Search results with tag "Rollover contributions"

Rollover Contributions - jh401kadvisor.com

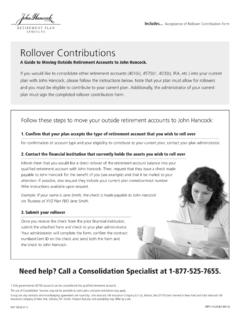

www.jh401kadvisor.comRollover Contributions A Guide to Moving Outside Retirement Accounts to John Hancock. Includes... Acceptance of Rollover Contribution Form ROP 18828 0113 RO021513126718

Rollover Contribution - Insperity

retirementdocs.insperity.comregarding planto- -plan transfers (not individual rollovers), contact us at the above number. • A direct Roth rollover contribution is allowed only if the receiving Plan allows Roth contributions. To confirm that the Plan allows direct Roth rollovers, check your Plan summary plan description or contact us at the above number. In the case of a

2019 Form 5498 - IRS tax forms

www.irs.govShows any rollover, including a direct rollover to a traditional IRA or Roth IRA, or a qualified rollover contribution (including a military death gratuity or SGLI payment) to a Roth IRA you made in 2019. It does not show any amounts you converted from your traditional IRA, SEP IRA, or SIMPLE IRA to a Roth IRA. They are shown in box 3.

Traditional IRA Rollover - Ally

www.ally.comI understand that the rollover contribution must occur within 60 days (unless an exception applies) after receipt of the distribution, and that I have the responsibility to determine what part, if any, of my distribution is eligible for rollover. I certify that, to the best of my knowledge, the information provided on this form is true and correct

Fidelity Advisor IRA Transfer or Direct Rollover

institutional.fidelity.comas a rollover contribution(s). • I understand it is my responsibility to track the five-year aging period for my Roth IRA as required by the IRS. • I understand that, if I elect to include my Roth 401(k) or 403(b) assets from my employer-sponsored plan in my eligible rollover distribution, that these assets will

PPD Retirement Savings Plan Rollover Contribution Form ...

wwwrs.massmutual.comPPD Retirement Savings Plan Rollover Contribution Form Plan ID 990500107 Enclosed are the items needed to make a rollover contribution to the PPD Retirement Savings Plan. • Please carefully review and complete each of the items as described in the procedures below.

HSA, Archer MSA, or Medicare Advantage MSA Information 2

www.irs.govShows any rollover contribution from an Archer MSA to this Archer MSA in 2020 or any rollover from an HSA or Archer MSA to this HSA. See Form 8853 or Form 8889 and their instructions for information about how to report distributions. This …

CONTRIBUTION AND INVESTMENT SELECTION

iradirect.ascensus.com• A rollover generally must be completed within 60 days from the date you receive the assets. • A rollover contribution of Traditional IRA or SIMPLE IRA assets may not be made to a Roth IRA. TRANSFER A transfer is a direct movement of assets to your Roth IRA from any of your other Roth IRAs. • You may perform an unlimited number of transfers.

CONTRIBUTION AND INVESTMENT SELECTION

iradirect.ascensus.com• A rollover contribution of assets distributed from a SIMPLE IRA within two years of the first contribution to your SIMPLE IRA may not be made to a Traditional IRA. TRANSFER A transfer is a direct movement of assets to your Traditional IRA from any of …

Similar queries

Rollover Contributions, Rollover contribution, Planto, Form, IRS tax forms, Rollover, Ally, Retirement Savings Plan Rollover Contribution Form, Retirement Savings Plan Rollover Contribution Form Plan, Retirement Savings Plan, Archer MSA, or Medicare Advantage MSA Information, Contribution, CONTRIBUTION AND INVESTMENT SELECTION