Search results with tag "Direct rollover"

Special Tax Notice Regarding Rollovers

www.opm.govII. Direct Rollover A direct rollover is a direct payment of your lump sum to a traditional Individual Retirement Arrangement (IRA), a Roth IRA, or an eligible employer plan that will accept it. You can choose a direct rollover of all or any portion of your payment that is an eligible rollover distribution, as described in Part I.

TSP Transfers and Rollovers

www.opm.gov• Transfer (aka . direct rollover) – Money moves directly from one account or retirement plan to the other • Rollover (aka . 60-day. or . indirect rollover) – You must complete the transaction within 60 days – May result in taxes, withholdings, and/or penalties if not properly executed

IRA Rollover Request Form - home.capitalone360.com

home.capitalone360.comEmployer Plan [401(k), 403(b) or other]direct rollover to a Capital One 360 Traditional IRA Employer Plan [401(k), 403(b) or other] direct rollover to a Capital One 360 Roth IRA . Note: Please consult a tax professional to your eligibility for a direct rollover of your Employer Plan. Your Name and Address. MR./ MRS./ MS. FIRST NAME LAST NAME ...

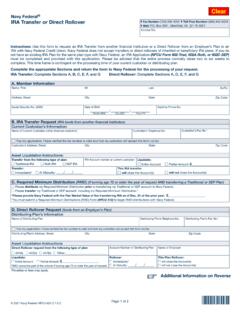

Navy Federal® IRA Transfer or Direct Rollover

www.navyfederal.orgIRA Transfer or Direct Rollover (703) 206-4250 . Toll-Free Number: (888) 842-6328 . Mail: P.O. Box 3001, Merrifield, VA 22119-3001 . Instructions: Use this form to request an IRA Transfer from another financial institution or a Direct Rollover from an Employer’s Plan to an IRA with Navy Federal Credit Union.

Fidelity Advisor IRA Transfer or Direct Rollover

institutional.fidelity.comIRA Transfer or Direct Rollover Page 1 of 5 Use this form to: • Authorize the Fidelity Advisor Traditional IRA, Rollover IRA, Roth IRA, SIMPLE IRA, SEP-IRA, or SARSEP-IRA Custodian (or its agent) to initiate a transfer of your existing IRA directly from another custodian and to invest the transferred assets in a Fidelity Advisor IRA.

Deferred Compensation Plan & NYCE IRA

www1.nyc.govType of Payment Direct payment or rollover Direct payment or rollover Direct payment Payment Start Date* Any time after the participant’s death, but no later than the later of: a) December 31st of the calendar year in which the participant would have reached age 70 1/2 b) December 31st of the calendar year immediately following

Member Refund Application - Mississippi

www.pers.ms.govMember Refund Application Form 5 – Revised 06/01/2018. Please print or type in black ink. Completed form should be mailed or faxed to PERS. See bottom of form for contact information. Refunds ... You can do either a direct rollover or a 60day rollover.- If you do a direct rollover,

Withdrawal Request Form - MassMutual

wwwrs.massmutual.com1. Direct Rollover . Note: An RMD must be requested prior to the rollover if you are required to receive an RMD because you are retired and age 70½ or older or are a beneficiary. Please indicate the Financial Institutions to make the check(s) payable for the Direct Rollover transaction requested below. Special Instructions:

Trustee Transfer/Direct Rollover Request - Bank of America

www.bankofamerica.comDirect Rollover Instructions to Bank of America, as Successor Custodian Ask your current Plan Administrator whether any additional documentation will be required to complete the transfer. You will be responsible for any early withdrawal fees or transfer fees charged by your current Plan.

Withdrawal Request Form - MassMutual

wwwrs.massmutual.comDirect Rollover or Transfer to the institution named in Direct Rollover or Transfer Payment Instructions, Section F (Select one below). Check with your Plan and financial institution for minimum amounts. Please be aware that when requesting a specific dollar amount that you take into consideration that the payment will be reduced by all applicable

2022 Form 5498 - IRS tax forms

www.irs.govShows any rollover, including a direct rollover to a traditional IRA or Roth IRA, or a qualified rollover contribution (including a military death gratuity or SGLI payment) to a Roth IRA you made in 2022. It does not show any amounts you converted from your traditional IRA, SEP IRA, or SIMPLE IRA to a Roth IRA. They are shown in box 3. It does

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS GENERAL ...

nb.fidelity.coma direct rollover to a designated Roth account in the Plan from a designatedRoth account in another employer plan, your participation will count from January 1 of the year your first contribution was made to the designated Roth account in the Plan or, if earlier, to the designated Roth account in the other employer plan. ...

IRA Distribution - T. Rowe Price

www.troweprice.comend statement and distribute based on the instructions provided above. This monitor indicates this can be done online. This stamp indicates that a signature guarantee is required. This paper clip indicates that you may need to attach documentation. this form to: Use • Request a distribution from an IRA, including direct rollover and

NORTH DAKOTA PUBLIC EMPLOYEES RETIREMENT SYSTEM …

www.ndpers.nd.govAPPLICATION FOR REFUND AND DIRECT ROLLOVER . SFN 53879 (Rev. 07-2017) Page 3 . PART A PARTICIPANT IDENTIFICATION . For member identification, complete all requested information. PART B NOTICE TO MEMBER . Read this section carefully! This section contains important information that you need to know before

DIRECT ROLLOVER REQUEST

iradirect.ascensus.comDIRECT ROLLOVER REQUEST The term IRA will be used below to mean Traditional IRA, Roth IRA, and SIMPLE IRA, unless otherwise specified. This form is to be used to request a direct movement of assets from an employer-sponsored retirement plan to an IRA. If your plan contains

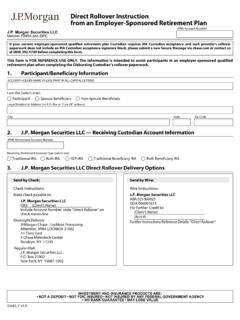

Direct Rollover Instruction from an Employer Sponsored ...

www.chase.comDirect Rollover Instruction from an Employer-Sponsored Retirement Plan. JPMS Account Number. 33482_C v1.0. INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NO BANK GUARANTEE • MAY LOSE VALUE

Similar queries

Special Tax Notice Regarding Rollovers, Direct Rollover, Direct, ROLLOVER, Transfer, Capital One, Navy Federal® IRA Transfer or Direct Rollover, IRA Transfer or Direct Rollover, Navy Federal Credit Union, Deferred, Rollover Direct, Member Refund Application, MassMutual, Instructions, Bank of America, Form 5498, IRS tax forms, IRA Distribution, Statement, APPLICATION FOR REFUND