And use tax exemption certification

Found 9 free book(s)01-339 Sales and Use Tax Exemption Certification

www.tasfaa.orgTEXAS SALES AND USE TAX EXEMPTION CERTIFICATION Name of purchaser, firm or agency Address (Street & number, P.O. Box or Route number) Phone (Area code and number) City, State, ZIP code

TP-584 New York State Department of Taxation …

www.judicialtitle.comNew York State Department of Taxation and Finance Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the

Form TP-584:4/13:Combined Real Estate Transfer …

www.tax.ny.govPage 4 of 4 TP-584 (4/13) Schedule D - Certification of exemption from the payment of estimated personal income tax (Tax Law, Article 22, section 663) Complete the following only if a fee simple interest or a cooperative unit …

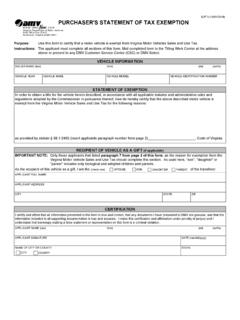

PURCHASER'S STATEMENT OF TAX EXEMPTION

www.dmv.virginia.govSUT 3 (07/01/2017) IMPORTANT NOTE: Only those applicants that listed . paragraph 7 from page 2 of this form, as the reason for exemption from the

TEXAS SALES AND USE TAX EXEMPTION …

www.lee.eduI, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below …

Sales Tax Exemption Administration - New Jersey

www.state.nj.usRev. 8/07 Sales Tax Exemption Administration . Tax Topic Bulletin S&U-6 . Introduction . The New Jersey Sales and Use Tax Act (the “Act”) imposes a tax on receipts from every retail

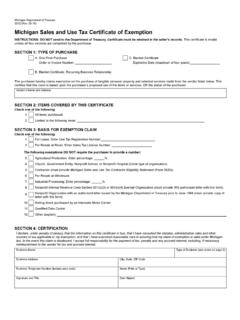

3372, Michigan Sales and Use Tax Certificate of …

www.michigan.gov3372, Page 2 Instructions for completing Michigan Sales and Use Tax Certificate of Exemption (Form 3372) Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

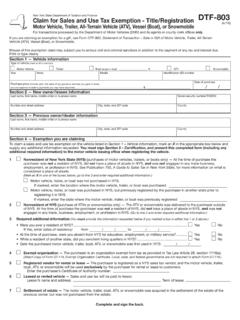

Form DTF-803:4/14: Claim for Sales and Use Tax …

www.tax.ny.govDTF-803 (4/14) New York State Department of Taxation and Finance Claim for Sales and Use Tax Exemption - Title/Registration Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile

Illinois Department of Revenue RUT-25 Vehicle Use …

tax.illinois.govRUT-25 Instructions (R-06/16) Line 1: Purchase price includes accessories, federal excise taxes, freight and labor, documentary fees, and any rebates or incentives for which a dealer is reimbursed from any source.

Similar queries

AND USE TAX EXEMPTION CERTIFICATION, York State Department of Taxation, York State Department of Taxation and, Certification, Exemption, TP-584, PURCHASER'S STATEMENT OF TAX EXEMPTION, And Use Tax Exemption, And use, Sales Tax Exemption Administration, New Jersey, And Use Tax, New York State Department of Taxation and Finance, Illinois Department of Revenue