Transcription of United States Department of Agriculture Agricultural ...

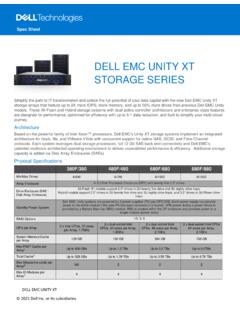

1 United States Department of Agriculture Foreign Agricultural Service Cotton: World Markets and Trade Approved by the World Agricultural Outlook Board/USDA For email subscription, click here to register: January 2022 Shipments Lag in First 5 Months as Disruption of Seasonal Patterns Continues Note: Shipments and Outstanding Sales through Week 53 of the 2021 Calendar Year; ROW (Rest of World) Source: USDA Export Sales The most recent Export Sales Report shows that total commitments for 2021/22 (accumulated exports plus outstanding sales, OS) relative to forecast exports of million bales for the 2021/22 marketing year (MY) are in line with historical levels. However, accumulated exports through week 22 as a percentage of forecast exports are the second-lowest since Export Sales Reporting started in 1974.

2 At the same time, current outstanding sales as a percentage of projected exports are the second-highest in 10 years. Simply put, large outstanding sales are offsetting low physical shipments thus far. Outstanding sales to China, Turkey, and Pakistan are up sharply from last year. A large portion of sales to China are believed to be destined for its State Reserve, with delivery expected in the second half of the marketing year. Pakistan, which experienced a very poor crop in 2020, saw very high levels of buying in 2020/21 resulting in both large carryover sales and 2021/22 sales; outstanding sales at the beginning of 2021/22 were nearly double their previous record level. Sales to Turkey have been strong with record forecast consumption exceeding the previous year s record by 800,000 bales; imports are forecast at their second-highest level.

3 While overall sales have been adequate to reach the export forecast, shipments have been extremely slow, particularly in the last 2 months reflecting low beginning stocks, lags in harvesting and processing, and logistical issues. Shipments 0123 Million BalesShipments2020/212021/220123 Million BalesOutstanding Sales2020/212021/22 through December are down 45 percent from last season (2021/22 exports are forecast down nearly 10 percent from the previous year). Exports to eight of the top 10 markets are down, with China down over 70 percent and Vietnam down by half. China s total imports during August-November 2021 are down nearly 60 percent from the same period, and market share has fallen from 61 to 42 percent.

4 Slower demand is attributed to China liquidating record stocks of foreign cotton in bonded warehouses since the beginning of the marketing year. Vietnam s total imports are up 15 percent through mid-December while shipments to the country are down 55 percent. Australia has greatly benefited from the fall in market share. However, shipments are up to destinations outside last season s top ten, particularly to Central American markets. Logistical issues affecting textile and apparel shipments to the United States from Asia and the Withhold Release Order on cotton from Xinjiang are likely supporting stronger mill demand in Central America. Similarly, the primary and secondary shocks of the COVID pandemic have altered typical seasonal patterns for cotton exports on both the plus and negative sides at various times since February 2020.

5 Late harvested cotton is reportedly moving into position for export and later-season shipments are expected to be above typical seasonal norms. Source: USDA Export Sales; Note: ROW (Rest of World) Shipments in the remainder of 2021/22 are expected to total more than million bales, 30 percent above last season and 25 percent above the average of the last 10 years. In only 2 years since 1974 has the United States shipped that level of cotton. In addition to logistical issues, tighter beginning stocks and delayed classing have also contributed to the slow start. As shippers adjust to logistical issues and COVID-affected classing catches up, exports are expected to accelerate significantly enabling exports to reach the forecast.

6 Similarly, during August-01234 Million Shipments & Outstanding Sales (Week 53 of 2021 Calendar Year)ExportedOutstanding SalesForeign Agricultural Service/USDA 2 January 2022 Global Market Analysis December 2020 cotton exports shot up 34 percent from the year before and 66 percent from 2 years earlier to a record high as shipments delayed by the pandemic s start were completed. 2021/22 Outlook Global production is lowered from last month with smaller crops in the United States and India more than offsetting larger crops in China, Australia, and Pakistan.

7 Use is mostly unchanged and ending stocks are down more than 700,000 bales. Global trade is trimmed with imports for China and exports both projected lower. production is down more than 600,000 to million bales. Exports are reduced 500,000 bales and use is raised 50,000 bales, with ending stocks 200,000 bales lower. The season-average farm price is unchanged at 90 cents per pound. For current prices received by farmers click here: NASS farm price. Note: A-Index is the average of the five cheapest quotations (quality being Middling 11/8) for Cost and Freight (CFR) at a Far Eastern Port (more information here); is the simple average of spot quotations reported by the Agricultural Marketing Service (more information here); China is the reported China Cotton Price Index ( CCIndex 3128B) and reflects the national weighted average of cotton (3128B grade) delivered to more than 200 enterprises in China; India is the Shankar-6 (grade ) spot price reported here; Brazil is the delivered price in S o Paulo city (grade strict low middling).

8 406080100120140160 Aug-19 Sep-19 Oct-19 Nov-19 Dec-19 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22cents per poundWeekly Cotton Agricultural Service/USDA 3 January 2022 Global Market Analysis Changes Since December WASDE (cents per pound) A-Index China India Brazil 8-Dec 10-Jan Change Global cotton prices rose since last month s WASDE following strong global demand amidst constrained supplies available for nearby delivery.

9 Speculators liquidated contracts after last month s onset of the Omicron COVID-19 variant, however, open interest has edged back up on the Intercontinental Commodity Exchange as speculators have registered greater long positions. India witnessed the most significant rise this month, climbing over 15 cents owing to resilient domestic demand. Strong export sales and logistical constraints continue to support prices in the United States . Spot prices in China and Brazil were marginally higher from the previous report. Nonetheless, a significant margin between prices in China relative to the rest of the world remains. The A-index is roughly 30 cents lower than domestic prices in China compared with 20 cents at this period last year; imports are expected to rise significantly in the coming months.

10 2021/22 Trade Outlook (1,000 480-lb Bales) Major Importers: Previous Current Change Reason WORLD 46,940 46,560 -380 China 10,250 9,750 -500 Lower consumption and larger crop Pakistan 5,300 5,500 200 Higher consumption Malaysia 800 700 -100 Inverted ICE market incentivizes greater shipments directly to mill and less into Malaysia for consignment Major Exporters: Previous Current Change Reason WORLD 46,945 46,560 -385 United States 15,500 15,000 -500 Logistical issues slowing recent shipments and lower production Australia 3,900 4,000 100 Larger production Burkina Faso 950 850 -100 Lower carryin The Foreign Agricultural Service (FAS) updates its production, supply, and distribution (PSD) database for cotton, oilseeds, and grains at 12:00 on the day the World Agricultural Supply and Demand Estimates (WASDE) report is released.