West Virginia Employee S Withholding Exemption

Found 9 free book(s)Form MW-507: Employee’s Maryland Withholding …

www.usaid.gov4. I claim exemption from withholding because I am domiciled in one of the following states. Check state that applies. District of Columbia Pennsylvania Virginia West Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions on page 2. Enter “EXEMPT” here 4.

WEST VIRGINIA EMPLOYER’S WITHHOLDING TAX TABLES

tax.wv.govWest Virginia Withholding Exemption Certificate, Form WV/IT-104. A reproducible form is on page 2 of this booklet. You should keep this completed certificate in your files. The tables provided in this booklet are to be used for ALL employees unless the employee has requested on the Withholding Exemption Certificate that tax be withheld at a ...

WEST VIRGINIA EMPLOYEE’S WITHHOLDING EXEMPTION …

tax.wv.govWEST VIRGINIA EMPLOYEE’S WITHHOLDING EXEMPTION CERTIFICATE FORM WV/IT-104 Complete this form and present it to your employer to avoid any delay in adjusting the amount of state income tax to be withheld from your wages. If you do not complete this form, the amount of tax that is now being withheld from your pay may not be

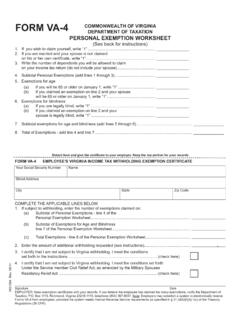

DEPARTMENT OF TAXATION PERSONAL EXEMPTION …

www.tax.virginia.govFORM VA-4 EMPLOYEE’S VIRGINIA INCOME TAX WITHHOLDING EXEMPTION CERTIFICATE COMPLETE THE APPLICABLE LINES BELOW 1. If subject to withholding, enter the number of exemptions claimed on: (a) Subtotal of Personal Exemptions - line 4 of the

Employee’s Withholding Exemption Certificate

tax.ohio.govz Reciprocity Exemption: If you are a resident of Indiana, Kentucky, Pennsylvania, Michigan or West Virginia and you work in Ohio, you do not owe Ohio income tax on your compensation. Instead, you should have your employer withhold income tax for your resident state. R.C. 5747.05(A)(2). z Resident Military Servicemember Exemption: If you are

INSTRUCTIONS & WORKSHEET FOR COMPLETING …

mva.maryland.govEmployee’s Federal Withholding Allowance Form W-4 (2011) Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. Exemption from withholding. If you are exempt, complete

MARYLAND FORM MW507

www.marylandtaxes.govUnder the penalty of perjury, I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on whichever line(s) I completed. Employee’s signature Date

West Virginia State Tax Department

tax.wv.govWest Virginia State Tax Department

2017 Publication 17 - IRS tax forms

www.irs.govPersonal exemption amount in-creased for certain taxpayers. Your personal exemption is $4,050. But the amount is reduced if your adjusted gross income is more than: $156,900 if married filing sep-arately, $261,500 if single, $287,650 if head of house-hold, or $313,800 if married filing jointly or qualifying widow(er). See chapter 3.

Similar queries

Employee’s Maryland Withholding, Exemption, Withholding, Virginia West Virginia, WEST VIRGINIA EMPLOYER’S WITHHOLDING TAX TABLES, West Virginia Withholding Exemption, Employee, WITHHOLDING EXEMPTION, WEST VIRGINIA EMPLOYEE’S WITHHOLDING EXEMPTION, VA-4 EMPLOYEE, S VIRGINIA, S Withholding Exemption, West Virginia, MARYLAND FORM MW507, 2017 Publication 17, IRS tax forms