Income and Loss Supplemental - IRS tax forms

If you report a loss from rental real es-tate or royalties in Part I, a loss from a partnership or S corporation in Part II, or a loss from an estate or trust in Part III, your loss may be reduced or not allowed this year. You must apply the following rules to your loss. • Basis rules apply to losses from a partnership or S corporation. See Basis

Tags:

Form, Real, Tates, R eal estate, Irs tax forms

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

UNITED STATES-THE PEOPLE'S REPUBLIC OF …

www.irs.govmessage from the president of the united states transmitting the agreement between the government of the united states of america and the government of the people's republic of china for the avoidance of double

SS-4 Application for Employer Identification Number

www.irs.govForm SS-4 (Rev. December 2017) Department of the Treasury Internal Revenue Service . Application for Employer Identification Number (For use by employers, corporations, partnerships, trusts, estates, churches,

Services, Applications, Internal revenue service, Internal, Revenue, Identification, Employers, Application for employer identification number, Number

2017 ANNUAL REPORT - Internal Revenue Service

www.irs.govI am excited to share the FY 2017 IRS Criminal Investigation Annual Report. The report gives us an opportunity to reflect on the many successes we have had as

Services, Annual, Report, Annual report, Internal revenue service, Internal, Revenue

Form Tip Income and Allocated Tips - irs.gov

www.irs.govForm 8027 Department of the Treasury Internal Revenue Service Employer’s Annual Information Return of Tip Income and Allocated Tips See the separate instructions.

SCHEDULE M Transactions Between Foreign …

www.irs.govSCHEDULE M (Form 8858) (Rev. December 2012) Department of the Treasury Internal Revenue Service . Transactions Between Foreign Disregarded Entity of a

Services, Internal revenue service, Internal, Revenue, Schedule m, Schedule, Schedule m transactions between foreign, Transactions, Between, Foreign, Transactions between foreign disregarded entity, Disregarded, Entity

2017 Instructions for Schedule M-3 (Form 1120)

www.irs.govPage 2 of 28 Fileid: … 1120SCHM-3/2017/A/XML/Cycle05/source 9:58 - 17-Oct-2017 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before prin

for Education Page 1 of 87 10:40 - 31-Jan-2018 Tax …

www.irs.govPage 3 of 87 Fileid: … tions/P970/2017/A/XML/Cycle03/source 10:40 - 31-Jan-2018 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before print

1041-T Allocation of Estimated Tax Payments to …

www.irs.govForm 1041-T Department of the Treasury Internal Revenue Service Allocation of Estimated Tax Payments to Beneficiaries (Under Code section 643(g))

Services, Internal, Revenue, Payments, Allocation of estimated tax payments to, Allocation, Estimated, Internal revenue service allocation of estimated tax payments to beneficiaries, Beneficiaries

2017 Form 4868

www.irs.govForm 4868 (2017) (Rev. 11-2017) Page 3 Specific Instructions How To Complete Form 4868 Part I—Identification Enter your name(s) and address. If you plan to file a joint return,

THIS BOOKLET DOES NOT CONTAIN …

www.irs.govPage 3 of 107 Fileid: … ions/I1040/2017/A/XML/Cycle16/source 16:24 - 22-Feb-2018 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printi

Related documents

100 Questions on Direct Examination - McKissock Learning

vc5.mckissock.comand committees related to real es tate activities. 18. Are you a licensed real estate bro ker in this state. 19- Will you name some of the govern mental agencies for whom you have done appraisal work. 20. Will you name some of the private individuals or firms for whom you have done appraisal work. 21. Have you ever been appointed

Customer Information Form - LREC

lrec.govform prescribed by the Louisiana Real Es tate Commission. Specific du ties owed to both buyer/seller and lessor/lessee are: • To treat all clients honestly. • To provide factual information about the property. • To disclose all latent material defects in the property that are known to them.

Form, Information, Customer, Real, Tates, Customer information form, R eal estate

OklahO ma residential prO perty cOnditiO n disclO sure

oklahoma.govform established by rule by the Oklahoma real es-tate commission which states that the seller: a. has never occupied the property and makes no disclosures concerning the condition of the property, and b. has no actual knowledge of any defect; or 2. a written property condition disclosure state-ment on a form established by rule by the Oklahoma

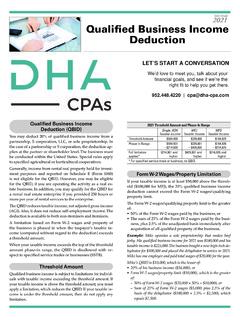

2021 Quali ed Business Income Deduction - DHA CPAs

dha-cpa.comGenerally, income from rental real property held for invest - ment purposes and reported on Schedule E (Form 1040) is not eligible for the QBID. However, you may be eligible for the QBID, if you are operating the activity as a real es-tate business. In …

Estate Tax deductions - Gudorf Law Group, LLC

www.daytonestateplanninglaw.comnews is that these expenses are deductible on your es-tate tax return, which in turn, can produce estate tax savings for your family. The even better news is that if you do not owe an estate tax at your death, many of these expenses can instead be taken as income tax

North Georgia News

nganews.comthe law, and all persons indebted to said es-tate are required to make immediate payment to the Personal Representative(s). This 14th day of January, 2022 By: Nancy Ledford Tipton 137 George Sorrells Rd. Hayesville, NC 28904 N(Jan19,26,Feb2,9) STATE OF GEORGIA UNION COUNTY NOTICE TO DEBTORS AND CREDITORS RE: Estate of Barbara Jean Lewis

Alberta Probate Kit - Self-Counsel

self-counsel.comtate Taxes17 Es 225 1. Inheritance and Death Taxes 225 2. Why Do Tax Returns? 225 3. Which Returns Do I Do, and When Should I Do Them? 226 4. Income Tax 228 5. Capital Gains Tax 228 6. Can I Use an Accountant? 229 7. What Is a Tax Clearance Certificate? 229

ELECTION LAW IN PENNSYLVANIA

jsg.legis.state.pa.usJun 23, 2021 · exclusively by Commission staff with the informal involvement of representativ es of those entities that can provide insight and information regarding the particular topic. When a study involves an advisory committee, the Commission seeks consensus among the members.