Tax Filer

Found 4 free book(s)2021 Instructions for Form 1095-A - IRS tax forms

www.irs.govtax filer's tax family (a tax family may include the tax filer, the tax filer’s spouse if the tax filer is filing a joint return with his or her spouse, and the tax filer’s dependents). See the instructions for line 4 for more information about who is a recipient. Don't furnish a Form 1095-A for a

Ohio Employer Withholding Tax General Guidelines

tax.ohio.govwithholding tax payments using Ohio IT 501, mailed to the Ohio Department of Taxation with remittance made payable to the Ohio Treasurer of State. Partial-weekly filers are required to pay withheld ... If the employer is a partial-weekly filer, payment must be made by EFT. Ohio Annual Return 1. To Employees (W-2 or 1099-R). On or before Jan. 31 ...

State Individual Income Tax Rates and Brackets for 2021

files.taxfoundation.orgThe Tax Foundation is the nation’s leading independent tax policy research organization. Since 1937, our research, analysis, and experts ... State Individual Income Tax Rates and Brackets for 2021 Single Filer Married Filing Jointly Standard Deduction Personal Exemption. State Individual Income Tax Rates and Brackets for 2021, ...

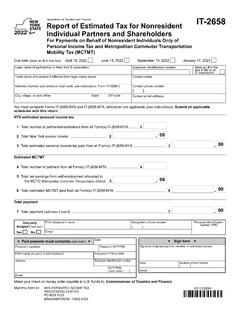

Form IT-2658 Report of Estimated Tax for Nonresident ...

www.tax.ny.govPersonal Income Tax and Metropolitan Commuter Transportation Mobility Tax (MCTMT) IT-2658 Legal name of partnership or New York S corporation Employer identification number ... box if filer is an S corporation..... Contact name Contact phone number ( ) Contact email address