Transcription of Foreword - acea.be

1 2018 edition of the European Automobile Manufacturers Association s annual Tax Guide provides an overview of specific taxes that are levied on motor vehicles in European countries, as well as in other key markets around the comprehensive guide counts more than 300 pages, making it an indispensable tool for anyone interested in the European automotive industry and relevant policies. The 2018 Tax Guide contains all the latest information about taxes on vehicle acquisition (VAT, sales tax, registration tax), taxes on vehicle ownership (annual circulation tax, road tax) and taxes on motoring (fuel tax).Besides the 28 member states of the European Union, as well as the EFTA countries (Iceland, Norway and Switzerland), this Tax Guide also covers countries such as Brazil, China, India, Japan, Russia, South Korea, Turkey and the United Tax Guide is compiled with the help of the national associations of motor vehicle manufacturers in all these countries.

2 I would like to extend our sincere gratitude to all involved for making the latest information available for this JonnaertACEA Secretary GeneralCopyright Reproduction of the content of this document is not permitted without the prior written consent of ACEA. Whenever reproduction is permitted, ACEA shall be referred to as source of the member countries 5 EFTA 245 Other countries 254 SummaryEU summary tables 5 Austria 10 Belgium 19 Bulgaria 42 Croatia 48 Cyprus 52 Czech Republic 55 Denmark 65 Estonia 79 Finland 82 France 88 Germany 100 Greece 108 Hungary 119 Ireland

3 125 Italy 137 Latvia 148 Lithuania 154 Luxembourg 158 Malta 168 Netherlands 171 Poland 179 Portugal 184 Romania 194 Slovakia 198 Slovenia 211 Spain 215 Sweden 224 United Kingdom 234EU member states 01EU summary tablesChapter prepared byFrancesca Automobile Manufacturers AssociationAvenue des Nerviens 85B 1040 BrusselsT. +32 2 732 55 50F. +32 2 738 73 MOTOR VEHICLE TAXATION.

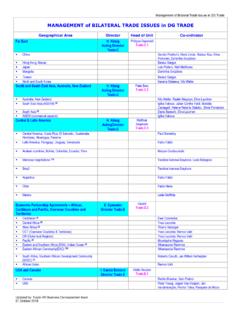

4 EU SUMMARY TAXES ON ACQUISITION Country VAT1 Registration Tax Austria 20% Based on CO2 emissions (max 32% + bonus/malus) Belgium 21% Based on cylinder capacity and age (Brussels-Capital) Fuel, age, Euro standards and CO2 emissions (Flanders) CO2 emissions (Wallonia) Bulgaria 20% Based on purchase price + BGN 25 (plate) + BGN 160 (eco tax) Croatia 25% Based on selling price and CO2 emissions Cyprus 19% Based on CO2 emissions and cylinder capacity Czech Republic 21% Based on vehicle type and Euro standards Denmark 25% Based on safety equipment, fuel consumption and value (85% up to DKK 185,200 + 150% of the remainder) Estonia 20% Registration label ( 62) + registration card ( 130) Finland 24% Based on price and CO2 emissions (min , max 50%) France 20% Bonus/malus system based on CO2 emissions Germany 19% Based on purchase price + (registration fees) Greece 24% Based on net retail price and CO2 emissions Hungary 27% Based on age and cylinder capacity Ireland 23% Based on CO2 emissions, from 14 to 36% Italy 22% Based on kilowatt, weight and seats Latvia 21% Based on weight and fuel type Lithuania 21% Based on vehicle type Luxembourg 17% Registration stamp ( 50) + supplement ( 24 or 50) Malta 18% Based on CO2 emissions, length and vehicle value Netherlands 21% Based on CO2 emissions and fuel efficiency Poland 23% Based on cylinder capacity from to (0% for electric and plug-in electric vehicles)

5 Portugal 23% Based on cylinder capacity and CO2 emissions Romania 19% Based on purchase price + registration fees ( ) Slovakia 20% Based on engine power (kW) and age Slovenia 22% Based on CO2 emissions and purchase price Spain 21% Based on CO2 emissions, from (121-159g/km) to (200g/km or more) Sweden 25% Based on purchase price and vehicle type United Kingdom 20% Based on invoice value or resale price 1 Situation on 1 January 2018 ACEA TAX GUIDE 20186 EUROPEAN TAXES ON OWNERSHIP Country Passenger cars Commercial

6 Vehicles Austria Engine power (kW) Gross vehicle weight Belgium Cylinder capacity, CO2 emissions and fuel type Weight and axles Bulgaria Engine power (kW) Weight and axles Croatia Engine power (kW) and age Engine power (kW) and age Cyprus CO2 emissions CO2 emissions Czech Republic Engine size Weight and axles Denmark Fuel consumption and weight Fuel consumption and weight Estonia None Weight and axles suspension Finland CO2 emissions, weight x days Weight x days France CO2 emissions and fuel type Weight, axles, use of trailer Germany CO2 emissions and cylinder capacity Weight, exhaust emission group and noise Greece Engine capacity or CO2 emissions (for new cars) Gross vehicle weight Hungary Age Euro standards Ireland CO2 emissions Deadweight Italy Engine power, Euro standards Weight, axles, suspension Latvia Gross weight, cylinder capacity, engine power (kW) Gross weight and axles Lithuania None Weight, axles, suspension Luxembourg CO2 emissions or cylinder capacity Weight, axles, suspension Malta CO2 emissions and age CO2 emissions and age Netherlands Deadweight, province, fuel, CO2 emissions Deadweight and axles Poland None Weight and axles Portugal Cylinder capacity and CO2 emissions Weight, axles, suspension Romania Cylinder capacity Gross weight and axles Slovakia Cylinder capacity Gross weight and axles Slovenia Cylinder capacity Gross weight Spain Engine rating (hp)

7 Payload Sweden Weight, fuel type or CO2 emissions Weight, axles, fuel and exhaust emissions United Kingdom Engine size and CO2 emission (for new cars) Dead weight, axles and environmental characteristics ACEA TAX GUIDE 20187 EUROPEAN TAXES ON MOTORING2 Excise duties on fuels in 3/1.

8 000 litres Country Unleaded Petrol Diesel Austria 515 425 Belgium 615 560 Bulgaria 363 330 Croatia 519 411 Cyprus 479 450 Czech Republic 505 431 Denmark 566 364 Estonia 563 493 Finland 703 530 France 659 547 Germany 655 470 Greece 700 410 Hungary 391 360 Ireland 588 479 Italy 728 617 Latvia 476 372 Lithuania 434 347 Luxembourg 465 338 Malta 549 472 Netherlands 778 490 Poland 395

9 346 Portugal 659 471 Romania 424 394 Slovakia 514 368 Slovenia 508 426 Spain 461 367 Sweden4 670 591 United Kingdom 661 661 EU minimum rates 359 330 Source: European Commission 2 Situation on 1 January 2018 3 Euro exchange rates at 20 March 2018; source: 4 Includes energy and CO2 tax ACEA TAX GUIDE 20188 EUROPEAN FISCAL INCOME FROM MOTOR VEHICLES IN THE EU5 Purchase or transfer AT ( bn) 2015 BE ( bn) 2016 DK (DKK bn) 2016 DE ( bn) 2016 ES ( bn) 2016 FI ( bn) 2016 FR ( bn) 2016 GR ( bn) 2016 IE ( bn) 2015 IT ( bn) 2016 NL ( bn) 2016 PT ( bn) 2016 SE (SEK bn) 2016 UK ( bn)

10 2017/20186 on vehicle sales servicing/ repair, parts, tyres 2. Fuels & lubricants 3. Sales & registration taxes Annual ownership taxes Driving license fees Insurance taxes Tolls Customs duties Other taxes