Search results with tag "1040a"

2016 Schedule 8812 (Form 1040A or 1040) - IRS tax forms

www.irs.govSchedule 8812 (Form 1040A or 1040) 2016. Schedule 8812 (Form 1040A or 1040) 2016. Page 2 Part III Certain Filers Who Have Three or More Qualifying Children 7 . Withheld social security, Medicare, and Additional Medicare taxes from Form(s) W-2, boxes 4 and 6. If married filing jointly, include your spouse’s

WHICH FORM --1040, 1040A, or 1040EZ - IRS tax forms

www.irs.govIncome or combined incomes over $50,000 Itemized Deductions Self-employment income Income from sale of property If you cannot use form 1040EZ or Form 1040A, you probably need a Form 1040. You can use the 1040 to report all types of income, deductions, and credits. You may have received a Form 1040A or 1040EZ in the mail because of the return

2015 Instruction 1040EZ - IRS tax forms

www.irs.govYou May Benefit From Filing Form 1040A or 1040 in 2015 Due to the following tax law changes, you may benefit from filing Form 1040A or 1040, even if you normally file Form 1040EZ. See the instructions for Form 1040A or 1040, as applicable. Requirement to reconcile advance payments of the premi-um tax credit.

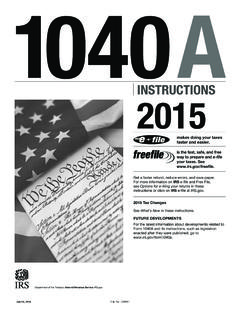

2016 Instruction 1040A - IRS tax forms

www.irs.govto Form 1040A and its instructions, such as legislation enacted after they were published, go to IRS.gov/form1040a. See What s New in these instructions. is the fast, safe, and free way to prepare and e- le your taxes. See IRS.gov/free le. 2016 Tax Changes

2017 Schedule 8812 (Form 1040A or 1040) - IRS tax forms

www.irs.govSchedule 8812 (Form 1040A or 1040) 2017. Schedule 8812 (Form 1040A or 1040) 2017. Page 2 Part III Certain Filers Who Have Three or More Qualifying Children 7 . Withheld social security, Medicare, and Additional Medicare taxes from Form(s) W-2, boxes 4 and 6. If married filing jointly, include your spouse’s

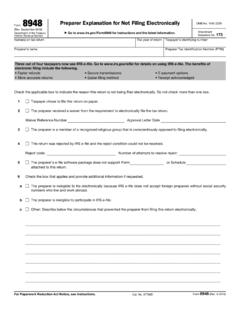

Attach to taxpayer's Form 1040, 1040A, 1040EZ, or …

www.irs.govForm 8948 (Rev. September 2012) Department of the Treasury Internal Revenue Service . Preparer Explanation for Not Filing Electronically Attach to taxpayer's Form 1040, 1040A, 1040EZ, or Form 1041.

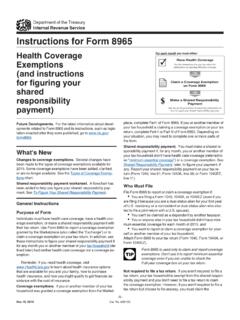

2015 Instructions for Form 8965 - Internal Revenue Service

www.irs.govYou are filing a Form 1040, 1040A, or 1040EZ (even if you ... Attach Form 8965 to your tax return (Form 1040, Form 1040A, or Form 1040EZ). ... er's return or can be claimed by a taxpayer with higher priority under the tiebreaker rules described in Pub. 501. Household income. You …

2016 Form 1040A - Internal Revenue Service

www.irs.govForm 1040A U.S. Individual Income Tax Return 2016. Department of the Treasury—Internal Revenue Service (99) IRS Use Only—Do not write or staple in this space.

2014 Form 1040A - Internal Revenue Service

www.irs.govForm 1040A U.S. Individual Income Tax Return 2014. Department of the Treasury—Internal Revenue Service (99) IRS Use Only—Do not write or staple in this space.

2015 Instruction 1040A - Internal Revenue Service | An ...

www.irs.govPage 2 of 88 Fileid: … ons/I1040A/2015/A/XML/Cycle07/source 16:12 - 4-Jan-2016 The type and rule above prints on all proofs including departmental reproduction ...

2017 Instruction 1040A - Internal Revenue Service

www.irs.govPage 2 of 92 Fileid: … ons/I1040A/2017/A/XML/Cycle10/source 16:11 - 22-Feb-2018 The type and rule above prints on all proofs including departmental reproduction ...

2015 Form 1040A - IRS tax forms

www.irs.govForm 1040A U.S. Individual Income Tax Return 2015. Department of the Treasury—Internal Revenue Service (99) IRS Use Only—Do not write or staple in this space. Your first name and initial . Last name . OMB No. 1545-0074Your social security number . If a joint return, spouse’s first name and initial . Last name . Spouse’s social security ...

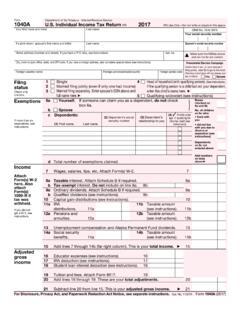

2017 Form 1040A - IRS tax forms

www.irs.govForm 1040A U.S. Individual Income Tax Return (99) 2017 Department of the Treasury—Internal Revenue Service . OMB No. 1545-0074 IRS Use Only—Do not write or staple in this space. Your first name and initial . Last name Your social security number . If a joint return, spouse’s first name and initial . Last name . Spouse’s social security ...

2014 Instruction 1040A - IRS tax forms

www.irs.govinstructions for Form 8962. Form 1095-A. If you, your spouse, or a dependent enrolled in health insurance through the Marketplace, you should have re-ceived Form(s) 1095-A. If you receive Form(s) 1095-A for 2014, save it, it will help you figure your premium tax credit. If you did not receive a Form 1095-A, contact the Marketplace.

2007 Form 1040A - Internal Revenue Service

www.irs.govEXAM DO NOT FILE PLE ONLY Head of household (with qualifying person). (See page 16.) If the qualifying person is a child but not your dependent, enter this child…

CHILD CARE SUBSIDY APPLICATION FORM DEPARTMENT

www.opm.gov15. Total family income as reported on adjusted gross income line of most recent IRS form 1040/1040A *Include a copy of the IRS form 10. 11. 14. Grade of spouse List information for all children for whom you are applying for a subsidy. (If you are applying for more than three children please attach the pertinent information to this form) 1a.

2015 Instructions for Schedule 8812 Child Tax Credit

www.irs.gov2015 Instructions for Schedule 8812Child Tax Credit Use Part I of Schedule 8812 to document that any child for whom you entered an ITIN on Form 1040, line 6c; Form 1040A, line 6c; or Form 1040NR, line 7c; and for whom you also checked the box in column 4 of that line, is a resident of the United States because the child meets the

Instructions Dividends Ordinary (Form 1040A or …

www.irs.govPage 2 of 3 Fileid: … /I1040SCHB/2017/A/XML/Cycle04/source 13:35 - 19-Oct-2017 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2013 Instruction 1040A - IRS tax forms

www.irs.govDo You Have To File? Use Chart A, B, or C to see if you must file a return. Even if you do not otherwise have to file a return, you should file one to get a refund of any federal income tax withheld. You should also file if you are eligible for any of …

2017 Form 8863 - Internal Revenue Service

www.irs.govForm 8863 Department of the Treasury Internal Revenue Service (99) Education Credits (American Opportunity and Lifetime Learning Credits) Attach to Form 1040 or Form 1040A.

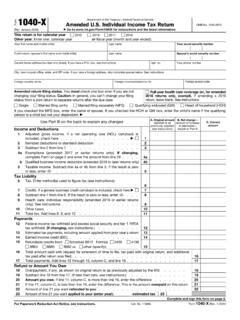

Form 1040-X Amended U.S. Individual Income Tax Return

www.taxformfinder.org2016. Other year. Enter one: calendar year. or. ... Schedule 8812: Form(s) 2439: 41368863: 8885 8962 or: other (specify): 15 16 : ... See the Forms 1040 and 1040-SR, or Form 1040A, instructions for the tax year being amended. See also the Form 1040-X instructions. A. Original number

2017 M1, Individual Income Tax Return

www.revenue.state.mn.usYour code. Spouse code. 1 Federal taxable income (from line 43 of federal Form 1040, line 27 of Form 1040A, or line 6 of Form 1040EZ) (if a negative number, place an ...

Resident, Nonresident or Part-Year Resident …

www.maine.gov3 Line 18. Enter the exemption amount shown on your federal return (Form 1040, line 42 or 1040A, line 26). If you fi led federal Form 1040EZ, enter $4,000 ($8,000 if married fi …

2017 Form OR-40 Office use only Oregon …

www.oregon.govOregon Department of Revenue. 2017 Form OR-40. Page 2 of 4, 150-101-040 (Rev. 12-17) Taxable income. 7. Federal adjusted gross income. Federal Form 1040, line 37; 1040A, line 21; 1040EZ, line 4;

Force Measurement Solutions - NOSHOK

www.noshok.com5 ORDERING INFORMATION LOAD CELLS 106P ND 6 - Compression - plastic piston 106S ND 6 - Compression - Stainless Steel piston MEASURING RANGES 150A 150 lb f 900A 900 lb f 4800A 4,800 lb f 400A 400 lb f 1400A 1,400 lb f 7000A 7,000 lb f 750A 750 lb f 2800A 2,800 lb f Other ranges available, please consult factory.

Square Body DIN 43 653 — 1250V/1300V (IEC/UL): 50-1400A

www.cooperindustries.com161 Square Body DIN 43 653 — 1250V/1300V (IEC/UL): 50-1400A Catalog Numbers-TN/110 -KN/110 Electrical Characteristics-/110 Type T Type K Rated I2t (A2 Sec) Visual Indicator Indicator Current Clearing Clearing Watts

Similar queries

2016 Schedule 8812 Form 1040A or 1040, IRS tax forms, Schedule 8812 Form 1040A or 1040, 2016. Schedule 8812 Form 1040A or 1040, 2016, Form, WHICH FORM --1040, 1040A, or 1040EZ, Income, Income Income, Return, 2015, Form 1040A, 2016 Instruction 1040A, 1040A, Form 1040A or, Attach to taxpayer's Form 1040, 1040A, Internal Revenue Service, Instructions for Form 8965, Form 1040, Attach Form, Taxpayer, 2016 Form 1040A, 2015 Instruction 1040A, Page, Type, 2015 Form 1040A, 2017 Form 1040A, 2017, 2014 Instruction 1040A, A child, Child, Instructions, Schedule 8812, Schedule, 2013 Instruction 1040A, File, Form 8863, 1040, Form 1040EZ, Force Measurement Solutions, 1400A