Transcription of NSDL e-Governance Infrastructure Limited e-Tutorial on TDS ...

1 Confidential. NSDL e-Gov Internal useonlyNSDL e-Governance InfrastructureLimitede-TutorialonTDS/TCS R eturnPreparationUtility(RPU) NSDL e-Gov Internal isRPU? for installation isFVU? to download & install RPU (JAVA) on for installing NSDL e-Gov(RPU) Regularstatements Save thefile Open the savedfile Create thefile Correctionstatements Save thefile Open the saved correctionfile Create the fileVersion NSDL e-Gov Internal useonlyWhat isRPU? (RPU)(basedonJAVA platform) is a freely for preparing quarterly e-TDS/TCSS tatement(s). ForForm24Q,26Q,27Q&27EQ(Regular&Correcti on)forFinancial Year (s).UsersmayuseotherRPUprovidedbysoftwar evendorsforpreparationofquarterlyTDS/TCS S tatement(s). , ,however,Statementsexceeding20,000 NSDL e-Gov Internal useonlyPre-requisites forRPUThee- (JavaRun-timeEnvironment)[versions: ]shouldbeinstalledonthecomputerwherethee - computer facilities (hardware) to install the same NSDL e-Gov Internal useonlyWhat isFVU?

2 FileValidationUtility(FVU)isasoftwaredev elopedbyNSDLe-Gov,whichisusedtoensuretha tthee-TDS/TCSS tatement(s)prepareddoesnotcontainanyform atlevelerror(s). Deductor/CollectorshouldensurethattheQua rterlyTDS/TCSS tatement(RegularandCorrection)isvalidate dbythelatestFVUprovidedbyNSDLe-Govonly. TodownloadlatestversionsofFVU, NSDL e-Gov Internal useonlyFeatures of Return Preparation Utility(RPU)using PreparationofQuarterlyCorrectionStatemen tsConsolidated TDS/TCS files downloaded fromTRACES. In built File Validation Utility (FVU) asfollows: (Regularand Correction) from FY 2007-08 up to FY2009-10. FVU version Statements (Regular and Correction) pertaining to FY :AsdirectedbyIncomeTaxDepartment, NSDL e-Gov Internal useonlySteps to download & install RPU on yourmachineGo to TIN website, on downloads and then click on Regular option undere-TDS/e-TCSV ersion NSDL e-Gov Internal useonlySteps to download NSDL e-Gov RPU( )Version todownload NSDL e-Gov RPUC onfidential.

3 NSDL e-Gov Internal useonlySteps to download NSDL e-Gov RPU( )Version to download NSDL e-GovRPUC onfidential. NSDL e-Gov Internal useonlySteps to download NSDL e-Gov RPU( )Version tosaveConfidential. NSDL e-Gov Internal useonlyGuidelines for installing NSDL e-Gov (RPU)( )Version zipfolderConfidential. NSDL e-Gov Internal useonlyGuidelines for installing NSDL e-Gov (RPU)( )Version click to open thefolderConfidential. NSDL e-Gov Internal useonlyGuidelines for installing NSDL e-Gov (RPU)( ) is a JAVA based utility, so kindly make sure that latest JAVA version is installed on your case you are unable to install RPU, contact TIN call center at 020-2721 8080 or send e-mail toopen RPUC onfidential. NSDL e-Gov Internal useonlyAfter clicking on following screen willappearSelecttherespectiveformforwhic htheStatementistobepreparedVersion NSDL e-Gov Internal useonlyPreparation of RegularstatementEnsure that form youhave selected is correctoneVersion NSDL e-Gov Internal useonlyFor Regular statements Deductor/CollectordetailsNote:1.

4 Be careful while selecting Financial Year, Quarter and also make sure that TAN you have entered is valid 10digit Valid TAN provided byITDE nter valid 10digit PAN provided by ITD, in case PAN is not available quote PANNOTREQDD eductor detailsneeds to beprovided hereSelect Financial YearSelectrespective quarter from dropdownSelectdeductor categoryOnce you select Financial Year, corresponding Assessment Year will that Financial Yearyou have selected NSDL e-Gov Internal useonlyRegular Statement Deductor/CollectordetailsFor Central and StateGovt. provide PAO code, in case PAO code is not available, quotePAOOCDNOTAVBLFor Central and State Govt. select the Ministry/Dept. nameFor Central and State Govt. provide DDO code, in case DDO code is not available quote DDOCDNOTAVBLAIN to be quoted only ifthe tax has been deposited through Transfer Voucher/BookEntryMention 15 digit validGoods and Service Tax Number (GSTIN) ifavailableIf clicked on check box,fields such as Flat No.

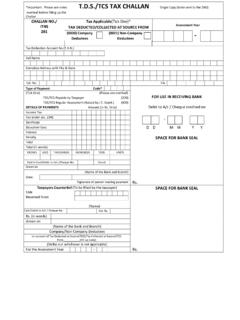

5 , Name of Bldg etc. will be auto populated from particular of deductorVersion NSDL e-Gov Internal useonlyRegular Statement Deductor/CollectordetailsIf regular statement for the TANandForm filed earlier then select Yes other wise No .If option selected in earlier field is Yes , then provide 15 digit receipt number of earlierstatementEnter valid 10 digit PANof person responsible for deduction oftaxVersion NSDL e-Gov Internal useonlyRegular statement -Challandetailsfor payment made through Challan/ TransfervoucherClick on to fillin challandetailsClick here to add numberof challans/transfervouchersVersion NSDL e-Gov Internal useonlyRegular statement -Challandetailsfor payment made through Challan/ TransfervoucherEnter the numberof rows to beinsertedAfter entering numberof rows, click on OK Note:1.

6 Utilization ofchallan:A single challan can be utilized across all Forms ( Form 24Q, 26Q, 27Q & 27EQ). Challan date can be any date on or after 1st April of immediate previous financial year for which the return Challan of `5000/-has been paid in Governments account. Out of `5000/-, `2500/-utilized for Q1 of Form 24Q for FY 2013-14, now remaining `2500/-can be utilized in any other quarter of for any other Form as NSDL e-Gov Internal useonlyRegular statement -Challandetailsfor payment made through Challan/ Transfervoucher1. Enter the row number to bedeleted2. After entering number of row to be deleted , click on OK For deletion of row, click on Delete Row and carryout aboveprocedureVersion NSDL e-Gov Internal useonlyRegular statement -Challandetailsfor payment made through Challan( ) code to be selected under which tax has been deducted.

7 Applicable for statements pertaining to FY 2007-08 to codes will be available under Annexure I in case of statements pertaining to FY field should not be left blank, instead quote amount as if Fee column, late fee paid under section 234E for late filing of TDS statement has to be mentioned. This is applicable for statements pertaining to FY 2012-13 onwards (Same will be applicable only for payments made throughchallan).Enter the challan details TDS amount,Surcharge,Cess, Interest, Fee & Others. Refer note 3 and 4belowSelect theapplicable section code . Refer note 1 and 2belowVersion NSDL e-Gov Internal useonlyRegular statement -Challandetailsfor payment made through Challan( )Enter 7 digit BSRcodeof receivingbranchEnter date on whichtax deposited challan tender date in DDMMYYYY formatEnter 5 digitchallan serialnumberSelect the mode of deposit ofTDS/TCS.

8 Refer note 2 and 3 belowEnter interest amount to be allocated out of totalinterest field should not be left blank, instead quote amount as if case TDS /TCS is deposited by challan then select the option as No . Nil-challans, no value to be selected under book entry flag column number 19 Whether TDS Deposited by Book Entry? (Yes/No).Version NSDL e-Gov Internal useonlyRegular statement -Challandetailsfor payment made through Challan( )For TDS payable by taxpayer, select 200 or select 400 for TDS regular assessment raised by Income Tax Dept. Refernote 1belowNote:1. Minor Head of challan value to be quoted for statements pertaining to FY 2013-14 onwards for tax deposited NSDL e-Gov Internal useonlyRegular statement -Challandetailsfor payment made through Challan( )Click here tocheck status of challan using CINdetailsClick here to view challan based on TANs and to download.

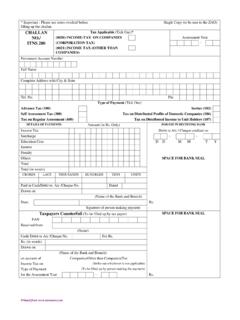

9 CsifilesNote:1..csi file contains challan details submitted to bank. Further , it is mandatory to use .csi file at the time of validation of TDS/TCS statement(s) where challan are paid throughbank(s).Version in OLTAS challanConfidential. NSDL e-Gov Internal useonlyThe fields that can be corrected by the Taxpayer through Bank are of CorrectiononChallanPeriod for correction request (indays)1 PAN/TANW ithin 7 days from challan depositdate2 AssessmentYearWithin 7 days from challan depositdate3 TotalAmountWithin 7 days from challan depositdate4 MajorHeadWithin 3 months from challan depositdate5 MinorHeadWithin 3 months from challan depositdate6 Nature ofPaymentWithin 3 months from challan depositdateVersion statement -Challandetailsfor payment made through Transfer Voucher( )Enter the challan details TDS amount,Surcharge,Cess, Interest, Fee & Others.

10 Refer note 3 and 4belowSelect theapplicable section code . Refer note 1 and 2belowConfidential. NSDL e-Gov Internal code to be selected under which tax has been deducted. Applicable for statements pertaining to FY 2007-08 to codes will be available under Annexure I in case of statements pertaining to FY field should not be left blank, instead quote amount as if Fee column, late fee paid under section 234E for late filing of TDS statement has to be mentioned. This is applicable for statements pertaining to FY 2012-13 onwards (Same will be applicable only for payments made throughchallan).Version NSDL e-Gov Internal useonlyRegular statement -Challandetailsfor payment made through Transfer Voucher( )Enter 7 digit BSRcodeof receivingbranchEnter date on whichtax deposited challan tender date in DDMMYYYY formatEnter 5 digitchallan serialnumberBook Entry flagshould be Yes in case of payment made through transfer note2and 3belowEnter interest amount to be allocated outof total interest field should not be left blank, instead quote amount as if case TDS /TCS is deposited by Book entry Transfer Voucher(Applicable only in case of Govt Department) then select the option as Yes.

![TAX DEDUCTION AT SOURCE [TDS]](/cache/preview/9/f/0/5/3/6/e/1/thumb-9f0536e1f15bf9dfca51b550636c04d3.jpg)