Search results with tag "R eal estate"

Income and Loss Supplemental - IRS tax forms

www.irs.govIf you report a loss from rental real es-tate or royalties in Part I, a loss from a partnership or S corporation in Part II, or a loss from an estate or trust in Part III, your loss may be reduced or not allowed this year. You must apply the following rules to your loss. • Basis rules apply to losses from a partnership or S corporation. See Basis

PAPERING THE DEAL: FROM LAND ACQUISITION TO …

www.gdhm.com6 - Page v Papering the Deal _____ _____ _ Melvin, Transferring Surface Water Rights, Advanced Real Est ate Law Course (Stat e Bar 2003); Water Issues: A Primer for Real Estate Law yers, Advanced Rea l Estate Law Course (State Bar 20 00); Conveyance of Surface Water, The Changing Face of Water Rights i n Texas (State Bar 2001 ); and

LICENSE LAW AND RULES COMMENTS - North Carolina Real ...

www.ncrec.govly in the state of North Carolina must have a North Caro-lina real estate broker license. In North Carolina, a real es-tate licensee may only engage in brokerage as an “agent” for a party to a transaction. Thus, a real estate licensee is com-monly and appropriately referred to …

THE REAL ESTATE ATTORNEY’S GUIDE TO PLATTING

www.wcglaw.comTexas Land Use Law, South Texas College of Law Real Estate Conference, June 1998; Houston Bar Association R eal Estate Law Section Seminar, September 1998 Deed Restrictions, City of Houston Neighborhood Connections Conference, September 1998 & 1999 Drafting, Maintaining & Enforcing Deed Restrictions, Houston Bar Association …

100 Questions on Direct Examination - McKissock Learning

vc5.mckissock.comand committees related to real es tate activities. 18. Are you a licensed real estate bro ker in this state. 19- Will you name some of the govern mental agencies for whom you have done appraisal work. 20. Will you name some of the private individuals or firms for whom you have done appraisal work. 21. Have you ever been appointed

EB-5: The Intersection of Real Estate and Immigration

files.ali-cle.orgThe Practical Real Estate Lawyer | 5 S.H. Spencer Compton and Diane Schottenstein As an alternative way to nance real es-tate projects, EB-5 is gaining ground.

OklahO ma residential prO perty cOnditiO n disclO sure

oklahoma.govform established by rule by the Oklahoma real es-tate commission which states that the seller: a. has never occupied the property and makes no disclosures concerning the condition of the property, and b. has no actual knowledge of any defect; or 2. a written property condition disclosure state-ment on a form established by rule by the Oklahoma

Customer Information Form - LREC

lrec.govform prescribed by the Louisiana Real Es tate Commission. Specific du ties owed to both buyer/seller and lessor/lessee are: • To treat all clients honestly. • To provide factual information about the property. • To disclose all latent material defects in the property that are known to them.

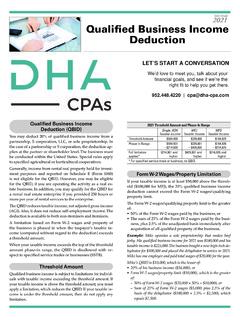

2021 Quali ed Business Income Deduction - DHA CPAs

dha-cpa.comGenerally, income from rental real property held for invest - ment purposes and reported on Schedule E (Form 1040) is not eligible for the QBID. However, you may be eligible for the QBID, if you are operating the activity as a real es-tate business. In …

Similar queries

IRS tax forms, Real es-tate, PAPERING THE DEAL: FROM LAND ACQUISITION, Real Est ate, Real Estate, Rea l Estate, License, North Carolina Real, State, North Carolina, North Caro-lina real estate, REAL ESTATE ATTORNEY’S GUIDE TO PLATTING, Real Estate Conference, R eal Estate, Conference, Real Es tate, The Intersection, Customer Information Form, Real