Contribution Plan Under

Found 6 free book(s)FAQs about Retirement Plans and ERISA - DOL

www.dol.gov401(k) Plan – In this type of defined contribution plan, the employee can make contributions from his or her paycheck before taxes are taken out. The contributions go into a 401(k) account, with the employee often choosing the investments based on options provided under the plan. In some plans, the employer

Retirement Plan Single Withdrawal ... - Fidelity Investments

www.fidelity.comYou are younger than 59½ at time of distribution. Must qualify under the Plan definition of “disability” as defined in Article 2.16 of the Defined Contribution Retirement Plan. Death of plan participant Plan termination Qualified birth or adoption . Distribution up to $5,000 must be made within the one-year period following the date of your

CHOOSING A RETIREMENT SOLUTION - IRS tax forms

www.irs.govDefined contribution plans are employer-established plans that do not promise a specific benefit at retirement. Instead, employees or their employer (or both) contribute to employees’ individual accounts under the plan, sometimes at a set rate (such as 5 percent of salary annually). At retirement, an employee

IRS HSA Contribution 2022 HSA Contributions Limits (Based ...

www.llnl.govthe dependent is a dependent under IRS rules (IRC Section 152). Please note that if you are enrolled in any other medical plan, including Medicare (Part A …

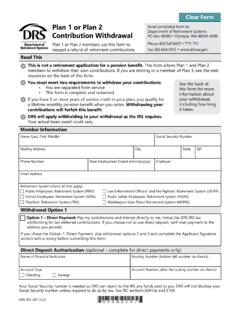

Plan 1 or Plan 2 Send completed form to: Contribution ...

www.drs.wa.govPlan 1 or Plan 2 Contribution Withdrawal Plan 1 or Plan 2 members use this form to request a refund of retirement contributions. Send completed form to: Department of Retirement Systems PO Box 48380 ꔷ Olympia, WA 98504-8380 Phone 800.547.6657 ꔷ TTY: 711 Fax 360.664.7975 ꔷ www.drs.wa.gov DRS MS 287 2/22 Read This

The United States of America - United Nations Framework ...

www4.unfccc.intApr 15, 2021 · The nationally determined contribution of the United States of America is: To achieve an economy-wide target of reducing its net greenhouse gas emissions by 50-52 percent below 2005 levels in 2030.