Through Entity Tax Election

Found 9 free book(s)California enacts pass-through entity tax election

www2.deloitte.compass-through entity tax election. Pass-through entity tax election • Effective for tax years beginning on or after January 1, 2021 and before January 1, 2026. • Qualifying entity is defined as a partnership or S corporation that has exclusively …

Minnesota enacts pass-through entity tax election

www2.deloitte.coman entity level state tax on income for taxable years beginning after December 31, 2020, provided that the limitation for the state and local tax deduction under IRC section 164(b)(6) still applies. This Tax Alert summarizes some of the provisions of …

Pass-Through Entity Tax

www.tax.ny.govPTET on behalf of an eligible entity through the entity’s Business Online Services account, now through October 15, 2021. If the entity does not have a Business Online Services account, the authorized person will need to create one. For tax years beginning on or after January 1, 2022, the annual election may be made

California’s Pass Through Entity Tax – Summary, Examples ...

singerlewak.comPer FTB (8/31/2021): A single member (SMLLC) cannot make the election to pay the passthrough entity tax. To be eligible, they must add a member or elect to be treated as an S corporation. However, an SMLLC owned by a husband and wife can elect to be taxed as a partnership and can qualify to pay the passthrough entity tax. (Rev. Proc. 2002-69)

Revenue Information Bulletin No. 19-019 February 5, 2020 ...

revenue.louisiana.govIndividual Income Tax Corporation Income Tax Fiduciary Income Tax Guidance on the Pass-Through Entity Election Act 442 of the 2019 Regular Session allows an S corporation or an entity taxed as a partnership for federal income tax purposes to elect to be taxed as if the entity had been required to file a federal income tax return as a C corporation.

Companies Limited Liability Taxation of - IRS tax forms

www.irs.gov2553 Election by a Small Business Corporation 8832 Entity Classification Election. See How To Get Tax Help near the end of this publication for information about getting publi-cations and forms. What Is a Limited Liability Company? For purposes of this publication, a limited liabil-ity company (LLC) is a business entity organ-

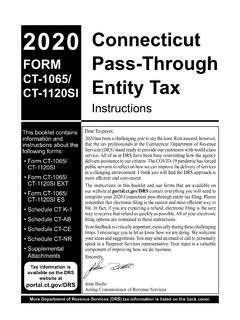

2020 Connecticut FORM Pass-Through

portal.ct.govTax information is available on the DRS website at portal.ct.gov/DRS Connecticut Pass-Through Entity Tax Instructions This booklet contains information and instructions about the following forms: • delivers assistance to our citizens. The COVID-19 pandemic has forced Form CT-1065/ CT-1120SI • Form CT-1065/ CT-1120SI EXT • Form CT-1065/ CT ...

(Rev. December 2020) - IRS tax forms

www.irs.gove. A 52-53-week tax year ending with reference to a year listed above. f. Any other tax year (including a 52-53-week tax year) for which the corporation (entity) establishes a business purpose. For details on making a section 444 election or requesting a natural business, ownership, or other business purpose tax year, see the instructions for ...

Franchise and Excise Tax Manual - Tennessee

www.tn.gov3 | Page Overview.....42