Transcription of IP 2016(8), Connecticut Tax Guide for Payers of …

1 Tax information is available on our website at 2016(8)Withholding taxIssued: 09/20/2016 Replaces: IP 2015( )The following information is included in this booklet: Electronic Filing Requirements Calendar of Duties Important Information for Connecticut Payers of Nonpayroll Amounts Withholding RequirementsInformational Publication 2016(8) Connecticut Income Tax Withholding RequirementsKeep and use this booklet until a new editionof the Connecticut Tax Guide for Payers ofNonpayroll Amounts is January 1, 2016 CONNECTICUTTAX Guide FOR PAYERSOF NONPAYROLLAMOUNTSPage 2 IP 2016(8), Connecticut Tax Guide for Payers of Nonpayroll AmountsConnecticut Department of Revenue ServicesConnecticut calls outside the Greater Hartford calling area .. 800-382-9463 From anywhere .. 860-297-5962 Collection Unit.

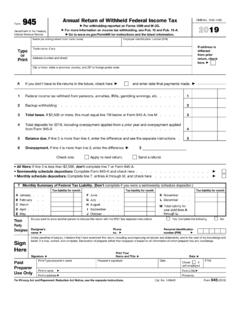

2 860-297-5909 Electronic Funds Transfer .. 860-297-4973 Forms Unit .. 860-297-4753 TTY, TDD, and Text Telephone users only .. 860-297-4911 Internal Revenue ServiceTax Assistance .. 800-829-1040 Tax Forms and Publications .. 800-829-3676 Frequently Used Telephone Numbers Connecticut Forms Referenced in This Booklet form CT-8109 .. Connecticut Withholding Tax Payment form for Nonpayroll AmountsForm CT-945 .. Connecticut Annual Reconciliation of Withholding for Nonpayroll AmountsForm CT-1096 .. Connecticut Annual Summary and Transmittal of Information ReturnsForm REG-1 .. Business Taxes Registration ApplicationForm CT-W4P .. Withholding Certifi cate for Pension or Annuity PaymentsForm CT-941X .. Amended Connecticut Reconciliation of WithholdingForm CT-8809 .. Request for Extension of Time to File Information ReturnsForm CT-8508.

3 Request for Waiver from Filing Information Returns ElectronicallyForm DRS-EWVR .. Electronic Filing and Payment Waiver RequestRelated Web SitesConnecticut Department of Revenue Services (DRS) .. Taxpayer Service Center (TSC) .. Revenue Service (IRS) .. 2016(8), Connecticut Tax Guide for Payers of Nonpayroll Amounts Page 3 Table of ContentsCalendar of Duties .. 4 Payer s Classifi cation Determines WhenPayments Are Required to Be Made .. 4On or Before January 31 .. 4On or Before March 31 .. 4 Frequently Asked Questions .. 5 Electronic Filing and Payment ofWithholding Tax .. 6 Electronic Filing Through the TaxpayerService Center (TSC).

4 6 Payment by Electronic Funds Transfer (EFT) .. 6 Penalties for Failure to Pay Electronically .. 6 Waiver of Requirement to File and Pay by EFT .. 6 Electronic Filing of Information Returns .. 6 Bulk Filing of Information Returns .. 6 Options for Filing Forms 1099-R, 1099-MISC, W-2G, and CT-1096 Through the TSC .. 6 Key and Send Dynamic Web Import (DWI) Batch File Upload Using DRS Standard File Layout Third Party Bulk Filing .. 7 Instructions .. 8 Who Is Required to Withhold ConnecticutIncome Tax .. 8 Income Subject to Connecticut IncomeTax Withholding .. 8 Pension and annuity distributions .. 8 Unemployment compensation payments .. 8 Gambling winnings other than Connecticut lottery winnings .. 8 Connecticut lottery winnings .. 8 Payments Made to Athletes or Entertainers.

5 8 Payee Request for Withholding Tax .. 9 Payments Not Subject to ConnecticutIncome Tax Withholding .. 9 How to Register for Withholding Tax .. 9 A payer of nonpayroll amounts not already registered with DRS .. 9 A payer of nonpayroll amounts already registered with DRS .. 9 A payer of nonpayroll amounts who acquires an existing business .. 9 Voluntary Registration by Persons OtherThan Employers to Withhold Tax .. 9 How to Report and Remit Taxes Withheld .. 9 When to Remit Withholding Payments .. 10 Remitter Classifi cations .. 10 Weekly Remitter .. 10 Weekly Period Spanning Two Quarterly Periods .. 10 Monthly Remitter .. 10 Quarterly Remitter .. 10 New Payer .. 10 Liability for Taxes Withheld .. 10 Annual Reconciliation of Withholding .. 10 form CT-945 .. 10 Amended Annual Reconciliation of Withholding.

6 11 Annual Summary of Information Returns ..11 form CT-1096 .. 11 Electronic Filing of Forms 1099 and W-2G .. 11 Request for Extended Due Date .. 11 Amended Summary of Information Returns .. 11 Penalties and Interest ..11 Late Payment Penalty .. 11 Penalty for Failure to Pay Electronically .. 11 Late Filing Penalty .. 11 Interest .. 11 Required Information Returns .. 11 Willful Evasion .. 11 Fraud .. 11 Criminal Penalties .. 12 What Records to Keep .. 12 How to Cancel Registration for WithholdingConnecticut Income Tax .. 12 Private Delivery Services .. 12 Related Publications .. 12 Effective Date .. 12 Effect on Other Documents .. 12 Effect of This Document .. 13 Forms and Publications .. 13 Paperless Filing Methods .. 13 DRS E-Alerts Service .. 13 Connecticut Tax Assistance.

7 Back CoverPage 4 IP 2016(8), Connecticut Tax Guide for Payers of Nonpayroll AmountsCalendar of DutiesPayer s Classifi cation Determines When Payments Are Required to Be MadeForms must be fi led electronically and all payments made by electronic funds transfer (EFT) as follows:Weekly remitters on or before the Wednesday following the weekly period during which the nonpayroll amounts were remitters on or before the fi fteenth day of the month following the month during which the nonpayroll amounts were remitters on or before the last day of the month following the quarterly period during which the nonpayroll amounts were Remitter Classifi cations on Page the due date falls on a Saturday, Sunday, or legal holiday, the returnwill be considered timely if fi led by the next business this publication, you means the payer, unless otherwise specifi or Before January 31Yo u must fi le form CT-945, Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts.

8 Even if no tax is due or has been withheld for the u must provide payees with federal form 1099-MISC, Miscellaneous Income; 1099-R, Distributions From Pensions, Annuities, Retirement, or Profi t-Sharing Plans, IRAs, Insurance Contracts, etc.; or W-2G, Certain Gambling Winnings, for each payment, distribution, or transaction made during the preceding calendar year. On or Before March 31Yo u must fi le form CT-1096, Connecticut Annual Summary and Transmittal of Information Returns and Forms 1099-MISC, 1099-R,and W-2G electronically. See Electronic Filing Through the Taxpayer Service Center (TSC) on Page you are unable to fi le information returns electronically due to a documented hardship DRS may waive the requirements. To request a waiver, complete and mail form CT-8508, Request for Waiver From Filing Information Returns Electronically, to DRS at least 30 days before the due date.

9 If a waiver is granted, the due date is the last day of 2016(8), Connecticut Tax Guide for Payers of Nonpayroll Amounts Page 51. Which nonpayroll information returns must be fi led with DRS?DRS requires every state copy of the following: Federal form W-2G for (1) Connecticut Lottery winnings paid to resident and nonresident individuals even if no Connecticut income tax was withheld, and (2) other gambling winnings paid to resident individuals even if no Connecticut income tax was withheld; Federal form 1099-MISC for payments made to Connecticut resident individuals or to nonresident individuals if the payments relate to services performed wholly or partly in Connecticut even if no Connecticut income tax was withheld; and Federal form 1099-R but only if Connecticut income tax was Does DRS participate in the Combined Federal/State Filing Program?

10 Yes. DRS does participate in the Combined Federal/State Filing Program for federal Forms 1099-MISC and Who is required to fi le electronically with DRS?All Payers must fi le form CT-1096 and Forms 1099-MISC,1099-R, or W-2G Where can I get information on fi ling electronically with DRS? You should refer to the current version of Informational Publication 2016(12), Forms 1099-R, 1099-MISC, and W-2G Electronic Filing How do I request a waiver from fi ling information returns electronically?DRS may waive the electronic reporting requirement only if you are unable to fi le electronically due to a documented hardship. To request a waiver, complete and mail form CT-8508, Request for Waiver From Filing Information Returns Electronically, to DRS at least 30 days before the due date.