Search results with tag "Tax compliance"

Factors influencing compliance with tax laws in Kenya

www.ijsrp.orgfactors influencing compliance with tax laws in Kenya. As part of conclusion of the study it was very clear from the findings that tax rates and tax compliance cost are the greatest contributing factor in tax compliance. Therefore the results of this study contradict the study that was done by Osebe (Osebe ...

SME Tax Compliance and Simplification - OECD.org

www.oecd.org1 SME Tax Compliance and Simplification Background note prepared by the OECD Centre for Tax Policy and Administration for a „Roundtable Discussion‟ at the 1st Meeting of the Working Group on Taxation of the SEE Investment Committee This note considers tax compliance costs imposed on small and medium-size enterprises (SMEs)

Foreign Account Tax Compliance Act (FATCA): Entity ...

www.fatca.hsbc.comtax advice. This document is not intended and cannot be used as a substitute for a detailed analysis of the Foreign Account Tax Compliance Act (FATCA), Intergovernmental Agreements or related documents. This document does not constitute or should not be construed as tax advice. In case of uncertainty, please obtain professional tax advice.

MANAGING AND IMPROVING TAX COMPLIANCE SEPT 04

www.oecd.orgtax compliance strategy — one aimed at achieving the best overall tax compliance outcome for the resources employed. The note went on to describe, in brief, the concept of revenue risk management in a tax administration context, discussed some practical considerations in undertaking revenue risk assessments, and provided a brief description

VADODARA SMART CITY DEVELOPMENT LTD. …

pdicai.orgEmpanelment of Chartered Accountants Firms 5. To verify the tax compliances to include direct tax, indirect tax, GST, Tax Planning, Labour Laws, Employees related compliance, other Statutory Compliances and filing of

What Not-for-Profits Need to Know About Tax Compliance

www.sos.wa.govtax-exempt status, routine reporting requirements, employer obligations, and special considerations for fundraising and political lobbying activities. More importantly, this booklet is intended to provide foundational knowledge about tax compliance that can be passed along to board members

Michigan Department of Treasury Tax Compliance Bureau ...

www.michigan.govTax Compliance Bureau Updated March 2019 Page 11 of 98 . installation and maintenance of systems used for an industrial processing activity • Fuel or energy used or consumed for an industrial process • Machinery, equipment and materials used within a plant site or between plant

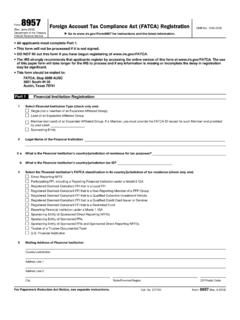

Form 8957 Foreign Account Tax Compliance Act (FATCA ...

www.irs.govForm 8957 (Rev. June 2018) Department of the Treasury Internal Revenue Service . Foreign Account Tax Compliance Act (FATCA) Registration . . Go to

Foreign Account Tax Compliance Act FATCA Online

www.irs.govForeign Account Tax Compliance Act User Guide. FATCA. Online. Registration. July 2018. Publication 5118 (Rev. 7-2018) Catalog Number 65265H Department of the Treasury Internal Revenue Service www.irs.gov

Foreign Account Tax Compliance Act - ABBL

www.abbl.luAgreement between the Government of the Grand Duchy of Luxembourg and the Government of the United States of America to Improve International Tax Compliance and

New Jersey Department of Community Affairs Urban ...

www.nj.govProgram Procedures Urban Enterprise Zone Program, Department of Community Affairs 101 South Broad Street, PO Box 822, Trenton, NJ 08625 ... Once a business becomes UEZ Certified, it is expected to remain in NJ tax compliance and maintain its certified location in the Zone. If the business has a tax problem at the time of certification, annual ...

FATCA Agreement Slovenia 6-2-2014

www.treasury.govAgreement between the Government of the United States of America and the Government of the Republic of Slovenia to Improve International Tax Compliance and to …

Tax data analytics A new era for tax planning and compliance

www2.deloitte.comERP systems, bolt-on systems, tax compliance software, and tax provision systems. The six areas surrounding the tax data warehouse in Figure 2 share several traits that make them prime candidates for tax data analytics. They are detailed and data intensive, focus on important organizational processes, and often

TAX PROCEDURES ACT - KRA

www.kra.go.keThis Act may be cited as the Tax Procedures Act, 2015. 2. Object and purpose of the Act (1) The object and purpose of this Act is to provide uniform procedures for— (a) consistency and efficiency in the administration of tax laws; (b) facilitation of tax compliance by taxpayers; and (c) effective and efficient collection of tax.

TAX AWARENESS AND PERCEPTION OF TAX PAYERS AND …

www.ijsrp.orgThus, in the environment of self assessment system developing tax knowledge and awareness of taxpayers is the critical issues to administer tax system successfully and enhance voluntary tax compliance.

Similar queries

Compliance with tax laws, Tax compliance, SME Tax Compliance and Simplification, OECD, MANAGING AND IMPROVING TAX COMPLIANCE, Tax compliances, Compliances, Michigan Department of Treasury Tax Compliance, User Guide, Registration, Internal Revenue Service www.irs.gov, Procedures, FATCA Agreement Slovenia 6-2-2014, United States of America, For tax planning and compliance, Tax Procedures Act, Tax laws, Self assessment, Tax knowledge