Real property gains tax

Found 32 free book(s)C3 REAL PROPERTY GAINS TAX - mia.org.my

www.mia.org.myReal Property Gains Tax (RPGT) is charged on gains arising from the disposal of real property, which is defined as any land situated in Malaysia and any interest, option or other right in or over such land. RPGT is also charged on the disposal of shares in a real property company (RPC). A RPC is a controlled company

www.hasil.gov.my

www.hasil.gov.myReal Property Gains Tax (RPGT) is charged on gains arising from the disposal / sale of real properties or shares in Real Property Companies (RPC) SUBMISSION OF RPGT FORM DISPOSAL NOT LIABLE TO INCLUDES : Disposal made after 5 years from the date of acquisition of the

LAWS OF MALAYSIA - people.utm.my

people.utm.myreal property gains tax act 1976 An Act to provide for the imposition, assessment and collection of a tax on gains derived from the disposal of real property and

OVERVIEW OF REAL PROPERTY GAINS TAX IN MALAYSIA

www.imf.orgThe first legislation to tax gains from the disposal of real property was introduced via Land Speculation Tax Act (1974) The Act was repealed in 1975 and

LAWS OF MALAYSIA - AGC

www.agc.gov.myreal property gains tax act 1976 An Act to provide for the imposition, assessment and collection of a tax on gains derived from the disposal of real property and matters

Taxation of Cross-Border Mergers and Acquisitions

home.kpmg• real Property Gains tax act, 1976 (rPGt act), which is imposed on profits from the disposal of real properties in Malaysia and shares in real property companies (rPC) • Petroleum (Income tax) act, 1967, which is imposed on profits from petroleum operations

TAX CASES - MIR

www.mir.com.my41 TAX CASES 1. Profit from Sale of Shares in a Property Development Company Not Subject to Real Property Gains Tax In Binastra Holding Sdn Bhd v KPHDN (Civil Appeal No. R2-14-8 of 2000), the taxpayer, a holding and investment company, acquired a total of 75,000 shares (at

LAWS OF MALAYSIA - Federal Government Gazette

www.federalgazette.agc.gov.my(Income Tax) Act 1967, the Real Property Gains Tax Act 1976, the Labuan Business Activity Tax Act 1990, the Goods and Services Tax Act 2014 and the Promotion of Investments Act 1986.

REAL PROPERTY Introduction Disposals Not Liable to RPGT ...

www.hasil.gov.myReal Property Gains Tax (RPGT) is tax charged on gains arising from the disposal/selling of real properties or shares in Real Property Companies (RPC) Submission of RPGT Form Remittance Attach The Following Documents Acquirer is required to remit an amount of 2%

Introduction to the taxation of foreign investment in US ...

www2.deloitte.comIncreases to the US tax rates on capital gains, the taxation of the disposition of real estate, and US ... Under a special set of rules for gains on dispositions of real property interests (“FIRPTA”), gains from the sale of a US real property interest (“USRPI”), such as real estate, or ...

New York State Department of Taxation and Finance Taxpayer ...

nystax.govthe Real Property Transfer Gains Tax Affidavit could have been used to comply with the Real Property Transfer Gains Tax (the gains tax) filing requirements. That is, would it have been necessary to comply with the gains tax pre-transfer audit procedure and submit a gains tax …

New Jersey Tax Guide - state.nj.us

www.state.nj.usProperty Tax Relief Programs ... Real Property in New Jersey. Reporting Income/Loss on the Sale of Property You will report any income earned on the sale of property as a capital gain. When filing your ... the sale of property as Net Gains or Income From Disposition of Property (if loss, enter 0).

Message from the State Department of Taxation - hawaii.gov

files.hawaii.govrequired by the Hawaii Real Property Tax Act (HARPTA). Hawaii residents and nonresidents alike must pay Hawaii income tax on capital gains recognized on the sale of real property located in Hawaii unless the gain can be excluded under Hawaii income tax law.

Capital Gains Taxation: Federal and State

www.house.leg.state.mn.uscapital gains income in tax year 2016 (these rates include the additional 3.8 ... real property) is taxed at a maximum 28.8 percent rate How are gains from the sale of the taxpayer’s main home taxed? Taxpayers may exclude up to $250,000 of gain on the sale of the home ($500,000

Impact of the 2018 Tax Law on Real Estate Owners

apiexchange.comInvestment property owners will continue to be able to defer capital gains taxes using 1031 tax-deferred exchanges which have been in the tax code since 1921. No new restrictions on 1031 exchanges of real property were made in

Your Home Page 1 of 22 16:00 - 30-Jan-2018

www.irs.govResidential Rental Property Tax Information for Homeowners Installment Sales ... Capital Gains and Losses Reduction of Tax Attributes Due to Discharge of ... (and Section 1082 Basis Adjustment) U.S. Individual Income Tax Return Proceeds From Real Estate Transactions Sales of Business Property Repayment of the First-Time Homebuyer Credit ...

Income 15: Colorado Capital Gain Subtraction

colorado.govQualifying taxpayers can claim a subtraction on their Colorado income tax returns for certain qualifying capital gain ... Acquisition date Real property Tangible personal property On or after May 9, 1994, but before June 4, 2009 ... C.R.S. Tax modification for net capital gains.

Assets Dispositions of Sales and Other - irs.gov

www.irs.gova U.S. real property interest, the buyer (or other transferee) may have to withhold income tax on ... Capital Gains and Losses U.S. Individual Income Tax Return Amended U.S. Individual Income Tax Return Acquisition or Abandonment of Secured Property Cancellation of Debt

Real Property Gains Tax and the Malaysian Housing Market

www.fig.netbackground – real property gain tax in malaysia Real Property Gains Tax, as the name suggests, is a tax on all capital gains made on the disposal of property, interest or rights in property …

Real Property Gains Tax.final.20.1.2010

www.mysunwayproperty.comReal Property Gains Tax (“RPGT”) What is RPGT? Section 6 of the RPGT Act, 1976 provides that every person will be subject to RPGT on the gain of a sale of a chargeable asset. A chargeable asset includes real property and shares in real property companies (“RPC”).

Real Property Gains Tax at a glance 1. by Yang Pei Keng

johorebar.org.myThe current rate of the Real Property Gains Tax (“RPGT”)was proposed by the Minister of Finance cum Prime Minister Najib Razak through the 2012 Budget, which was delivered last year, on 7 October 2011.

Real Property Gains Tax Act 1976 (Act 169)

www.wolterskluwer.com.myReal Property Gains Tax (Exemption) Order 2011 5 2(2) Where the disposal of a chargeable asset is made in the sixth year after the date of acquisition of such chargeable asset or any year thereafter, the Minister exempts any person from the application of Schedule 5 of the Act on the payment of tax on the

Real Property Gains Tax General - accaglobal.com

www.accaglobal.comReal Property Gains Tax There have been amendments to the RPGT Act since this article was originally published in April 2011. This article is updated to include amendments as at 31 March 2012, and is relevant to candidates sitting the exam in December 2012 and June 2013.

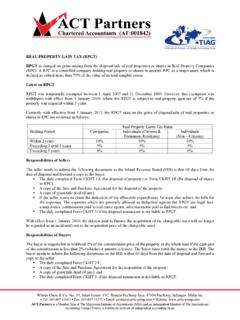

REAL PROPERTY GAIN TAX (RPGT) RPGT - Arris-Group

arris-group.comRPGT is charged on gains arising from the disposal/sale of real properties or shares in Real Property Companies (RPC). A RPC is a controlled company holding real property or shares in another RPC as a major asset, which is

Real Property Gains Tax 2016 - CTIM

www.ctim.org.myIn a lively property market, Malaysia presents many opportunities to take advantage of appreciating property values and it is important to understand the tax planning opportunities

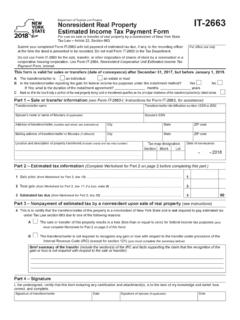

Form IT-2663:2019:Nonresident Real Property Estimated ...

www.tax.ny.govNonresident Real Property Estimated Income Tax Payment Voucher For use on sale or transfer of real property by a nonresident Note: You must complete Form IT-2663-V (below), even if there is no payment of estimated personal income tax due.

Form TP-584:4/13:Combined Real Estate Transfer Tax Return ...

www.tax.ny.govPage 2 of 4 TP-584 (4/13) Part III – Explanation of exemption claimed on Part I, line 1 (check any boxes that apply) The conveyance of real property is exempt from the real estate transfer tax for the following reason: a. Conveyance is to the United Nations, the United States of America, the state of New York, or any of their instrumentalities,

HOW TO AVOID CAPITAL GAINS & LAND GAINS TAXES …

section1031.comIn sum, with a Section 1031 exchange, you can, at the least, postpone capital gains tax on the sale of your investment property, and in some circumstances, avoid some or all of the tax entirely.

Real Property Gains Tax - JPPH

www.jpph.gov.myDisposal in the fifth year after the date of acquisition of the chargeable asset Disposal in the sixth year after the date of acquisition of the

State of Georgia Department of Revenue

dor.georgia.gov2 INTRODUCTION O.C.G.A. Section 48-7-128 provides for income tax withholding at a rate of 3 percent on sales or transfers of real property and associated tangible personal property by …

10 Most FAQ’s of Foreign Buyers and Sellers of New York ...

www.romerdebbas.comcapital gains tax is currently 20% of the net capital gain. Net capital gain is the amount of the gain on the property minusthe original purchase price, closing costs,

State of South Carolina Department of Revenue

dor.sc.govTax free exchanges of property for stock in a corporation under Internal Revenue Code §351. 5. Transfers of property as part of a tax free corporate reorganization.

Similar queries

Real Property Gains Tax, Gains, Real property, Real, OVERVIEW OF REAL PROPERTY GAINS TAX IN MALAYSIA, Tax gains, LAWS OF MALAYSIA, TAX CASES, Property, Gains tax, Property Tax, Message from the State Department of Taxation, Real Property Tax, Impact of the 2018 Tax Law on Real Estate Owners, Real Property Gains Tax and the Malaysian Housing Market, Real Property Gains Tax at, Real Property Gains Tax Act 1976, RPGT, Nonresident Real Property Estimated Income Tax, TP-584, AVOID CAPITAL GAINS & LAND GAINS TAXES, State of Georgia Department of Revenue, Of Foreign Buyers and Sellers of, State of South Carolina Department of Revenue