Transcription of Employer Guide to Reemployment Tax - …

1 RT-800002. R. 04/18. Employer Guide to Reemployment Tax Table of Contents Employer Multi-unit Reports .. 10. 2. Preface .. 2 Reporting Employees Contracted to Governmental or Nonprofit Educational Institutions .. 10. Background .. 2. Classification of Workers .. 2 Reporting 11. Alternative Forms Reporting .. 11. State Unemployment Tax Act (SUTA) .. 2. Electronic Reporting and Payment Federal Unemployment Tax Act (FUTA).. 2. 11. Reporting Wages and Paying Reemployment Penalty for Failure to File Electronically .. 11. Taxes ..2 Benefits of Filing and Paying Electronically .. 11. General Liability Requirements .. 2. Timely Reporting and Payment.

2 11. Special Liability Requirements for Installment Payment Option .. 11. Specific Employer Types .. 2. Penalty and Interest Charged for Late Filing and Nonprofit employers .. 2. Payment .. 12. Governmental Entities .. 3. Assessments .. 12. Indian Tribes .. 3. Liens .. 12. Reimbursement Option .. 3. Tax Rate Consequences .. 12. Agricultural employers .. 3. 12. Domestic employers .. 3. Adjusting/Correcting Your Report .. 12. Voluntary Coverage .. 3. New Hire Reporting .. 13. Employer -Employee Relationship .. 3. Inactivation of Account .. 13. Employment Not Covered .. 4. Termination of Liability .. 13. Required 5 When to Notify the Department.

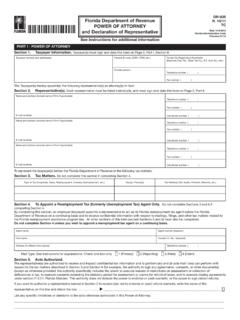

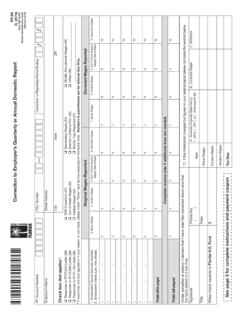

3 13. Employer Registration Report .. 5. Tax Audits and Required Employer Successions .. 5. 13. Employee Leasing Companies .. 5 Audit Purpose .. 13. Common Paymaster .. 6 Records Required and Examined .. 13. Payrolling .. 6. Tax Rate .. 14. Power of Attorney .. 6 Regular .. 14. Reemployment Tax Data Release Agreement Successor 15. (RT-19) .. 6. Mandatory Transfers .. 15. Tax and Wage Reporting .. 6 Federal Certification .. 15. Where to Report Employees .. 6. 16. Reciprocal Coverage Agreement (RCA).. 7. How Benefits Are Charged and Their Employer 's Quarterly Report (RT-6) .. 7 Impact on employers .. 16. Taxable Wage Base .. 8. Employer 's Checklist for 16.

4 Annual Filing Option .. 9. Reporting Wages .. 9 Glossary .. 17. Taxable Wages .. 9 Contact Us .. 18. Exempt Wages .. 10. Department of Revenue, Employer Guide to Reemployment Tax, Page 1. Introduction assistance benefits. If a person files a claim for benefits and the Employer has not been including The Employer Guide to Reemployment Tax contains the person on the quarterly report, this can cause a information employers need to comply with Florida's delay in benefit payments. In addition, the intentional Reemployment Assistance Program Law. This misclassification of a worker is a felony. Guide provides simplified explanations of the taxing procedures of the law.

5 It is not intended to take State Unemployment Tax Act (SUTA). precedence over the law or rules. All Reemployment tax payments are deposited to the Unemployment Compensation Trust Fund for the Background sole purpose of paying benefits to eligible claimants. Every state has an Unemployment Compensation The Employer pays for this Reemployment Program. In Florida, legislation passed in 2012 Assistance Program as a cost of doing business. changed the name of Florida's Unemployment Workers do not pay any part of the Florida Compensation Law to the Reemployment Assistance Reemployment tax and employers must not make Program Law and directed the focus of the program payroll deductions for this purpose.

6 employers with to helping Florida's job seekers with becoming stable employment records receive credit in reduced reemployed. Reemployment benefits provide tax rates after a qualifying period. temporary income payments to make up part of the wages lost by workers who lose their jobs through no Federal Unemployment Tax Act (FUTA). fault of their own, and who are able and available Federal unemployment taxes are deposited to the for work. It is job insurance paid for through a tax FUTA Trust Fund and administered by the United on employee wages. The Reemployment Assistance States Department of Labor (USDOL) for funding Program supports Reemployment services through the administrative costs of state Reemployment local One-Stop Career Centers located throughout assistance, One-Stop Career Centers, and part of the state.

7 Labor Market Statistics Programs. The USDOL is also charged with monitoring state Reemployment The Federal Unemployment Tax Act provides for Assistance Programs and can withhold funds from a cooperation between state and federal governments state if it does not comply with federal standards. in the establishment and administration of the Reemployment Assistance Program. Under this dual Reporting Wages and Paying system, the Employer pays payroll taxes levied by Reemployment Taxes both the state and federal governments. General Liability Requirements Classification of Workers A business is liable for state Reemployment tax if, in employers must understand how to determine the current or preceding calendar year, the Employer : whether a worker is an employee or an independent (1) has paid at least $1,500 in wages in a calendar contractor, so they can correctly include all quarter; or (2) has had at least one employee for any employees on their Employer 's Quarterly Report portion of a day in 20 different weeks within the (RT-6).

8 One main distinction is that an employee same calendar year; or (3) is liable for the Federal is subject to the will and control of the Employer . Unemployment Tax as a result of employment in The Employer decides what work the employee another state. will do and how the employee will do it. An officer of a corporation who performs services for the Special Liability Requirements for corporation is an employee, regardless of whether Specific Employer Types the officer receives a salary or other compensation. Nonprofit employers An independent contractor is not subject to the Coverage is extended to employees of nonprofit will and control of the Employer .

9 The Employer organizations (such as religious, charitable, scientific, can decide what results are expected from the literary, or education groups) that employ four or independent contractor, but cannot control the more workers for any portion of a day in 20 different methods used to accomplish those results. How the calendar weeks during the current or preceding worker is treated, not a written contract or issuance calendar year. Exceptions to this coverage include of a 1099, determines whether the worker is an churches and church schools. For purposes of employee or an independent contractor. the Florida Reemployment Assistance Program Misclassification of workers is not just a tax reporting Law, a nonprofit organization is defined in section issue; it also affects claims for Reemployment (s.)

10 3306(c)(8) of the Federal Unemployment Tax Act and s. 501(c)(3) of the Internal Revenue Code (IRC). Department of Revenue, Employer Guide to Reemployment Tax, Page 2. Governmental Entities Likewise, employers liable for their general Coverage is also extended to employees of the state employment must not report domestic workers or of Florida and any city, county, or joint governmental agricultural workers unless they also establish liability unit. in these categories. In making a determination of liability, the wages paid in agricultural employment Indian Tribes and in domestic employment must be counted Coverage is extended to employees for service separately from wages paid in other types of performed in the employ of an Indian tribe, as employment.