Mortgage forgiveness debt relief

Found 34 free book(s)IRS, Taxes – Mortgage Forgiveness Debt Relief Act Expiring ...

documents.jdsupra.comthe Mortgage Forgiveness Debt Relief Act, you will need to fill out form 982 and attach it to your Federal Income Tax return for the tax year in which the qualified mortgage debt was forgiven. Form 982 is called Reduction of Tax Attributes Due to Discharge of Indebtedness. 8. Mortgage debt forgiven on second homes, rental properties, and business

TAX LIABILITY OF FORGIVEN DEBT - nlslaw.net

nlslaw.netTAX LIABILITY OF FORGIVEN MORTGAGE DEBT OBLIGATION TO PAY TAXES ON CANCELED MORTGAGE DEBTEsmeralda Counties Lenders sometimes cancel or forgive a person’s debt. While this relieves the debtor of ... Mortgage Forgiveness Debt Relief Act: This was passed in December 2007 by Congress. It allows taxpayers to exclude

Publication 4705 (Rev. 2-2009)

www.irs.govPublication 4705 (2-2009) Catalog Number 51765C www.irs.gov for Additional Information ... Overview of the Mortgage Forgiveness Debt Relief Act of 2007 and Frequently Asked Questions. Does the Mortgage Forgiveness Debt Relief Act of 2007 apply to all forgiven or cancelled debts?

FORGIVEN MORTGAGE DEBT RELIEF IN THE - FACPA.com

www.facpa.commortgage forgiveness debt relief act of 2007 Addressing the subprime lending crisis, Congress recently passed and the President signed into law a new measure giving tax breaks to homeowners who have mortgage debt forgiven.

What Were the Tax Deductions Offered to Help Cure the ...

www.ship.eduThe Mortgage Forgiveness Debt Relief Act of 2007 allowed taxpayers to exclude income from debt forgiveness if they had to dispose of their primary residence. This act was applicable in the calendar years 2007-2013. Normally, if a taxpayer has a debt such as a mortgage that is

Reporting Tax-free Debt Discharge Income from a Forgiven ...

www.jajonescpa.comMortgage Forgiveness Debt Relief Act of 2007 (the “Mortgage Relief Act”) may save the day for many individuals. New Exception for DDI from Principal Residence Mortgages

Credit Suisse Mortgage Settlement Justice and Credit ...

www.credit-suisse.comModification of residential mortgage loans through principal forgiveness, forbearance, and balance ... As of January 1, 2018, the Mortgage Forgiveness Debt Relief Act, which exempted certain borrowers from paying income tax on principal forgiveness, is no longer in effect.

Exclusion for Income from Discharge of Indebtedness ...

russophdcpa.comThe Mortgage Forgiveness Debt Relief Act of 2007, P.L. 110-142, provides an exclusion from income for the discharge of indebtedness (DOI) on a qualified principal residence. The exclusion is effective for home mortgage debt discharged between January 1, 2007, and

Housing Legislation Fact Sheet United States - US ...

www.sandiegohousingsolutions.comUS HR 3648 Mortgage Forgiveness Debt Relief Act of 2007 Gave ‘cancellation of debt’ 1099C relief through 12/31/2009 to those eligible who short sell their property or lose to foreclosure (e.g., 25% tax bracket, 200,000 second mortgage loss = 50,000 in taxable income).

Malpractice Prevention Education for Oregon Lawyers ...

www.osbplf.orgMalpractice Prevention Education for Oregon Lawyers ... The mortgage debt relief provisions for ho-meowners in the federal tax code, first enacted ... The Mortgage Forgiveness Debt Relief Act of 2007 (the Act) (Pub L 110-142, 121 Stat 1803) and its extending amendment allowed

1. W PRINCIPAL REDUCTION MODIFICATION PROGRAM …

www.fhfa.govBorrowers whose homes are their primary residence and who otherwise meet the terms of the Mortgage Forgiveness Debt Relief Act may be able to benefit from the exclusion of forgiven mortgage debt from taxable income. The Internal Revenue Service has issued guidance regarding the tax treatment of Principal Reduction Modifications

HB 600 Department of Legislative Services 2012 Session

mlis.state.md.usThe federal Mortgage Forgiveness Debt Relief Act of 2007 excludes from the gross income of a taxpayer any discharge of indebtedness income by reason of a discharge of qualified principal residence indebtedness occurring on or after January 1, 2007, and before January 1, 2010. ...

HB 1155 Department of Legislative Services 2017 Session

mgaleg.maryland.govThe federal Mortgage Forgiveness Debt Relief Act of 2007 enacted a temporary measure that excludes from the gross income of a taxpayer any discharge of indebtedness income by reason of a discharge of qualified principal residence indebtedness.

Analysis of the Tax Exclusion for Canceled Mortgage Debt ...

fas.orgThe Mortgage Forgiveness Debt Relief Act of 2007 (P.L. 110-142) signed into law on December 20, 2007, temporarily excluded qualified COD income. Thus, the act allowed taxpayers who did

PROPERTY ACQUISITION WORKSHEET

fortunebuilderstv.s3.amazonaws.comThe Mortgage Forgiveness Debt Relief Act was introduced in Congress on September 25, 2007, and became law on December 20, 2007. This act offers relief …

R E P O R T - Congress.gov

www.congress.gov69–006 110TH CONGRESS REPORT 1st Session " !HOUSE OF REPRESENTATIVES 110–356 MORTGAGE FORGIVENESS DEBT RELIEF ACT OF 2007 OCTOBER 1, 2007.—Committed to the Committee of the Whole House on the State of the Union and ordered to be printed

Fact Sheet: Principal Reduction Modification

www.fhfa.govThe terms of the Mortgage Forgiveness Debt Relief Act may apply. i For borrowers with mark-to-market loan-to-value (MTMLTVs) ratios over 115 percent, the Enterprises’ standard and streamlined modifications forbear post-

HOUSING FINANCEPOLICY CENTER COMMENTARY

www.urban.orgwww.urban.org 1 HOUSING FINANCEPOLICY CENTER COMMENTARY URBAN INSTITUTE The Mortgage Forgiveness Debt Relief Act Has Expired—Renewal Could Benefit Millions LAURIE GOODMAN AND ELLEN SEIDMAN. Under the federal tax code, when a lender forgives

HOUSE BILL 1155 - Maryland General Assembly

mgaleg.maryland.gov9 federal Mortgage Forgiveness Debt Relief Act of 2007, as amended, prior to its expiration 10 on December 31, 2012, and without regard to the date limitation in § …

Mortgage Debt Forgiveness - Las Vegas Bankruptcy Lawyers

www.goldguylaw.comThe Mortgage Forgiveness Debt Relief Act and Debt Cancellation Internal Revenue System Do you have any mortgage debt that was forgiven or

Annex 3 Tax Payments on Consumer Relief for Homeowners

www.justice.govForgiveness Debt Relief Act of 2007 or its equi valent becomes effective through the end of 2015, for principal forgiveness of forbearance under Menu Item 1.B, extinguishment of second liens, junior liens, or unsecured mortgage debt under Menu Items 1.D or 1.E, and

Massachusetts Alliance Against Predatory Lending

maapl.infoThis bill provides relief to every Massachusetts citizen who receives any kind of debt forgiveness related to their primary residence. Based on initial reports of the National Mortgage Settlement Monitor, in the short period between March

Mortgage Forgiveness Debt Relief Act of 2007

www.thetaxbook.comMortgage Forgiveness Debt Relief Act of 2007 . H.R. 3648. Passed by Congress on December 18, 2007 and signed into law as Public Law 110-142 by the President on December 20, 2007, the Mortgage Forgiveness Debt Relief Act of 2007 provides debt forgiveness relief to many homeowners facing foreclosure, as well as other non-mortgage related tax breaks.

Mortgage Forgiveness Debt Relief Act of 2007

www.middletontraining.com2 What is the Mortgage Forgiveness Debt Relief Act ? •The Mortgage Forgiveness Debt Relief Act of 2007 was enacted on December 20, 2007 •The Act allows taxpayers to exclude from income certain canceled debt on

Mortgage Forgiveness Debt Relief Act - Real Estate Lawyer ...

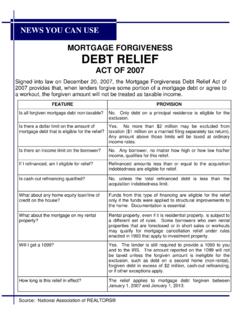

www.awslawandtitle.comSigned into law on December 20, 2007, the Mortgage Forgiveness Debt Relief Act of 2007 provides that, when lenders forgive some portion of a mortgage debt or agree to a workout, the forgiven amount will not be treated as taxable income.

Mortgage Forgiveness Debt Relief Act of 2007

extension.illinois.eduThe Mortgage Forgiveness Debt Relief Act of 2007 was enacted on December 20, 2007 (see News Release IR-2008-17). Generally, the Act allows exclusion of income realized as a result of modification of the terms of the mortgage, or foreclosure on your principal residence.

MORTGAGE DEBT FORGIVENESS – KEY FACTS - HOCMN

www.hocmn.orgIn late 2014, this tax relief was extended, covering debts ... targeted for home mortgage debt forgiveness. ... The exception for debt forgiveness only qualifies if the original debt was incurred for home acquisition or to pay for home improvement costs – not cash out to pay other bills. ...

Mortgage Forgiveness Debt Relief Law - sonlehome.com

sonlehome.comThe Mortgage Forgiveness Debt Relief Act of 2007 was enacted on December 20, 2007 (see News Release IR-2008-17). Generally, the Act allows exclusion of income realized as a result of modification of the terms of the mortgage, or foreclosure on your principal residence.

Mortgage Forgiveness Debt Relief Act

images.kw.comAUSTIN REALTOR ® 12 February 2008 On December 20, 2007, the Mortgage Forgiveness Debt Relief Act of 2007 (the “Act”) was signed into law. The Act was passed in part in response to

Are You Eligible for Mortgage Relief?

www.responsiblelending.orgAre You Eligible for Mortgage Relief? OVERVIEW The National Mortgage Settlement will offer various forms of relief for distressed families who qualify. ... debt forgiven. Preliminary Checklist for Eligibility When you owned the home, you occupied the house as the owner, and the ...

Real Property: Cancellation of Debt and Foreclosure

www.irsvideos.govReal Property: Cancellation of Debt and Foreclosure Kim Lawson Senior tax analyst. ... • Mortgage Debt Relief Act of 2007 • Exclusion related to restructuring and ... • Closing costs rolled into the debt when refinanced. 15 Only Part of Loan Qualifies Canceled debt .

Abandonments and Repossessions, Foreclosures, Canceled …

www.irs.govIf a lender agreed to a mortgage loan modification (a “workout”) in 2016 that in-cluded a reduction in the principal balance of ... cellation of debt unless you retain the collateral and either: The lender offers a discount for the early payment of the debt, or

In the Senate of the United States, - GPO

www.gpo.gov2 †HR 8 EAS 1 (c) TABLE OF CONTENTS.—The table of contents for 2 this Act is as follows: Sec. 1. Short title, etc. TITLE I—GENERAL EXTENSIONS Sec. 101. Permanent extension and modification of 2001 tax relief. Sec. 102. Permanent extension and modification of 2003 tax relief.

One Hundred Tenth Congress of the United States of America

www.gpo.govH.R.3648 One Hundred Tenth Congress of the United States of America AT THE FIRST SESSION Begun and held at the City of Washington on Thursday,

Similar queries

Mortgage Forgiveness Debt Relief, Mortgage debt, TAX LIABILITY OF FORGIVEN DEBT, TAX LIABILITY OF FORGIVEN MORTGAGE DEBT, Mortgage, Debt, Publication 4705, FORGIVEN MORTGAGE DEBT RELIEF IN, Debt forgiveness, Reporting Tax-free Debt Discharge Income from, Mortgage Relief, Forgiveness, Housing Legislation Fact Sheet United States, Relief, Malpractice Prevention Education for Oregon Lawyers, Mortgage Debt Relief, 1. W PRINCIPAL REDUCTION MODIFICATION PROGRAM, 1155 Department of Legislative Services 2017, The Tax Exclusion for Canceled Mortgage Debt, WORKSHEET, Fact Sheet: Principal Reduction Modification, HOUSING FINANCEPOLICY CENTER COMMENTARY, HOUSING FINANCEPOLICY CENTER COMMENTARY URBAN INSTITUTE, HOUSE BILL 1155, Maryland General Assembly, Mortgage debt forgiveness, Payments on Consumer Relief for Homeowners, Forgiveness Debt Relief, Mortgage Forgiveness Debt Relief Act, Debt forgiveness relief, MORTGAGE DEBT FORGIVENESS – KEY FACTS, Are You Eligible for Mortgage Relief, Real Property: Cancellation of Debt and, One Hundred Tenth Congress of the United States