Search results with tag "Federal income"

Form 945-X: Adjusted Annual Return of Withheld Federal ...

www.irs.govAnnual Return of Withheld Federal Income Tax. Use a separate Form 945-X for each year that needs correction. Type or print within the boxes. You MUST complete both pages. Do not attach this form to Form 945. Part 1: Select ONLY one process. 1. Adjusted return of withheld federal income tax. Check this box if you underreported amounts.

17182 Federal Register /Vol. 82, No. 67/Monday, April 10 ...

www.gpo.govThe guidelines are used to determine eligibility for free and ... The Income Eligibility Guidelines The following are the Income ... were obtained by multiplying the year 2017 Federal income poverty guidelines by 1.30 and 1.85, respectively, and by rounding the result upward to the next whole dollar.

20788 Federal Register /Vol. 83, No. 89/Tuesday, May 8 ...

www.gpo.govon the Federal income poverty guidelines and are stated by household size. The guidelines are used to determine eligibility for free and ... The Income Eligibility Guidelines The following are the Income Eligibility Guidelines to be effective from July 1, 2018 through June 30, 2019.

General Explanations of the - United States Secretary of ...

home.treasury.govraised by this proposal would result in no additional federal income tax burden to U.S. persons. Also, the majority of U.S. equity income is untaxed by the U.S. government at the individual level, so the corporate tax is a primary mechanism for taxing such capital income.

Hints: Federal Tax Withholding Form and Your Pension Check

www.acera.orgHints: Federal Tax Withholding Form and Your Pension Check ACERA can withhold federal income taxes from your monthly retirement allowance check.

2021 Instructions for Form 2555 - IRS tax forms

www.irs.gov1040-SR, line 25a or 25b (federal income tax withheld from Form(s) W-2 or 1099, respectively), any taxes an employer withheld from your pay that was paid to the foreign country's tax authority instead of the U.S. Treasury. Purpose of Form If you qualify, you can use Form 2555 to figure your foreign earned income

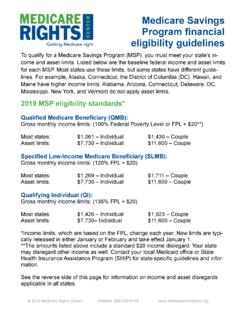

Medicare Savings Program financial eligibility guidelines

www.medicareinteractive.orgeligibility guidelines To qualify for a Medicare Savings Program (MSP), you must meet your state’s in- ... Listed below are the baseline federal income and asset limits for each MSP. Most states use these limits, but some states have different guide-lines. For example, Alaska, Connecticut, the District of Columbia (DC), Hawaii, and Maine have ...

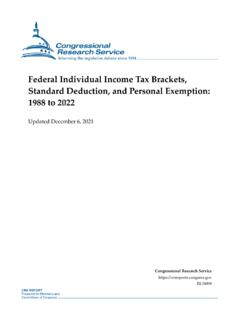

Federal Individual Income Tax Brackets, Standard …

sgp.fas.orgDec 06, 2021 · Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption Congressional Research Service 1 Introduction U.S. citizens and residents are subject to a federal income tax on their worldwide income.1 Their taxable income is equal to gross income from numerous sources (including pass-through business

Federal Income Tax on Timber - US Forest Service

www.fs.fed.usFederal Income Tax on Timber A Key to Your Most Frequently Asked Questions Harry L. Haney, Jr., Garland Gray Emeritu s Professor of Forestry, Department of Forestry, Virginia Polytechnic Institute and State University, Blacksburg, Virginia William C. Siegel, Attorney and Forest Service Volunteer, River Ridge, Louisiana

Similar queries

Federal, Federal Income, Guidelines, Eligibility, Income Eligibility Guidelines, Income, Hints: Federal Tax Withholding Form and Your, Your, Instructions, Form 2555, IRS tax forms, Taxes, Eligibility guidelines, Guide-lines, Federal Individual Income Tax Brackets, Standard, Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption, US Forest Service