Contractor Exempt Purchase

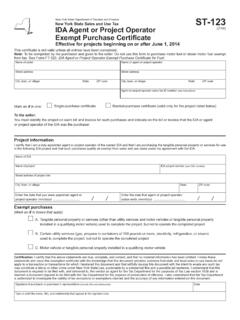

Found 9 free book(s)New York State Department of Taxation and Finance New …

www.tax.ny.govA contractor or subcontractor not appointed as agent or project operator of an IDA must present suppliers with Form ST-120.1, Contractor Exempt Purchase Certificate, when making purchases that are ordinarily exempt from tax in accordance with Tax Law sections 1115(a)(15) and 1115(a)(16). For more information, see Form ST-120.1. Exempt purchases

Business axes for C Subcontractors, and Repairmen

ksrevenue.govContractor-retailers may purchase their inventory exempt from sales tax using the Contractor-Retailer Exemption Certificate. The contractor-retailer will then collect sales tax when these items are sold at retail. EXAMPLE: A lumberyard buys lumber and paint directly from a manufacturer using a Kansas Resale Exemption Certificate.

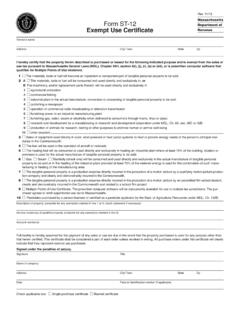

Form ST-12 Department of Exempt Use Certificate

www.mass.govDec 12, 2017 · An exempt use cer-tificate furnished by the contractor’s customer to the contractor will not relieve the contractor from liability. See DD 07-6, “Exemptions under G.L. c. 64H, sec. 6(r) and sec. 6(s)” for further information. Notice to Purchasers This form is not to be used by an exempt organization (use Form

Important—Certifi cate not PURCHASE EXEMPTION valid …

revenue.ky.govName of Exempt Institution Name of Vendor Address CAUTION TOSELLER: This certifi cate cannot be issued or used in any way by a construction contractor to purchase property to be used in fulfi lling a contract with an exempt institution. Sellers accepting certifi cates for such purchases will be held liable for the sales or use tax.

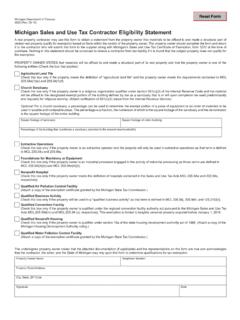

3520, Michigan Sales and Use Tax Contractor Eligibility ...

www.michigan.govit to the contractor who will submit this form to the supplier along with Michigan’s Sales and Use Tax Certificate of Exemption, form 3372 at the time of purchase. Nothing in this statement should be construed to relieve a contractor from tax liability if it is found that the subject property does not qualify for the exemption.

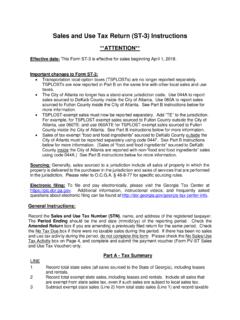

Sales and Use Tax Return (ST-3) Instructions

dor.georgia.govare exempt from state sales tax, even if such sales are subject to local sales tax. ... A contractor purchases an item for $600.00 in a Georgia jurisdiction where the total ... pays the other state’s 5% state sales tax at the time of purchase and returns to Georgia with the item. The purchaser will receive credit against Georgia’s

Sales and Use Tax Information for Contractors

www.revenue.wi.govNew exemption for building materials sold to a construction contractor who, in fulfillment of a r eal property construction activity, transfers the building materials to certain exempt entities, if the building materials become part of a "facility" in Wisconsin, owned by the exempt entity.

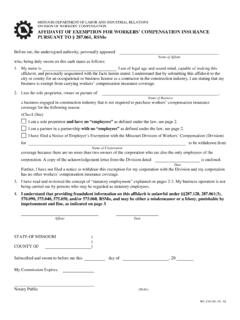

Affidavit of Exemption for Workers' Compensation Insurance

labor.mo.govbusiness is exempt from carrying workers’ compensation insurance coverage. 2. I am the sole proprietor, owner or partner of , Name of Business. a business engaged in construction industry that is not required to purchase workers’ compensation insurance coverage for the following reason: (Check One) I am a sole proprietor . and have no ...

General and Targeted Distribution Post-Payment Notice of ...

www.hrsa.govor contractor payroll, overhead employees, or security personnel. 2 d. Fringe Benefits: Extra benefits supplementing an employee’s salary, which may include hazard pay, travel reimbursement, and employee health insurance. e. Lease Payments: New …