Your rights as a taxpayer

Found 8 free book(s)WELCOME TO THE DEPARTMENT OF TAXATION

tax.nv.govThe TAXPAYER BILL OF RIGHTS pamphlet explains how the Nevada tax system works, explains your rights as a taxpayer, lists services provided by the Department and can be found on our website by going to

Pub 131:10/19 Your Rights and Obligations Under the Tax ...

www.tax.ny.govto help taxpayers understand their rights and responsibilities. Taxpayer awareness of these rights is essential to maintaining the efficiency and fairness of the state and local tax systems. New York State established a Taxpayers’ Bill of Rights in Tax Law Article 41. The Tax Department assists taxpayers by providing:

96-295 Property Taxpayer Remedies

comptroller.texas.govThe first step in exercising your rights under the Tax Code is to protest your property’s ap-praised value. The following remedies only address appraised values and related matters. Government spending and taxation are not ... 96-295 Property Taxpayer Remedies

CLGS-32-1 (10-21) TAXPAYER ANNUAL LOCAL EARNED …

keystonecollects.comTAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLGS-32-1 (10-21) You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes. Contact your Tax Officer. DATES LIVING AT EACH ADDRESS STREET ADDRESS (No PO Box, RD or RR) CITY OR POST OFFICE …

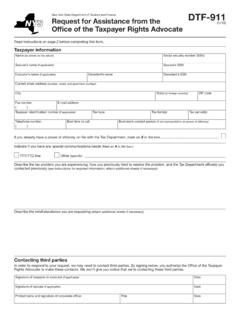

Form DTF-911:1/10: Request for Assistance from the Office ...

www.tax.ny.govIn order to respond to your request, we may need to contact third parties. By signing below, you authorize the Office of the Taxpayer Rights Advocate to make these contacts. We won’t give you notice that we’re contacting these third parties. Signature of taxpayer or executor (if applicable) Date Signature of spouse (if applicable) Date

Your Rights as a Taxpayer - IRS tax forms

www.irs.govYour Rights as a Taxpayer The IRS Mission The Taxpayer Bill of Rights Publication 1 This publication explains your rights as a taxpayer and the processes for examination, appeal, collection, and refunds. Also available in Spanish. Provide America’s taxpayers top-quality service by helping them understand and meet

National Taxpayer Advocate ANNUAL REPORT TO CONGRESS

www.taxpayeradvocate.irs.govJan 12, 2022 · Each year, the National Taxpayer Advocate has the privilege of submitting her Annual Report to Congress. I respectfully submit this year’s report for your consideration and welcome the opportunity to discuss it in more detail. Section 7803(c)(2)(B)(ii) of the IRC requires the National Taxpayer Advocate to submit an annual

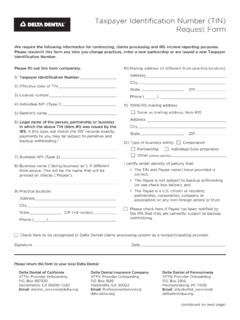

Taxpayer Identification Number (TIN) Request Form

www1.deltadentalins.comenter the name shown on your social security card on line 5 and your new name on line 6. Sole proprietors must furnish their individual name and SSN, which is preferred by the IRS, or employer . identification number (EIN) as their TIN. Enter your name(s) as shown on your social security card and/ or as it was used to apply for your EIN on Form ...