Search results with tag "457 plan"

A Complete Guide to Your UC Retirement Benefits

ucnet.universityofcalifornia.educontribution plan Tax-Deferred 403(b) Plan (the 403(b) Plan): a defined contribution plan 457(b) Deferred Compensation Plan (the 457(b) Plan): a deferred compensation plan A pension plan for Pension Choice participants and existing and newly eligible UCRP members A retirement savings and investment plan for Savings Choice participants, and for

401(k) AND 457 PLANS HANDBOOK

www.ers.ga.govPSR offers two plans for employees to use—a 457 plan and a 401(k) plan. The State of Georgia Employees’ Deferred Compensation 457 Plan operates as an eligible state and local government deferred compensation plan under the provisions of Section 457 of the United States Internal Revenue Code. The

Fact Sheet – 457 Rollovers and Transfers

www.nrsforu.com9 Plan-to-plan transfers for permissive service credit purchases from an eligible 457 plan can only be made to a governmental defined benefit plan. The transfer can be made at anytime and the participant does not need to be eligible for a distribution. 9 Exchanges between 457 plan providers of the same employer can occur at anytime and the

NC 457 Plan Highlights

ncplans.retirepru.comThe NC 457 Plan. The NC 457 Plan is a deferred compensation plan administered by the North Carolina Department . of State Treasurer, and available exclusively to those North Carolina public employees whose . employers offer the Plan. This includes full-time, part-time and temporary employees, elected and

City of New York DeferreD CompeNsatioN plaN

www.nyc.govThe New York City Deferred Compensation Plan has two programs, the 457 plan and 401(k) plan. You can ... you may have the option to utilize Deferral Acceleration for Retirement (DAR). This provision allows eligible 457 plan participants nearing retirement to contribute double the regular maximum

ARKANSAS DIAMOND DEFERRED COMPENSATION PLAN …

myplan.voya.comCompensation Plan on a pre-tax basis to the traditional 457 plan, an after-tax basis to the Roth 457 plan, or a combination of the two, depending upon what is best for your personal circumstances and savings objectives. Having the flexibility to contribute pre- or after-tax doesn’t change how much you can contribute, but rather gives you more

New York City Deferred Compensation 457 Plan Deferral ...

www.nyc.govNew York City Deferred Compensation 457 Plan Deferral Acceleration for Retirement (DAR) Form for the 457 Plan ˘ ˇ ˆ ˙˝˛ ˚˜ !˜ ˆ

Deferral of Vacation and Sick Leave Payouts From Final ...

www.ctdcp.comFinal Paychecks to 403(b) or 457 Plans I. INTRODUCTION Employees who are retiring or leaving State service can contribute a portion of their final payouts for unused vacation or sick leave to the 457 Deferred Compensation Plan—open to most active employees—or the 403(b) Plan, limited

Page 1 of 4 — Please Sign Page 4

www1.nyc.govPlease note that if you are participating in both the 457 Plan and the 401(k) Plan, changing beneficiaries in one plan will not effect changes in the other plan, unless you indicate otherwise in Section 1 of the Change Form. Page 3 of 4 — Please Sign Page 4:

Special Tax Notice Regarding Rollovers

www.opm.govemployer (governmental 457 plan). An eligible employer plan is not legally required to accept a rollover. Before you decide to roll over your payment to an employer plan, you should find out whether the plan accepts rollovers and, if so, the types of distributions it accepts as a rollover. You should also find out

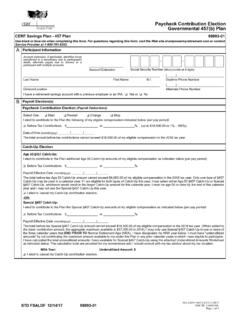

Paycheck Contribution Election Governmental …

www.mocerf.orgPaycheck Contribution Election Governmental 457(b) Plan STD FSALDF ][12/14/17)(98993-01NO_GRPG 58073/][GU22][GP22DOC ID: 510091916)(Page 1 of 4 CERF Savings Plan - 457 Plan 98993-01

I. SECTION 457 DEFERRED COMPENSATION PLANS OF …

www.irs.govDec 31, 1996 · Section 457 Plans Most recently, in Notice 98-8, 1998-4 I.R.B. 6 (January, 1998) we issued substantive guidance concerning the revisions made to eligible section 457(b…

457 Guidebook - Nationwide Retirement Plans

www.nrsforu.comThis section is a basic overview of the types of 457 plans, plan document requirements, eligible employers and participants, and the general governance structure of public sector plans. Types of 457 Plans There are two types of 457 deferred compensation plans — eligible plans [457(b) plans] and ineligible plans [457(f) plans].

457 401k SPD - Welcome to NYC.gov | City of New York

www1.nyc.govWelcome to the award winning City of New York Deferred Compensation Plan! This booklet describes the City of New York Deferred Compensation Plan, an umbrella program consisting of the 457 Plan and the 401(k) Plan. Deferred Compensation is a retirement savings plan which lets you save for the future through easy payroll deductions.

Similar queries

Retirement, Plan, Deferred, Plan 457, Deferred compensation plan, 457 Plans, Plans, Deferred Compensation 457, Eligible, Deferred Compensation, Under, Section 457, 457 Plan, 457 Plan Highlights, City of New York DeferreD CompeNsatioN plaN, New York City Deferred Compensation Plan, Deferral Acceleration for Retirement, New York City Deferred Compensation 457 Plan, New York City Deferred Compensation 457 Plan Deferral Acceleration for Retirement, Change, Special Tax Notice Regarding Rollovers, Paycheck Contribution Election Governmental, Paycheck Contribution Election Governmental 457, SECTION 457 DEFERRED COMPENSATION PLANS, Section, 457 deferred compensation plans, Eligible plans, City, New York, New York Deferred Compensation Plan