Fringe benefit guide

Found 9 free book(s)DOMESTIC TAXES DEPARTMENT EMPLOYER’S GUIDE TO PAY …

www.kra.go.ke3. purpose of employer’s guide to “pay as you earn” 8 4. regulations 8 5. definitions of terms used 9 6. employment benefits 11 7. low interest rate employment benefit/fringe benefit 13 8. housing - section 5(3) 16 9. car benefit - sec 5(2b) 17 10. tax free remuneration 18 11. passages 18 12. medical services and medical insurance 18 13.

PAYE-GEN-01-G02 - Guide for Employers in respect of Fringe ...

www.sars.gov.zaGUIDE FOR EMPLOYERS IN RESPECT OF FRINGE BENEFITS PAYE-GEN-01-G02 REVISION: 9 Page 3 of 29 1 PURPOSE The purpose of this document is to assist employers in understanding their obligations relating to determining the cash equivalent of the value of a taxable fringe benefit as provided for in the Seventh Schedule to the Income Tax Act.

EMPLOYER WITHHOLDING INFORMATION GUIDE

www.revenue.pa.govThis guide is designed to help employers recognize and fulfill these requirements. Definition of Employer and Employee An employer is any individual, partnership, association, corpo- ... Employee fringe benefit programs, such as pensions, profit-sharing and stock bonus plans and simplified employee plans 4

CDOT LCPTracker Contractor User Guide

www.codot.govFringe Benefit Statement shown on the next page. • To view eDocuments you have already uploaded, click . View eDocuments. o Enter any relevant information in the filters, and click load data. o Any available eDocuments will show in a list below the load data button . From here you can view the document, view the document details,

PAYE-GEN-01-G16 - Guide for Employers iro Employees Tax ...

www.sars.gov.zaFringe benefit: employer - owned provided motor vehicles With effect from 1 March 2011, the percentage rate for all employers - owned provided vehicles is 3.5 % per month of the vehicle’s determined value.

FRINGE BENEFITS

cfr.gov.mtFRINGE BENEFITS TAX GUIDE This guide is published by the Office of the Commissioner for Revenue to provide explanations and instructions on the application of the Fringe Benefits Rules (SL 123.55). It replaces the Fringe Benefits Tax Guide that was published in January 2001 and the updates to that guide.

Fringe Benefit Guide - IRS tax forms

www.irs.govThe taxable amount of a benefit is reduced by any amount paid by or for the employee. For example, an employee has a taxable fringe benefit with a FMV of $300. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Special valuation rules apply for certain fringe benefits. These rules are covered in other sections

Benefits Fringe Tax Guide to Page 1 of 34 16:10 - 10-Dec ...

www.irs.gov1. Fringe Benefit Overview. A fringe benefit is a form of pay for the performance of services. For example, you provide an employee with a fringe benefit when you allow the employee to use a busi-ness vehicle to commute to and from work. Performance of services. A person who performs serv-ices for you doesn't have to be your employee. A person

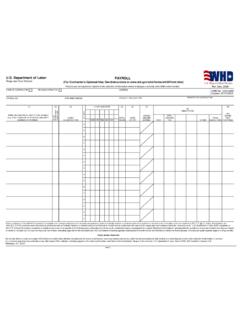

U.S. Department of Labor PAYROLL Wage and Hour Division ...

www.dol.govRev. Dec. 2008 While completion of Form WH-347 is optional, it is mandatory for covered contractors and subcontractors performing work on Federally financed or assisted construction contracts to respond to the information collection contained in 29 C.F.R. §§ 3.3, 5.5(a).