THE COMPLETE GUIDE TO DEDUCTING BUSINESS TRAVEL …

deductions to explore: medical expense, charitable, student loan interest, mortgage interest and more. ... A taxpayer may deduct business travel expenses IF they are ordinary and necessary and IF they are incurred away from his or her tax home. ... Create and store a …

Tags:

Medical, Travel, Expenses, Travel expenses

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

A Summary of Your Rights Under the Fair Credit …

www.hrblock.comConsumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete or unverifiable information must be

Your, Direct, Under, Consumer, Summary, Rights, Fair, Summary of your rights under the fair credit

Privacy Notice - Tax Preparation Services Company

www.hrblock.comAs part of providing products and services to you, we may collect information, including personal information, about you, your spouse, your dependents, or your business when you use our services.

Individual Tax Rate Table - H&R Block®

www.hrblock.comIndividual Tax Rate Table 2018 Updated for the Tax Cuts and Jobs Act As of December 20, 2017 If your filing status is Single: If your taxable income is: Over - But not over - $0 $9,525 10% of the amount over $0 $9,525 $38,700 $952.50 + 12% of the amount over $9,525

2017, Income, Individuals, Rates, Table, Block, H amp r block, Individual tax rate table

Preseason Tax Professional Job Description - H&R Block®

www.hrblock.comPreseason Tax Professional Job Description: As a Preseason Tax Professional, you are responsible for providing an outstanding client experience by utilizing interview techniques that will help you determine

Professional, Descriptions, Block, Preseason, H amp r block, Preseason tax professional job description

AIRBNB HOST REPORTING GUIDE - hrblock.com

www.hrblock.compassive income and not against nonpassive income, such as wages or investment income. If you cannot use losses in a particular year because of the rules, the losses are carried forward indefinitely to future tax years in which your passive activities generate enough income to absorb the losses.

H&R BLOCK EMERALD PREPAID MASTERCARD

www.hrblock.comThe Card is a prepaid card and is connected to a Card Account. The Card is not a credit card. Neither the Card nor the Card Account constitutes a checking or savings account.

A little about H&R Block.

www.hrblock.comH&R Block is a global consumer tax services provider, having prepared more than 720 million tax returns by and through retail locations and digital solutions since 1955.

About, Little, Block, H amp r block, A little about h amp r block

Tax Year 2018 H&R Block Deluxe

www.hrblock.comForm 4972 Tax on Lump-Sum Distributions Form 5329 Return for IRA and Retirement Plan Tax Form 5405 Repayment of First-Time Homebuyer Credit Form 5498-SA Health Savings Account

Tax Year 2018 H&R Block Premium

www.hrblock.comTax Year 2018 H&R Block Premium Form 1040 Individual Income Tax Return Form 1040 Schedule 1 Additional Income and Adjustments to Income Form 1040 Schedule 2 Tax

Tax Year 2018 H&R Block Online Tax Program State Forms

www.hrblock.comTax Year 2018 H&R Block Online Tax Program State Forms . Alabama . 2210AL Estimated Tax Penalties – Individual 40

Programs, Form, States, Online, Estimated, Block, H amp r block online tax program state forms

Related documents

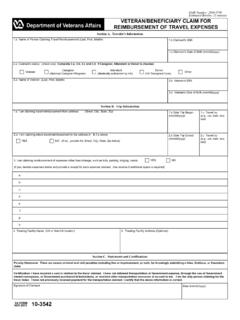

OMB Number: 2900-0798 - Veterans Affairs

www.va.govREIMBURSEMENT OF TRAVEL EXPENSES . OMB Number: 2900-0798 Estimated Burden: 15 minutes. ... VA systems of records 24VA19 Patient Medical Record-VA, published in the Federal Register in accordance ... travel benefits may also be done in person at a VA health care facility. 4. Application for travel reimbursement must be done within 30 days of travel.

Medical, Record, Travel, Affairs, Expenses, Veterans, Medical records, Veterans affairs, Travel expenses

CLAIMANT'S RECORD OF MEDICAL AND TRAVEL …

www.wcb.ny.govmileage or other necessary expenses going to and from your health care provider's office or the hospital. To help you keep a record of such expenses we have provided this form. In order to help insure that you are properly reimbursed, list each item of expense below -- whether or not you obtained a receipt (wherever possible obtain receipts).

Medical, Record, Travel, Expenses, Record of medical and travel

Tax Prep Checklist - H&R Block

www.hrblock.comAmounts of miles driven for charitable or medical purposes Expenses related to your investments Amount paid for preparation of last year’s tax return Employment-related expenses (dues, publications, tools, uniform cost and cleaning, travel) Job-hunting expenses Receipts for energy-saving home improvements Record of estimated tax payments made

Medical, Checklist, Record, Travel, Block, Expenses, Prep, H amp r block, Tax prep checklist

BookSafe Travel Protection Plan - Norwegian Cruise Line

www.ncl.com4. expenses incurred for non-emergency medical evacuation, including medically appropriate transportation and medical care en route, to a Hospital or to your place of residence, when deemed medically necessary by the attending Physician, subject to the Program Medical Advisors prior approval; 5. expenses for transportation not to exceed the cost

Medical, Norwegian, Line, Travel, Cruises, Expenses, Norwegian cruise line

Temporary Duty (TDY) Travel Voucher Guide

www.dfas.milThe DD Form 1351-2 is the primary form used to record travel itineraries and claim expenses for government travel. As with tax forms there is a correct way to fill out the DD 1351-2, regardless of the type of travel you are performing. The following is a step-by-step guide to ensure that you are filling the form out correctly.

Travel and Business Expense Policy (OFS-3)

www.brookings.eduAll travel and business expenses must be authorized and approved by Brookings ... • For a documented medical conditionRequests . ... record this reimbursement as …

Business, Policy, Medical, Record, Travel, Expenses, Travel and business expense policy, Ofs 3

Department of Defense

www.defensetravel.dod.milC. Request and record debt collection via payroll deduction. D. Request and record debt write-off for uncollectible debts under $225 belonging to travelers that are no longer paid by DoD in accordance with DoD FMR, Volume 4, Chapter 3.. E. Request and record debt transfers of debts $225 and over belonging to

DTS Guide 4: Local Vouchers - Defense Travel Management ...

www.defensetravel.dod.mildriven from your residence to the local travel location is 30 minus 20 for your daily commute, multiplied by the current mileage rate .56 = $5.60 reimbursement for one direction (Figure 4-7a).