Guidelines For Vat Registration

Found 10 free book(s)Part 38-01-03a - Guidelines for Registration for IT, CT ...

revenue.ieThese guidelines are for Revenue staff dealing with the registration process for Income Tax (IT), Corporation Tax (CT), Employer PAYE/PRSI (PREM), Relevant Contracts Tax (RCT) and some minor taxes. Information on registering for VAT is available in Tax and Duty Manual (TDM) Guidelines for VAT Registration (Part 38-01-03b).

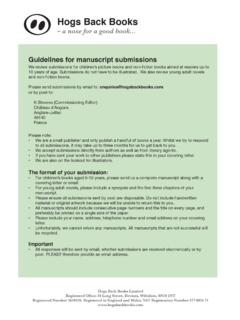

Hogs Back Books

www.hogsbackbooks.comGuidelines for manuscript submissions. We review submissions for children’s picture books and non-fiction books aimed at readers up to 10 years of age. Submissions do not have to be illustrated. We also review young adult novels ... VAT Registration Number 977 6056 71 www.hogsbackbooks.com. Created Date:

Mechanisms for the Effective Collection of VAT/GST - OECD

www.oecd.orgforeign suppliers are relieved of the obligation to both register for and collect VAT through a simplified registration and collection regime . VAT - Any national tax that embodies the basic features of a value added tax as described in Chapter 1 of the International V AT/GST Guidelines by whatever acronym it is known (e.g. GST)

Implementing rules and regulations of the TRAIN Law - …

www2.deloitte.comP3,000,000 may continue to be VAT-registered taxpayer and avail of the “Optional Registration for Value-Added Tax of Exempt Person”. Once availed, the taxpayer shall not be entitled to cancel the VAT registration for the next three years. 2. A VAT-registered taxpayer who opted to register as non-VAT as a

Tax and Duty Manual VAT – Postponed Accounting VAT ...

www.revenue.ieNumber – Registration on ROS for further guidance. Once registered for C&E, they will be given automatic entitlement to Postponed Accounting. All new applicants for VAT Registration who wish to avail of Postponed Accounting should refer to TDM Part 38-01-03b - …

E-Invoicing Detailed Guidelines

zatca.gov.saThis Guidelines addresses all Persons covered by the scope of application of Article (3) of the E-Invoicing Regulation which covers: Taxable person that is a resident in KSA. The customer or any third party who issues a tax invoice on behalf of the taxable person that is a resident in KSA according to the VAT Implementing Regulation.

STEPS FOR THE INSTALLATION OF EBM TO VAT REGISTERED ...

www.rra.gov.rw••A copy of RDB Full Registration Certificate or copy of Notice of Taxpayer Identification Number (TIN) registration in case the business is not registered in RDB. ••A copy of Value Added Tax (VAT) Certificate ••A copy of Identification Number or Passport of the person who signed the letter requesting the installation of EBM software

BIR Form 2550M (ENCS) - Page 2 ALPHANUMERIC TAX ... - …

www.lawphil.netBIR FORM NO. 2550M - Monthly Value-Added Tax Declaration VM 100 VM 010 VB 113 VB108 VB109 VB 111 Guidelines and Instructions VM 040 VM 110 VM 120 VM 130 VM 140 VM 030 VM 020 VM 150 VM 050 ALPHANUMERIC TAX CODES (ATC) VQ010 VB 102 VH 010 VP 102 INDUSTRIES COVERED BY VAT ATC INDUSTRIES COVERED BY VAT ATC INDUSTRIES …

Guide to Developed FATOORA Compliant QR Code

zatca.gov.saVAT registration number 2 15 310122393500003 020F333130313232333933353030 303033 Time stamp 3 20 2022-04-25T15:30:00Z 0314323032322d30342d323554313 53a33303a30305a Invoice total (with VAT) 4 7 1000.00 0407313030302e3030 VAT total 5 6 150.00 05063135302e3030

Guide to the VAT One Stop Shop

vat-one-stop-shop.ec.europa.euestablishment) and who will be the person liable to pay VAT and to fulfil the VAT obligations laid down in the import scheme (e.g. submission of VAT declaration, payment of VAT, record keeping obligation etc.) in the name and on behalf of another taxable person who has appointed him as intermediary. Member States may introduce

Similar queries

Guidelines for Registration for IT, Guidelines, Registration, For VAT, Guidelines for VAT Registration, VAT registration, Mechanisms for the Effective Collection, OECD, Value Added Tax, V AT, Implementing rules and regulations of, Registration for Value-Added Tax, For VAT Registration, Value-Added Tax, Guide to the VAT One Stop Shop