Transcription of TAX DEPRECIATION OF VEHICLES - AIPB

1 Section 8 TAX DEPRECIATION OF VEHICLESI ntroductionFor tax DEPRECIATION purposes, a vehicle is generally placed into one of threegeneral categories. Some categories have dollar limits on Section 179expensing or DEPRECIATION , some on both, some on neither. All VEHICLES are5-year property (have a 5-year recovery period)The three categories are as follows:1. Passenger tax law a passenger auto is anyfour-wheel vehicle made primarily for use on public streets, roads, orhighways and rated at 6,000 pounds or less of unloaded gross vehicleweight.

2 This includes most cars and light (up to 6,000 pounds) SUVs,pickups or vans not specially modified (see below).All passenger autosare subject to annual IRS limits for combined Section 179 expensing andtax Heavy SUVs, pickups and are VEHICLES that weigh morethan 6,000 pounds, but less than 14,000 pounds. Section 179 expensingis limited to $25,000 but there is no limit on annual Other are VEHICLES that do not fit in the first twocategories. They have no limits on Section 179 expensing or annualdepreciation.

3 Other VEHICLES include the following:specially modified VEHICLES . Specially modified has a specificmeaning under tax law. It means modified in a way that makes itunlikely that the vehicle will be driven for personal use; such asmodified so that there is seating for only a driver and one weighing at least 14,000 pounds ( , tractor-trailers andconstruction VEHICLES ); andlarger delivery trucks, hearses, taxis ( used in the trade or businessof transporting people for pay or hire ), and delivery VEHICLES ( usedin the business of transporting property for pay or hire ) and trucksnot designed to carry Limitson Passenger AutosUnder MACRS, annual DEPRECIATION of a company car is computed in thesame way as other 5-year equipment.

4 But the amount of depreciationallowed each year is limited, as shown in Exhibit A above. There is one setof IRS limits for autos (cars); another for light SUVs, pickups and vansweighing 6,000 pounds or less that are not specially modified. Note thedifference in the IRS limits between new and used VEHICLES throughout therecovery each year, you must compute Table 1 DEPRECIATION for the car, compare itto the IRS limit, and use the lower :The IRS publishesthis limit table each year, adjusting the limits for inflation.

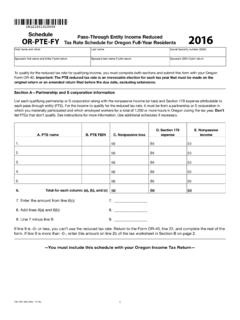

5 However, youmust use the IRS limits for the year in which the car was acquiredthroughout the car s recovery 1:On July 6, 2012, StudCo acquires* a new passengerauto with a cost basis of $28,000. What is Table 1 DEPRECIATION (seepage 147) for Year 1? What is the IRS limit for Year 1? Which amountmust StudCo use for its tax return? What is StudCo s maximumdepreciation deduction for each subsequent year?Mastering Depreciation188 EXHIBIT APassenger Autos Placed in Service in 2012 Light SUVsAutos (cars)Pickups and Vans*50% bonusNo bonus taken50% bonusNo bonus takentakenor used vehicletakenor used vehicle1st year$11,160$3,160$11,360$3,3602nd year5,1005,1005,3005,3003rd year3,0503,0503,1503,1504th year and after 1,8751,8751,8751,875* Weigh 6,000 pounds or less and are not specially modified.

6 *Under both generally accepted accounting principles (GAAP) and tax law, DEPRECIATION cannot beginuntil the asset has been acquired and placed in service. However, to avoid cumbersome, repetitiouslanguage ( acquires and places in service .. ), it is assumed throughout this course that the acquiredasset is placed in service on the date of compute Year 1 DEPRECIATION :$28,000 cost basis 50% bonus DEPRECIATION rate = $14,000 bonusdepreciation. $28,000 cost basis $14,000 bonus DEPRECIATION = $14,000new cost basis 20% Table 1 rate for Year 1 DEPRECIATION = $2,800 +$14,000 bonus DEPRECIATION = $16,800 total DEPRECIATION for Year the IRS Year 1 limit for a new passenger auto purchased in 2012,(Exhibit A) is $11,160.

7 StudCo can take only $11,160 DEPRECIATION thefirst year. The $5,640 excess ($16,800 DEPRECIATION $11,160 limit)will be taken in later schedule below shows tax DEPRECIATION for the auto over itsrecovery DEPRECIATION of Vehicles189 Tax ReturnDepreciation rateComputedIRS LimitDepreciationDepreciationCost basis(Table 1) DEPRECIATION (2012)ExpensedeferredYear 1$28,000 $14,00014,000* ,800$11,160$11,160$5,640 Year 214,000 ,4805,1004,480** Year 314,000 ,6883,0502,688** Year 414,000 ,8751,613 Year 514,000 ,8751,613 Year 614,000 ,875806 Year 71,8751,875**3,765 Year 81,8751,8751,890 Year 91,8751,87515 Year 10150 Total$28,0000*Revised cost basis ($28,000 original cost basis $14,000 bonus DEPRECIATION ).

8 **Year 2 computed DEPRECIATION of $4,480 is lower than the IRS limit of $5,100. Because the company mustalways use the lower amount, StudCo can take only $4,480 DEPRECIATION in Year 2.**The company must use the computed DEPRECIATION of $2,688 because it is lower than the IRS limit of $3,050.**In Year 7, the company can start to take the $5,640 of DEPRECIATION deferred in Year 1. It can take up tothe IRS limit of $1,875 per year until it has depreciatedthe full cost basis of $28,000. To allow for full depreci-ation of the cost basis, the recovery period is extended to 10 's Annual Tax DEPRECIATION for the New CarEXAMPLE 2:On July 6, 2012, StudCo acquires ausedpassengerauto with a cost basis of $28,000.

9 What is Table 1 DEPRECIATION forYear 1? What is the IRS limit for Year 1? What is StudCo s maximumdepreciation for Year 1?To compute Year 1 DEPRECIATION :$28,000 cost basis $20% Table 1 rate for Year 1 = $5, IRS Year 1 limit for a used passenger auto purchased in 2012is $3,160 (Exhibit A, page 188).StudCo s maximum DEPRECIATION for Year 1 is $3,160. The $2,440excess ($5,600 Table 1 DEPRECIATION $3,160 limit) will be taken inlater Sec. 179 Is Rarely Usedfor Passenger AutosUnder IRS Year 1 passenger auto limits $11,160 for a new auto and $11,360for a new light SUV, pickup or van there is no point in wasting part of the$139,000 Sec.

10 179 deduction, because it would exceed the deduction 179 limits onheavySUVs, pickups and any heavy SUV purchased after October 22, 2008, the Sec. 179deduction is limited to $25, of annual tax deductions for vehiclesSection 179 deduction($139,000 in 2012)DepreciationPassenger autos (includes unmodifiedlight SUVs, pickups and vans)Rarely usedApply the lesser ofIRS limits or Table SUVs, pickups and vansUp to $25,000 Table 1 Other vehiclesUp to $139,000 Table 1 The remaining cost basis after the Sec. 179 deduction is taken can bedepreciated using Table Depreciation190 EXAMPLE 3:During 2012, StudCo purchases a new, heavy SUVwith a cost basis of $27,000.