Filing Past Due Returns

Found 7 free book(s)(Rev. October 2020) - IRS tax forms

www.irs.gov•During the past 5 tax years, you (and your spouse if filing a joint return) have timely filed all income tax returns and paid any income tax due, and haven’t entered into an installment agreement for the payment of income tax; •You agree to pay the full amount you owe within 3 years and to comply with the tax laws while the agreement is in

Amended and Prior Year Returns - IRS

apps.irs.govAfter the due date of the original return, a taxpayer can change from Married Filing Separately to Married Filing Jointly, but cannot change from Married Filing Jointly to Married Filing Separately. However, an executor may be able to make this change for a deceased spouse. Refer to Publication 17 for more information.

Instructions for Form 8379 (Rev. November 2021)

www.irs.govpast-due obligation of the other spouse. By filing Form 8379, the injured spouse may be able to get back his or her share of the joint refund. Which Revision To Use Use the November 2021 revision of Form 8379 for tax years beginning in 2021 or later, until a later revision is issued. Use prior revisions of the form and instructions

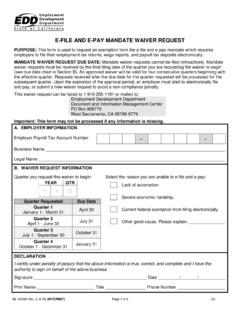

E-FILE AND E-PAY MANDATE WAIVER REQUEST

edd.ca.govemployers to file their employment tax returns, wage reports, and payroll tax deposits electronically. MANDATE WAIVER REQUEST DUE DATE: Mandate waiver requests cannot be filed retroactively. Mandate waiver requests must be received by the final filing date of the quarter you are requesting the waiver to begin (see due date chart in Section B).

2017 Tax Brackets FACT

files.taxfoundation.orgFiling Status Exemption Amount Single $54,300 Married Filing Jointly $84,500 Married Filing Separately $42,250 Trusts & Estates $24,100 SourceL IRS. In 2017, the 28 percent AMT rate applies to excess AMTI of $187,800 for all taxpayers ($93,900 for …

Filing Status - IRS tax forms

apps.irs.govagainst their spouse’s outstanding debts. This includes past due child support, past due student loans, or a tax liability the spouse incurred before they were married. If married taxpayers want to file separately, and a potential refund offset is the reason, suggest that they file a joint return with Form 8379, Injured Spouse Allocation.

Mailing Addresses for D.C. Tax Returns Form Mailing ...

otr.cfo.dc.govMailing Addresses for D.C. Tax Returns Business Forms Mailing Address FP-31 Personal Property Tax (without payment) Office of Tax and Revenue PO Box 96144 Washington, DC 20090-6144 FP-129A, Extension of Time to File Personal Property Tax Office of Tax and Revenue PO Box 96196 Washington, DC 20090-6196 FR-800A Sales and Use Annual