Search results with tag "Pay as you earn"

Public Service Loan Forgiveness Application for ...

www.sbcc.eduinclude the Revised Pay As You Earn (REPAYE) plan, the Pay As You Earn (PAYE) plan, the Income-Based Repayment (IBR) plan, the Income-Contingent Repayment (ICR) plan, the Standard Repayment plan with a maximum 10-year repayment period, and any other Direct Loan repayment plan if payments are at least

If you stop trading - what you need to know - GOV.UK

assets.publishing.service.gov.ukWhen you stop being self-employed, you no longer have to pay Class 2 National Insurance contributions (NICs). To stop paying Class 2 NICs you need to call the ... • pay over any Pay As You Earn (PAYE) that's been deducted from employees' wages • complete a tax return to cover the part of the tax year when you stopped trading.

NI38 - Social Security abroad - GOV.UK

assets.publishing.service.gov.ukPay as You Earn (PAYE) Settlement Agreement with HMRC for tax. Subject to certain exceptions, Class 2 NICs have to be paid in respect of each week in which you are self-employed. You pay the same amount however much you earn. In the UK, most Class 2 NICs from self-employment are collected through Self Assessment together with tax and Class 4 NICs.

Income-Driven Repayment Plan Request - Student Aid

studentaid.govFor the Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans under the William D. Ford Federal Direct Loan (Direct Loan) Program and Federal Family Education Loan (FFEL) Programs. OMB No. 1845-0102 Form Approved Expiration Date: 8/31/2021. WARNING

Example letters to HMRC regarding tax repayments - LITRG

www.litrg.org.ukPay As You Earn [Insert your address...] BX9 1AS [Insert date] Dear Sir National Insurance Number: [Insert your National Insurance Number] PAYE Tax reference[s]: [Insert references – look at your payslips or P45s/P60s] REPAYMENT CLAIM – [Insert tax year in the format 2020/21] I believe I am entitled to a tax repayment for the [Insert tax ...

Part 05-01-21a - Remittance basis of assessment - Revenue

www.revenue.iewithin the scope of the Pay As You Earn (PAYE) system of deduction at source. Therefore, the remittance basis of assessment no longer applies to such income (i.e. the remittance basis of assessment applies only in respect of income chargeable to tax under Case III of Schedule D and cannot apply to income chargeable to tax under Schedule E).

ZIMBABWE REVENUE AUTHORITY PAY AS YOU EARN

www.techzim.co.zwPAY AS YOU EARN ( PAYE) TABLES FOR JANUARY TO DECEMBER 2022 Example Rates If an employee earns from - to 821.92 multiply by 0% Deduct - $1000 per day Example Rates If an employee earns Example ...

DOMESTIC TAXES DEPARTMENT EMPLOYER’S GUIDE TO PAY …

www.kra.go.kekenya revenue authority 2017 employer’s guide to paye contents part 1: general 8 1. “pay as you earn” applies to all employments 8 2. employer’s duty to deduct income tax 8 3. purpose of employer’s guide to “pay as you earn” 8 4. regulations 8 5. definitions of terms used 9 6. employment benefits 11 7.

SOUTH AFRICAN REVENUE SERVICE

www.sars.gov.za28/29 February for Pay-As-You-Earn (PAYE), Skills Development Levy (SDL) and Unemployment Insurance Fund (UIF). While the annual reconciliation declaration will still be required for the full year of assessment ending February, the interim reconciliation has now become an integral part of the Employer Reconciliation.

eFiling for EMP201

www.sarsefiling.co.zabanking accounts for Pay-As-You-Earn (PAYE), Skills Development Levy (SDL) and Unemployment Insurance Fund (UIF) into one PAYE account supported by one referencing routine. A new addition to the EMP201 is a unique Payment Reference Number (PRN), which is pre-populated onto the EMP201 form.

EXTERNAL GUIDE TAX REFERENCE NUMBER (TRN) …

www.sars.gov.zaThe purpose of the guide is to assist authorised Institutions to request or verify a clients Tax Reference Number (TRN) for Income Tax, Value Added Tax (VAT) and Pay As You Earn (PAYE) via eFiling. This guide in its design, development, implementation and review phases is …

Real Time Information User Guide - Nicx

www.nicx.co.uk6 | P a g e Real Time Information Real Time Information (RTI) is a government initiative designed to improve the operation of Pay As You Earn (PAYE). It will make the PAYE system easier for employers and HM Revenue & Customs (HMRC) to

Guide for contractors and subcontractors - Citizens Advice

www.citizensadvice.org.uk• Pay As You Earn (PAYE) tax due from the company’s employees. • Employers’ and employees’ National Insurance contributions (NICs) due. • Student Loan repayments due from the company's employees. • Construction Industry Scheme (CIS) deductions made from the company's subcontractors. The company will need to reduce the amount of ...

DOMESTIC TAXES DEPARTMENT EMPLOYER’S …

www.kra.go.ke6 kenya revenue authority 2017 employer’s guide to paye contents part 1: general 8 1. “pay as you earn” applies to all employments 8 2. employer’s duty to deduct income tax 8

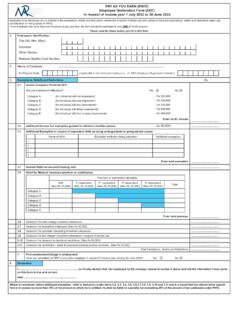

PAY AS YOU EARN (PAYE) Employee Declaration Form (EDF) …

www.mra.muPAY AS YOU EARN (PAYE) Employee Declaration Form (EDF) In respect of income year 1 July 2021 to 30 June 2022 Applicable to an Employee who is entitled to the exemptions, reliefs and deductions mentioned in section 3 below and who wishes to have the exemptions, reliefs and deductions taken into consideration for the purpose of PAYE.

PAYE-easyFile-G001 - South African Revenue Service

www.sars.gov.zaPay-As-You-Earn (PAYE), Skills Development Levy (SDL), the Unemployment Insurance Fund (UIF) and Employment Tax Incentive (ETI) in their Monthly Employer Declarations (EMP201s) submitted, Payments made, Tax values of the Employee Tax Certificates [IRP5/IT3(a)s].

Similar queries

PAY AS YOU EARN, PAYE, Trading, You pay, You earn, Example letters to HMRC regarding tax repayments, Guide, Guide to paye, Guide to “pay as you earn, Pay-As-You-Earn, GUIDE TAX REFERENCE NUMBER (TRN), Real Time Information User, Real Time Information Real Time Information, Guide for contractors and subcontractors, Employers, DOMESTIC TAXES DEPARTMENT EMPLOYER’S, Kenya revenue authority, Employee