Roth Ira

Found 6 free book(s)Strategies for Canadians with U.S. retirement plans

www.sunnet.sunlife.comA Roth IRA is similar to a Canadian Tax-Free Savings Account (TFSA). Roth IRA contributions may not be deducted from income, but grow tax-free. As long as the withdrawal rules are obeyed Roth IRA withdrawals are tax-free. Under current law, Roth IRA balances may not be transferred to a TFSA or vice versa. 6. Treaty, Article XVIII.

Form 1099-R Roth IRA - IRS tax forms

apps.irs.govForm 1099-R Roth IRA The basis of property distributed from a Roth IRA is its fair market value (FMV) on the date of distribution, whether or not the distribution is a qualified distribution. You don’t include in your gross income qualified distributions or distributions that are a return of your regular contributions from your Roth IRA(s).

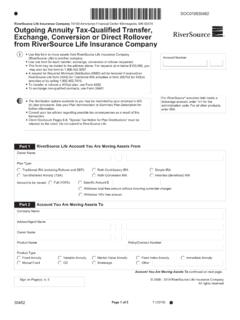

Form 30482 - Request for IRA/Roth ANNUITY Transfer or ...

www.ameriprise.comDirect Conversion from TSA to a Roth IRA DOC020530482 Page 2 of 5 If product is an annuity (Select one): Plan Type: New Contract Existing Contract (annuities active for 13 months or more) Traditional IRA (including Rollover and SEP) Inherited (Beneficial) IRA Tax-Sheltered Annuity (TSA) Roth IRA 457 Tax-Sheltered Custodial Account (TSCA)

Important update for IRA owners - The Vanguard Group

personal.vanguard.comRoth IRA will accumulate on a tax-deferred basis and may ultimately be tax-free if the earnings are part of a “qualified distribution .” (A “qualified distribution” is generally a distribution made to you after age 59½ and after you have held your Roth IRA account at least five

314 Traditional and SIMPLE IRA Withdrawal Authorization (3 ...

iradirect.ascensus.comconversions to a Roth IRA, substantially equal periodic payments, or IRS levy are reported on Form 1099-R using code 2. Certain distributions taken due to federally declared disasters also are reported using code 2. Please refer to the IRS website at www.irs.gov for more information and

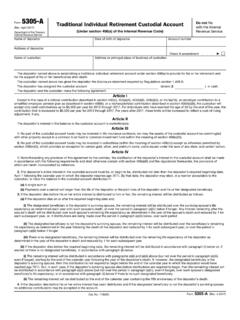

Form 5305-A (Rev. April 2017) - IRS tax forms

www.irs.govtraditional individual retirement account (traditional IRA) is established after the form is fully executed by both the individual (depositor) and the custodian. To make a regular contribution to a traditional IRA for a year, the IRA must be established no later than the due date of the individual’s income tax return for the tax year (excluding