Transcription of 2019 Insurance Benefits Guide

1 2019 Insurance Benefits Guide Table of contents 9. State Health Plan's grandfathered status .. 9. Notice of non-discrimination .. 10. Language 10. General 12. What's new for 2019? .. 13. Eligibility for Insurance 13. Initial enrollment .. 17. After your initial enrollment .. 19. Enrolling as a transferring employee .. 20. Annual open enrollment .. 20. MyBenefits .. 21. Special eligibility situations .. 21. Leaves of absence .. 27. When coverage ends .. 28. Continuation of coverage (COBRA) .. 29. Other coverage options .. 31. Death of a subscriber or covered spouse or child .. 31. Appeals of eligibility determinations .. 32. Health Insurance .. 34. Your State Health Plan choices .. 35. Comparing the plans .. 35. Comparison of health plans .. 37. Your online State Health Plan tools.

2 39. How the State Health Plan pays for covered Benefits .. 40. Insurance Benefits Guide | 2019 1. Paying health care expenses with the Standard Plan .. 41. Paying health care expenses with the Savings 43. Paying health care expenses if you're eligible for Medicare .. 45. Coordination of Benefits .. 45. Using State Health Plan provider networks .. 46. Out-of-network Benefits .. 49. Getting preauthorization for your medical care .. 51. Managing your health .. 55. Adult well 55. PEBA Perks .. 55. Naturally Slim .. 60. Health coaching .. 60. Medical case management programs .. 62. Additional State Health Plan Benefits .. 64. Exclusions services not covered .. 73. How to file a State Health Plan 76. 77. GEA TRICARE Supplement Plan .. 78. Prescription 82.

3 Using your prescription 83. Member resources .. 83. State Health Plan Prescription Drug 83. Express Scripts Medicare .. 84. Pharmacy network .. 84. Prescription copayments and formulary .. 86. Specialty pharmacy 87. 2 Insurance Benefits Guide | 2019. Coverage reviews .. 88. Compound 89. Coordination of Benefits .. 89. Exclusions .. 89. Value-based prescription Benefits at no cost to you .. 89. Filing a prescription drug claim .. 90. 90. Dental Insurance .. 92. Online resources .. 93. State Dental 93. Dental Plus .. 93. Special provisions of the State Dental Plan .. 95. Dental Benefits at a glance .. 96. Exclusions dental services not 97. Coordination of Benefits .. 100. How to file a dental claim .. 100. 101. Vision care .. 103. Online vision Benefits information.

4 104. State Vision Plan .. 104. Vision Benefits at a glance .. 105. Diabetic vision Benefits at a glance .. 108. Using the EyeMed provider network .. 108. Exclusions and limitations .. 109. Contact EyeMed .. 109. 110. Insurance Benefits Guide | 2019 3. Vision Care Discount Program .. 110. State Vision Plan examples .. 112. Life Insurance .. 113. Eligibility .. 114. 115. Basic life 115. Optional life Insurance .. 115. Dependent life Insurance .. 118. Beneficiaries .. 121. Accidental Death and 121. MetLife Advantages .. 125. Claims .. 127. When your coverage ends .. 128. Extension of Benefits .. 128. Long term disability .. 131. Basic long term disability .. 132. Eligibility .. 132. When are you considered disabled? .. 132. Claims .. 134. When BLTD coverage ends.

5 135. When Benefits end .. 135. Exclusions and limitations .. 135. Appeals .. 136. Supplemental long term disability .. 137. SLTD Plan Benefits summary .. 138. Eligibility .. 139. 4 Insurance Benefits Guide | 2019. Enrollment .. 139. When are you considered disabled? .. 139. Claims .. 141. Lifetime security 142. Death Benefits .. 142. When SLTD coverage ends .. 142. When Benefits end .. 142. Conversion .. 143. Exclusions and limitations .. 143. Appeals .. 144. 145. MoneyPlus 146. How MoneyPlus can save you money .. 146. MoneyPlus administrative 147. Member resources .. 147. Earned income tax credit .. 148. IRS rules for spending accounts .. 148. Pretax Group Insurance Premium feature .. 149. Medical Spending Account .. 149. Eligibility .. 149. Enrollment.

6 149. Deciding how much to set aside .. 149. Contribution 150. People who can be covered by an MSA .. 150. Eligible expenses .. 150. Ineligible expenses .. 151. Insurance Benefits Guide | 2019 5. Using your MSA funds .. 151. ASIFlex Card .. 151. Requesting reimbursement of eligible expenses .. 152. Comparing the MSA to claiming expenses on IRS Form 1040 .. 153. What happens to your MSA when you leave your 154. What happens to your MSA after you die .. 154. Dependent Care Spending Account .. 154. Eligibility .. 154. Enrollment .. 1155. Deciding how much to set aside .. 155. Contribution 155. People who can be covered by a DCSA .. 156. Eligible expenses .. 156. Ineligible expenses .. 156. Requesting reimbursement of eligible expenses .. 156. Reporting your DCSA to the 157.

7 Comparing the DCSA to the child and dependent care credit .. 157. What happens to your DCSA when you leave your job .. 157. What happens to your DCSA after you 158. Health Savings Accounts .. 158. Eligibility .. 158. Enrollment .. 159. Contribution 159. When your funds are 159. Using your funds .. 159. 6 Insurance Benefits Guide | 2019. Eligible expenses and 160. Investing HSA funds .. 160. Reporting your HSA to the 160. What happens to your HSA after you 161. Closing your 161. Limited-use Medical Spending 161. Eligible expenses .. 161. Ineligible expenses Limited-use MSA only .. 161. Making changes to your MoneyPlus coverage .. 161. 162. Contacting ASIFlex .. 164. Retiree group Insurance .. 165. Are you eligible for retiree group Insurance ? .. 166.

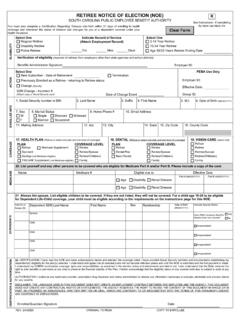

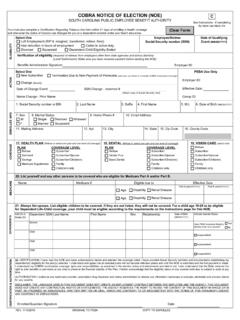

8 Will your employer pay part of your retiree Insurance premiums? .. 167. Only PEBA can confirm your eligibility .. 167. Retiree Insurance eligibility, funding .. 168. For members who work for a state agency, state institution of higher education or public school 168. For members who work for optional employers, such as county governments and municipalities .. 170. Health plans for retirees, dependents not eligible for Medicare .. 171. Your retiree Insurance coverage choices .. 172. When to enroll in retiree Insurance coverage .. 173. How to enroll in retiree Insurance coverage .. 174. Retiree premiums and premium payment .. 175. When your coverage as a retiree begins .. 175. Insurance Benefits Guide | 2019 7. Other Insurance programs PEBA offers.

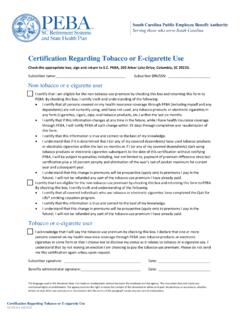

9 177. Changing coverage .. 178. Returning to work in an Insurance -eligible job .. 179. When your retiree Insurance coverage ends .. 180. Monthly premiums .. 183. Active employees .. 184. Permanent, part-time teachers .. 184. Funded retirees .. 185. Non-funded retirees .. 187. Partially funded retirees .. 188. Non-funded survivors .. 190. Partially funded survivors .. 191. COBRA .. 193. Former spouses .. 193. Life Insurance .. 194. SLTD 194. Tobacco-use premium .. 195. Employer contributions .. 195. Helpful terms .. 197. Contact 201. PEBA .. 202. 2019 Insurance vendors .. 202. Other helpful contacts .. 203. Index .. 204. 8 Insurance Benefits Guide | 2019. Disclaimer State Health Plan's Benefits administrators and others chosen by grandfathered status your employer who may assist with Insurance enrollment, changes, retirement or termination The Public Employee Benefit Authority and related activities are not agents of the believes the State Health Plan is a South Carolina Public Employee Benefit grandfathered health plan under the Patient Authority (PEBA) and are not authorized to bind Protection and Affordable Care Act (the the South Carolina Public Employee Benefit Affordable Care Act).

10 Authority. As permitted by the Affordable Care Act, a The Insurance Benefits Guide contains an grandfathered health plan can preserve certain abbreviated description of Insurance Benefits basic health coverage that was already in effect provided by or through the South Carolina when that law was enacted. Being a Public Employee Benefit Authority. The Plan of grandfathered health plan means that your plan Benefits documents and Benefits contracts may not include certain consumer protections contain complete descriptions of the health and of the Affordable Care Act that apply to other dental plans and all other Insurance Benefits . plans, for example, the requirement for the Their terms and conditions govern all Benefits provision of preventive health services without offered by or through the South Carolina Public any cost sharing.