Search results with tag "Orth"

orth merican teel onstruction onference Rules of Thumb …

www.aisc.orgfor “Rules of Thumb” and approximate methods, several steel framing “Rules of Thumb” are presented in this paper. In general, these rules of thumb are service-load based, which simplifies their applica-tion. Formal checks can then be made with factored loads and LRFD or service loads and ASD in the final design. Structural DDepths:

2021 Form 5498

www.irs.govRoth IRA conversion amount $ 4 . Recharacterized contributions $ 5 . FMV of account $ 6 . Life insurance cost included in box 1 $ 7. IRA. SEP. SIMPLE Roth IRA. 8 . SEP contributions $ 9 . SIMPLE contributions $ 10 . Roth IRA contributions $ 11 . Check if RMD for 2022. 12a . RMD date. 12b . RMD amount $ 13a . Postponed/late contrib. $ 13b . Year ...

IRA Distribution Request for Withdrawal, Rollover or ...

www.chase.comyou to write your name and account number on each page when you print the form. What you need to know • Authorize a one-time withdrawal from your J.P. Morgan Securities LLC (“JPMS”) Roth or Traditional Individual Retirement Account ("IRA") …

Roth IRA Conversion - Fidelity Investments

www.fidelity.comdistributions from retirement accounts are subject to the highest marginal tax rate. If you are exempt from state tax, you have the option to elect out of state tax withholding. Otherwise, penalties may apply. The penalty for reporting false information is a fine of not more than $5,000, imprisonment for not more than five years, or both.

TSP-60, Request For a Transfer Into The TSP

www.waed.uscourts.govTHRIFT SAVINGS PLAN TSP-60 REUESt fo R a tRanSfER Into tHE tSp FORM TSP-60 (10/2012) Use this form to request a transfer or to complete a rollover of tax-deferred money from an eligible retirement plan into the traditional (non-Roth) balance of your Thrift Savings Plan (TSP) account. Funds received by the TSP will not be invested until a properly completed

Important update for IRA owners - The Vanguard Group

personal.vanguard.comRoth IRA will accumulate on a tax-deferred basis and may ultimately be tax-free if the earnings are part of a “qualified distribution .” (A “qualified distribution” is generally a distribution made to you after age 59½ and after you have held your Roth IRA account at least five

457 401k SPD

www1.nyc.gov457 401(k) Provision Pre-Tax 457 Roth 457 Pre-Tax 401(k) Roth 401(k) Contributions • 2022 annual limit of $20,500; $27,000 if age 50 or older • 2022 annual limit of $20,500; $27,000 if age 50 or older In the 457 Plan, you may choose to make pre-tax contributions and/or Roth (after-tax) contributions. However, the combined deferral cannot

Strategies for Canadians with U.S. retirement plans

www.sunnet.sunlife.comA Roth IRA is similar to a Canadian Tax-Free Savings Account (TFSA). Roth IRA contributions may not be deducted from income, but grow tax-free. As long as the withdrawal rules are obeyed Roth IRA withdrawals are tax-free. Under current law, Roth IRA balances may not be transferred to a TFSA or vice versa. 6. Treaty, Article XVIII.

Withdrawal Request - John Hancock Financial

www.jhannuities.com12-month limit and the risk of tax by requesting a direct transfer from your IRA to another IRA. ¡ Required Minimum Distributions are not eligible to be rolled over. ¡ The limit on indirect rollovers does not apply to a conversion from a traditional IRA to a Roth IRA.

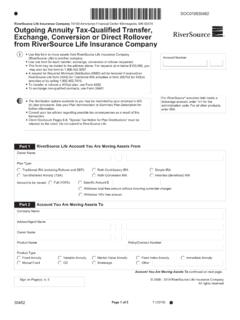

Form 30482 - Request for IRA/Roth ANNUITY Transfer or ...

www.ameriprise.comDirect Conversion from a Traditional, SEP or SIMPLE IRA to a Roth IRA Part 3 Plan Sponsor Information Part 4 Withholding Instructions A direct conversion from a TSA to a Roth IRA results in income tax being due on the taxable portion of the transaction. Please see the Special Tax Notice for Plan Distributions.

Distribution Request from IRA - Wells Fargo Advisors

fa.wellsfargoadvisors.comPayments based on IRC 72(t), convert your Traditional IRA to a Roth IRA, remove an excess contribution, recharacterize a contribution, or request a death claim. Different forms are needed to complete these transactions: • Distributions sent via international wire - complete the International Wire Funds Request from IRA form (592322).

Request for a Roth Transfer Into the TSP

www.tsp.govRoth account from which you are transferring or rolling over. Documentation required. SECTION III. The instructions for Section III are intended for the plan representative. The TSP is a retirement savings and investment plan for federal employees and members of the uniformed services. Congress

Designated Roth Accounts - IRS tax forms

www.irs.govA designated Roth account is a separate account under a 401(k), 403(b) or governmental 457(b) plan: ‧ to which designated Roth contributions are made, and ‧ for which separate accounting of contributions, gains and losses is maintained. Designated Roth Accounts under a 401(k), 403(b) or governmental 457(b) plan

314 Traditional and SIMPLE IRA Withdrawal Authorization (3 ...

iradirect.ascensus.comconversions to a Roth IRA, substantially equal periodic payments, or IRS levy are reported on Form 1099-R using code 2. Certain distributions taken due to federally declared disasters also are reported using code 2. Please refer to the IRS website at www.irs.gov for more information and

State-by-state analysis of IRAs as exempt property Roth ...

www.thetaxadviser.comPartly No The debtor’s right to receive IRAs and Roth IRAs is exempt to the extent reasonably nec-essary for the support of the debtor and any dependent of the debtor. Nevada Nev. Rev. Stat. §21.090(1)(r) Yes Yes The exemption is limited to $500,000 in present value held in an IRA that conforms with Sec. 408 or 408A.

2019 Instructions for Form 5329 - IRS tax forms

www.irs.govIRAs, is more than zero, or the distribution includes a recapture amount subject to the 10% additional tax, or it’s a qualified first-time homebuyer distribution (see Distributions from Roth IRAs, later). • You received a distribution subject to the tax on early distributions from a qualified retirement plan (other than a Roth IRA).

Spousal Claim Form for IRAs

www.fidelity.comthe decedent’s Roth IRA or the end of the 5-Year Aging Period for your own Roth IRA. If you do not have your own Roth IRA, you inherit the decedent’s 5-Year Aging Period. • Understand that the RMD for inherited Roth IRA assets is the same as applied to traditional IRA assets when the original owner dies before the applicable RMD beginning ...

IRA Distribution Form for Traditional, Roth, and SIMPLE IRAs

www.discover.comConversion to a Roth IRA Distributions based on an election to receive substantially equal periodic payments for the greater of a five-year period or until you attain age 59 1/2 IRS Levy . Additional Information. Additional Documents. Applicable law or policies of the IRA custodian/trustee may require additional documentation. A separate ...

Differences between a Roth in-plan conversion and a Roth ...

retirementplans.vanguard.comDifferences between a Roth in-plan conversion and a Roth IRA rollover Roth in-plan conversion Retirement plan to Roth IRA conversion Passed into law The Small Business Jobs Act of 2010 (SBJA) signed into law on September 27, 2010. Modified by The American Taxpayer Relief Act of 2012 (ATRA), signed into law on January 2, 2013.

Summary of the Thrift Savings Plan

www.tsp.govRoth (after-tax) See “A Choice of Tax Treatments” on page 6. Regular employee contributions are payroll deductions that come out of your basic pay before taxes are withheld (traditional contributions) or after taxes have been withheld (Roth contributions). Each pay period, your agency or service will deduct your

The Healing Scriptures - Sid Roth

sidroth.orgFaith—The Key to Experiencing Heaven’s Reward Hebrews 11:6 tells us, But without faith it is impossible to please Him, for he who comes to God must believe that He is, and that He is a rewarder of those who diligently seek Him. Without faith, we cannot please God! For us to receive anything in the Kingdom, from salvation onward, we need ...

Fifth Grade Basic Skills Reading Comprehension and Skills

www.sc45.weebly.com“Thor’s day”! 1. What is the main idea of this story? (Circle the answer) A. Thor was not very smart. B. Thor, a figure from Norse mythology, is still remembered today. C. Thor had a magic hammer. 2. Thor was the god of: (Circle the answer) A. Thursday B. Odin C. war and thunder 3. How was Thor able to double his strength?

IRA Distribution Request Form - TD Ameritrade

www.tdameritrade.comPage 2 of 6 TDA 5 F 04/21 3 ROTH IRA C Normal Distribution (Account Owner has attained age 59½) (Please make a selection below.) C Qualified - Roth IRA has been funded/converted for MORE than five years. C Non-Qualified - Roth IRA has been funded/converted for LESS than five years.. C Premature Distribution (under age 59½) – Exceptions to the 10% penalty must be …

OWNER’S MANUAL - Thor Motor Coach

media.thormotorcoach.comOct 05, 2018 · THO MOTO COACH MADE TO FIT 1 Introduction INTODCTION About This Owner's Manual Thank you for choosing Thor Motor Coach (TMC). This Owner's Manual is intended to help you better understand the features and general operation of your new motorhome. ... your motorhome. TMC Warranty Guide The Thor Motor Coach Limited …

CONTACT INFORMATION RETIREMENT

www.revenue.pa.govIRA Comparison Reference Traditional IRA Roth IRA Are there differences between Pennsylvania and federal tax rules on roll-over contributions and plan conversions? Yes. For federal tax purposes, amounts rolled over into Roth IRAs from traditional IRAs are considered income. Similarly, the conversion of a traditional IRA to a Roth IRA is ...

Roth Conversions/Retirement Planning for Life Events

www.irs.govJan 01, 2010 · Roth IRAs aren’t new, but let me briefly discuss what they are and how they work. A Roth IRA is an account or annuity designated as a Roth IRA. Although you can’t deduct contributions to a Roth IRA, “qualified distributions” from it are tax-free. Some reasons for their popularity are that, unlike a traditional IRA, you can continue to

IRA Distribution Request for Withdrawal, Rollover or ...

static.chasecdn.comRoth IRA. and I have met the 5-year holding period requirement by holding this Roth IRA account at J.P. Morgan and another firm for 5 years or more. (Please provide account statements from your prior firm to prove that you held the Roth IRA for 5 years or more.) This is a . Roth IRA

Roth IRA Conversion Request - Chase

www.chase.com• A Roth conversion is a distribution and is reported as a taxable event to the IRS. Speak to your tax advisor if you have any questions. • Recharacterization is changing a contribution from one type of IRA to another type of IRA. IRS rules do not allow you to recharacterize a Roth IRA contribution that was the result of a conversion ...

The Roth 457 Option - Empower Retirement

htg.empower-retirement.comtraditional 457 may be subject to income taxes. How much can I contribute? The maximum combined contribution limit in 2017 is $18,000. If you are age 50 or older, you can make additional “catch-up” contributions of $6,000. If you are in the three years ending prior to the year you attain normal retirement

IRA/IRRA /Roth IRA/SEP/SRA MERRILL~. - Login

olui2.fs.ml.comIf you are a U.S. citizen with a foreign address, you may not waive the Federal withholding requirement. If you are a Non-Resident Alien, all distributions are subject to a tax treaty rate or 30% tax withholding and you must complete Form W-8BEN. A …

In-Plan Roth Rollovers - IRS tax forms

www.irs.govDec 20, 2010 · In-Plan Roth Rollovers - Background. z. The Small Business Jobs Act of 2010, §2112 permits §401(k) and §403(b) plans to offer in-plan Roth rollovers.

IRA Beneficiary Designation Kit

www.bsgi401k.comSIMPLE IRA SEP–IRA Inherited traditional IRA * Inherited Roth IRA * > Last four digits of Social Security (SSN) number or taxpayer ID number (TIN) Zip code *INFL955281230027* 2 of 4 Form R350 3. Beneficiaries you want to designate Primary beneficiaries Check all that apply.

EUROPEAN NEW CAR ASSESSMENT PROGRAMME (Euro …

cdn.euroncap.com2 INTRUSION MEASUREMENTS 4 2.1 Before Test 4 2.2 After Test 5 3 DUMMY PREPARATION AND CERTIFICATION 7 3.1 General 7 3.2 THOR dummy certification 7 3.3 THOR Dummy preparation 7 3.4 THOR Dummy Test Condition 7 3.5 Hybrid III Dummy Certification 8 3.6 Additions and Modifications to the Hybrid III Dummy 8 3.7 Hybrid III Dummy Clothing and …

Thrift Savings Plan

www.tsp.govThe TSP account that you want to transfer must have a total vested account balance that is greater than $200 to be eligible. Money that you transfer will be deposited as employee contributions into the traditional or Roth balance of the combined account based on the way it was identified in the original account. These funds will be

(Red.) Sonja Sheridan & Pia Williams

www.skolverket.seVallberg Roth, Pia Williams samt Eva Ärlemalm-Hagsér. Anna Westerholm. Avdelningschef. Innehåll. ... sid. 224). Vetenskaplig grund är kunskap som baseras på vetenskaplig metod, medan beprövad erfarenhet handlar om professionell erfarenhet, att förskollärare lär

Form 1099-R Roth IRA - IRS tax forms

apps.irs.govForm 1099-R Roth IRA The basis of property distributed from a Roth IRA is its fair market value (FMV) on the date of distribution, whether or not the distribution is a qualified distribution. You don’t include in your gross income qualified distributions or distributions that are a return of your regular contributions from your Roth IRA(s).

Healing Scriptures - Home | Sid Roth

sidroth.orgJesus otherwise it is just religious. To obtain experiential knowledge ... Enjoy His presence 24/7. Experience more of Him each day. Really make Him Lord. ... perceives as real fact what is not revealed to my senses]. Acts 10:38...God anointed Jesus of Nazareth with the Holy Spirit and with power, who went about doing good and

The Hammer of Thor - Weebly

www.readster.weebly.com40. Little Billy Totally Deserved It 41. When in Doubt, Turn Into a Biting Insect 42. Or You Could Just Glow a Lot. That Works, Too 43. You Keep Using the Word Help. I Do Not Think It Means What You Think It Means 44. We Are Honored with Runes and Coupons 45. Pigtails Have Never Looked So Frightening 46. Here Comes the Bride and/or the Assassin 47.

/Roth IRA/SEP/SRA MERRILL~- - Merrill Lynch - Login

olui2.fs.ml.comIRA/IRRA® /Roth IRA/SEP/SRA One Time Distribution Form Use this form to take a withdrawal (distribution) from a Merrill: • • IRRA ® (Rollover IRA) • Roth IRA • Simplified Employee Pension (SEP) plan, or • SIMPLE Retirement Account (SRA) Complete, sign and send this form to the appropriate channel for processing. For clients with a ...

Merrill Edge® Self-Directed Inherited IRA Account

olui2.fs.ml.comAn Inherited IRA is used to transfer inherited retirement plan assets into an account in your name. Use this application to establish either a Traditional or Roth Inherited IRA. Only U.S. residents can apply for a Merrill Edge® Self-Directed investing account. Foreign residents may be able to apply for an account through one of our Global Offices.

BRAND LISTING - Southern Glazer's Wine and Spirits

www.southernglazers.comKitchen Sink Kj Avant Korbel Sprkling Kosta Browne Koz Kunde Estates L Mrtini Designates La Crema La Jota La Merika Lake Snma ... Cloudveil Erath Firesteed Gran Moraine King Estate Nxnw 19.5L Portlandia Primarius Thor’s Well Trefethen Misc Van Duzer Windy Bay Leese-Fitch Liberated Liberty Creek Light Grape Line 39 Livingston Cellars Lock And ...

THURSDAY PRIME TIME • Dec. 16th, 2021 6:00 6:30 7:00 7:30 ...

extras.messengernews.netWEEKDAY MORNING/AFTERNOON 8:00 8:30 9:00 9:30 10:00 10:30 11:00 11:30 12:00 12:30 1:00 1:30 2:00 2:30 3:00 3:30 4:00 4:30 5:00 5:30 # KFPX NCIS: LA Varied NCIS: New Orleans Varied Programs 7 KDMI The 700 Club Wommack Sid Roth’s MarilynVaried Len Julie & TCT Prince Rick Ask the Pastor Les Feld Everyday 3D Movie $ KTIV (7:00) Today Today 3rd Hour …

Summary Plan Description General Mills 401(k) Plan

cache.hacontent.comthe maximum combined rate for pre-tax and Roth 401(k) contributions cannot exceed 65%. Catch-up contributions alone cannot be greater than 50%. Annual Dollar Limits There is an annual dollar limit on the combined amount of pre-tax and Roth 401(k) contributions that may be made by individuals. This limit is subject to change each calendar year ...

Tax Information: Death Benefit Payments

www.tsp.govThe Roth earnings portion of a death benefit payment is qualified (i.e., paid tax-free) if 5 years have passed since ... conditions specified in Treas. Reg. § 1.401(a)(9)-4, Q&A 5. An inherited IRA is an IRA established specifically for the purpose of transferring money inherited from a …

6314 Roth IRA Withdrawal Authorization (3/2019)

iradirect.ascensus.comRoth IRA assets can be withdrawn at any time. Most Roth IRA withdrawals are reported to the IRS. IRS rules specify the distribution code that must be used to report each withdrawal on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Five-Year Period.

Questions? Go to Fidelity.com or call 800-343-3548. One ...

www.fidelity.comUse this form to request a one-time withdrawal from a Fidelity Self-Employed 401(k), Profit Sharing, or Money Purchase Plan account. Possible requests include a one-time, immediate distribution; a qualified or direct conversion to a Roth IRA; or a direct

Roth Individual Retirement Account (Roth IRA)

olui2.fs.ml.comAbout Your Roth IRA [1] Your Roth Individual Retirement Account (Roth IRA) is a means of accumulating tax-advantaged assets for retirement. Your Roth IRA is a custody account established for the exclusive benefit of you and your beneficiaries for which Merrill Lynch acts as custodian. Your right to the balance in your Roth IRA cannot be

Where should all the trees go? Investigating the impact of ...

www.urbanaffairs.com.auNY16005 Horticulture Innovation Australia Limited (Hort Innovation) and RMIT University make no representations and expressly disclaim all warranties (to the extent permitted by law) about the accuracy, completeness, or currency of information in this

Similar queries

Orth merican teel onstruction onference Rules, Rules, Roth IRA Conversion, Roth IRA, Account, Roth, Individual Retirement Account, Fidelity Investments, Retirement accounts, A Transfer Into The TSP, THRIFT SAVINGS PLAN TSP, A tRanSfER Into tHE tSp FORM TSP, Form, Transfer, Into, Thrift Savings Plan, The TSP, The Vanguard Group, Roth 401, Strategies for Canadians with U.S, Request, Conversion, Designated Roth Accounts, IRS tax forms, IRAs, Roth IRAs, 2019 Instructions for, Differences between a Roth in-plan conversion and, Rollover, Summary of the Thrift Savings Plan, Sid Roth, Faith, Grade, Reading Comprehension, Thor, Hammer, TD Ameritrade, Motorhome, Guide, Retirement, Differences between, Plan, A Roth, Roth IRA Conversion Request, Chase, The Roth 457 Option, Income, IRA/IRRA /Roth IRA/SEP/SRA MERRILL, Alien, IRA Beneficiary Designation Kit, INTRUSION, 1099, Healing Scriptures, Jesus, Presence, Real, Hammer of Thor, Billy, SRA MERRILL, Merrill, IRRA, Simplified Employee Pension, Merrill Edge® Self-Directed Inherited IRA Account, Kitchen, Summary Plan Description General Mills 401, Death Benefit Payments, Roth IRA Withdrawal Authorization, Hort