Quickbooks Payroll

Found 9 free book(s)Intuit QuickBooks Direct Deposit

pws.quickbooks.comSending Direct Deposit paychecks to QuickBooks Payroll You must send your Direct Deposit paychecks to QuickBooks Payroll by 5:00 p.m. (Pacific time) at least two business banking days* before the paycheck date. This allows time for the service to process your payroll information and transfer funds from your account into your employees' accounts.

Quick Guide Setting up Payroll - Intuit

globalsmallbusiness.intuit.comNote: Payroll Items track amounts such as wages or salaries you pay and taxes you deduct from pay cheques. You can create payroll items for compensation, taxes, employer-paid expenses, and other additions and deductions. Payroll Setup Checklist To set up QuickBooks payroll, you need the information mentioned in the following table. You can get

New Client Checklist - QuickBooks

quickbooks.intuit.comPayroll Payables Recurring Transactions Multi-currency Delayed Charges Time Tracking Time Tracking Only Users Billable Hours Expenses by Customer Billable Expenditures Class Tracking ... Apps.com or Apps tab in QuickBooks Online Accountant Apps.com or Apps tab in QuickBooks Online Accountant

Intuit QuickBooks Payroll

http-download.intuit.comInstructions Employee: Fill out and return to your employer. Employer: Save for your files only. This document must be signed by employees requesting automatic deposit of paychecks and

QuickBooks Online Payroll - Intuit

intuitglobal.intuit.comQuickBooks Online Payroll 5 7. If you are starting QuickBooks Payroll from scratch, you’ll select No, I’m a brand new employer paying T4 employees for the first time. Click Continue. NOTE When you’re setting up payroll in QuickBooks, you need to enter summarized payroll amounts if you’re just beginning to use QuickBooks payroll but you ...

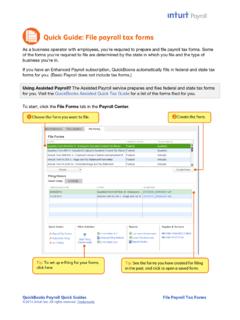

Quick Guide: File payroll tax forms - Intuit

http-download.intuit.comforms for you. (Basic Payroll does not include tax forms.) Using Assisted Payroll? The Assisted Payroll service prepares and files federal and state tax forms for you. Visit the QuickBooks Assisted Quick Tax Guide for a list of the forms filed for you. To start, click the File Forms tab in the Payroll Center. Tip: Choose the form you want to file.

Premium Audit – Payroll Report Instructions – QUICKBOOKS

business.thehartford.com1. Log in to QuickBooks 2. Click Reports and select Payroll Summary 3. At the top of the page, enter the policy period dates. The report will capture all check dates within this period. • For example, if the policy period is 9/1/2018 – 9/1/2019, the provided report should include: – 1st pay date that occurred on or after 9/1/2018 until ...

Chapter 9 QuickBooks Online Payroll - Intuit

www.intuit.comQuickBooks Online Payroll 9 10. Click the Enter TD1 form. 11. Complete the TD form for the employees. You must enter the Last Name, First Name, Home Address (including Postal Code), Date of Birth and Social Insurance Number. 12. Enter the …

Starting Out with QuickBooks Online

quickbooks.intuit.comQuickBooks Online has been designed to be intuitive, fast and simple to use. The user interface is simple and unified, which results in fewer clicks to find the desired information or functions.