instruction if liquidating surrendering account. ... professional before requesting any distributions during this period.

Roth IRA Conversion - Fidelity Investments

www.fidelity.comIRA. If a liquidating trade is necessary, go to Fidelity.com or call a Fidelity representative. Full Conversion in kind Convert the entire balance of your IRA to your Roth IRA. The conversion will be based on the existing positions in your IRA on the date of the conversion; the IRA will be closed and any residual income on the existing ...

CHAPTER 18 Dividend and Other Payouts

homepage.ntu.edu.twb. distributions. c. share repurchases. d. payments-in-kind. e. stock splits. Difficulty level: Easy REGULAR CASH DIVIDENDS c 3. A cash payment made by a firm to its owners in the normal course of business is called a: a. share repurchase. b. liquidating dividend. c. regular cash dividend. d. special dividend. e. extra cash dividend.

Similar queries

Current and Liquidating Distributions, Liquidating, Liquidating a Sole Proprietorship, Sole Proprietorship A sole proprietorship, Transfer, Structuring Redemptions of Partnership and, Structuring Redemptions of Partnership and LLC Interests: Navigating Issues Unique to Liquidating Distributions, Real estate, 1035 exchange, rollover, John Hancock Financial, Current, Distributions, Roth IRA Conversion, Fidelity Investments