Search results with tag "Income statements"

Chapter 2: Introduction to Income Statements Chapter 2

www.navigatingaccounting.comcurrently included in other comprehensive income will move to net income. In fact, the U.S. standard setters are considering new income statement formats that include all comprehensive income on the income statement. COMPREHENSIVE INCOME Comprehensive income is the broadest type of income. As illustrated

Chapter 4 The Income Statement, Comprehensive Income, …

contabilidad.uprrp.eduComprehensive income is the total change in equity for a reporting period other than from transactions with owners. Reporting comprehensive income can be accomplished with a continuous statement of comprehensive income that includes an income statement and other comprehensive income items or in two statements, an

FRS 102 Illustrative Financial Statements - ey.com

www.ey.comcomprehensive income) and items of other comprehensive income; or o A separate income statement and a separate statement of comprehensive income. If an entity chooses to present both an income statement and a statement of comprehensive income, the statement of comprehensive income begins with profit

Upload Income Statements - Michigan

www.michigan.govIncome Statements – Overview Income statements are: Internal Revenue Service (IRS) forms filed by persons or businesses who pay compensation to persons or businesses. IRS determines the type of federal form required and the State of Michigan follows these federal guidelines. Treasury requires issuers to file state copies of income

BANK PROFITABILITY: FINANCIAL STATEMENTS OF BANKS

www.oecd.orgIncome statement 1. Interest income This item generally includes income on interest-bearing assets, fee income related to lending operations, and dividend income on shares and participations. In some cases it may also include income on bonds calculated as the difference between the book value and the redemption value of bonds. 2. Interest expenses

Chapter 07: Financial Statements

www.mccc.eduof cash flow, and statement of changes in financial position. 1. The net income (or net loss) from the income statement is on the balance sheet’s capital section. The net income or net loss is used to update the balance sheet’s capital amount: Capital Beginning of the Year - Net Loss (or + Net Income) = Total Capital. 2.

Financial Statements 2016 - Nestlé

www.nestle.comShare of other comprehensive income of associates and joint ventures 14/17 (10) 112 Items that will never be reclassifi ed to the income statement (153) (250) Other comprehensive income for the year 17 741 (3 938) Total comprehensive income for the year 9 624 5 529 of which attributable to non-controlling interests 343 317

Financial Statements 2015 - Nestlé Global

www.nestle.comShare of other comprehensive income of associates and joint ventures 15 112 (153) Items that will never be reclassifi ed to the income statement (250) (1 546) Other comprehensive income for the year 18 (3 938) 1 900 Total comprehensive income for the year 5 529 16 804 of which attributable to non-controlling interests 317 556

CHAPTER 3 UNDERSTANDING FINANCIAL STATEMENTS

people.stern.nyu.eduThe next is the income statement , shown in Figure 3.2, which provides information on the revenues and expenses of the firm, and the resulting income made by the firm, during a period. The period can be a quarter (if it is a quarterly income statement) or a year (if it is an annual report).

Illustrative financial statements - KPMG

home.kpmgMar 01, 2013 · Consolidated statement of changes in equity 17 Consolidated statement of cash flows 21 Notes to the consolidated financial statements 25. Appendices. I New standards or amendments first effective for 2012 and forthcoming requirements 221 II Consolidated income statement and consolidated statement of comprehensive income –

September 2015 FRS 102 The Financial Reporting Standard ...

www.frc.org.uk3 Financial Statement Presentation 37 4 Statement of Financial Position 42 5 Statement of Comprehensive Income and Income Statement 46 Appendix: Example showing presentation of discontinued operations 6 Statement of Changes in Equity and Statement of Income and Retained Earnings 52 7 Statement of Cash Flows 54 8 Notes to the Financial Statements 59

Financial Statements 2018 - Nestlé

www.nestle.comConsolidated Financial Statements of the Nestlé Group 2018 67 Consolidated statement of comprehensive income for the year ended December 31, 2018 In millions of CHF Notes 2018 2017 * Profi t for the year recognized in the income statement 10 468 7 511 Currency retranslations, net of taxes 17 (1 004) (561)

Financial Forecasting (Pro Forma Financial Statements)

www.spreadsheetml.comFinancial Pg 2-2 Planning and Forecasting Version 1.0 2. Financial Planning and Forecasting Spreadsheet 2.1 Financial Statements Inputs The template requires inputs from the Income Statement and Balance Sheet from the past 5

ANALYZING BANK PERFORMANCE - University of Nevada, Reno

www.business.unr.edu•An Overview of the Balance Sheets and Income Statements of Banks •The Balance Sheet or Report of Condition Asset Items Liability Items •Components of the Income Statement: Revenues and Expenses •Stock Values and Profitability Ratios •Measuring Credit, Liquidity, and Other Risks •The UBPR and Comparing Performance 5-2

Financial Statements 2019 - Nestlé

www.nestle.comConsolidated statement of comprehensive income for the year ended December 31, 2019 In millions of CHF Notes 2019 2018 Profit for the year recognized in the income statement 12 904 10 468 Currency retranslations, net of taxes 17 (1 050) (1 004) Fair value changes and recycling on debt instruments, net of taxes 17 — (39)

DECEMBER 31, 2020 FINANCIAL STATEMENTS …

r.lvmh-static.comConsolidated statement of comprehensive gains and losses CONSOLIDATED STATEMENT OF COMPREHENSIVE GAINS AND LOSSES (EUR millions) Notes 2020 2019 2018 Net profit before minority interests 4,955 7,782 6,990 Translation adjustments (1,650) 299 274 Amounts transferred to income statement (11) 1 (1) Tax impact (10) 11 15 16.5, 18 (1,671) 311 288

Ivy Tech Course Descriptions

www.ivytech.eduprocedures, payroll, depreciation, work sheets, balance sheets, and income statements are covered as well. ACCT 101 Financial Accounting TransferIN 3 Credits Prerequisites: Demonstrated competency through appropriate assessment or earning a grade of “C” or better in ENGL 093 and ENGL 083, or ENGL 095, and MATH 023 or higher.

Draft NISTIR 8286C, Staging Cybersecurity Risks for ...

nvlpubs.nist.gov196 (e.g., income statements, balance sheets, and 197 cash flow) and similar requirements (e.g., 198 reporting for appropriation and oversight 199 . authorities) for public-sector entities. 200 This NISTIR explores the methods for 201 integrating disparate cybersecurity risk 202 management (CSRM) information from

Statement of Cash Flows - Washington State University

apps.aoi.wsu.eduOverview of Financial Statements Balance sheet provides a point-in-time statement of overall financial position of a hotel - “snapshot” of financial health of a hotel Income statement Assess hotel’s operating performance over a period of time Reports the profitability of a hotel’s operating activities Prepared on accrual basis accounting and include noncash revenues

IFRS brings a radical change to financial statement ...

www.knowledgeplus.orgThe new income statement (Statement of Comprehensive Income) The Statement of Comprehensive Income is similar to today’s income statement in that it calculates a subtotal for net income and then has a section for other comprehensive income (OCI). However, everything above net income is divided into the same categories that the balance sheet is

Multi-Step Income Statement CR - Harper College

www.harpercollege.eduAn income statement that includes cost of goods sold as another expense and shows only one subtotal for total expenses is a: a) Single-step income statement. b) Balanced income statement. c) Multiple-step income statement. d) Simplified income statement. 2. Expenses that support the overall operations of a business and include the

How to access your income statement

www.ato.gov.auan income statement or payment summary. Your income information will be available . in the following ways: via your agent via myGov – income statement your employer – payment summary. Through myGov. For most people, their income, tax and super information will be finalised by employers and made available via . myGov by 14 July.

CHAPTER The Income Statement and Statement of Cash …

www.cengage.com3. Define the elements of an income statement. 4. Describe the major components of an income statement. 5. Compute income from continuing operations. 6. Report results from discontinued operations. 7. Identify extraordinary items. 8. Prepare a statement of retained earnings. 9. Report comprehensive income. 10. Explain the statement of cash ...

Module 5 – Statement of Comprehensive Income and …

www.denetimnet.netstatement of comprehensive income and the income statement in accordance with Section 5 Statement of Comprehensive Income and Income Statement of the IFRS for SMEs that was issued in July 2009 and the related non-mandatory guidance subsequently provided by the IFRS Foundation SME Implementation Group..

Net Income (Loss) Reconciliation for Corporations OMB No ...

www.irs.govReconciliation of Net Income (Loss) per Income Statement of Includible Corporations With Taxable Income per Return

INCOME STATEMENT - University of Western Australia

www.annualreport.uwa.edu.auINCOME STATEMENT for the year ended 31 DECEMBER 2014 The above statements should be read in conjunction with the accompanying notes. STATEMENT OF COMPREHENSIVE INCOME

SCHEDULE M-3 Net Income (Loss) Reconciliation (Form 1065 ...

www.irs.govHas the partnership’s income statement been restated for any of the 5 income statement periods immediately preceding the period ... line 11, and column (d) must equal Form 1065, Analysis of Net Income (Loss), line 1. Schedule M-3 (Form 1065) (Rev. 12-2021) Schedule M-3 (Form 1065) (Rev. 12-2021) Page : 3 : Name of partnership : Employer ...

Accounting Income Statement

images.template.netIncome Statement An income statement is a type of summary flow report that lists and categorizes the various revenues and expenses that result from operations during a given period - a year, a quarter or a month. The difference between revenues and expenses represents a company's net income or net loss. The

Evolution of US Generally Accepted Accounting Principles ...

www.iasplus.comperformance’ concept of the income statement, thus displaying ‘unusual’ and ‘extraordinary’ items after net income; the SEC chief accountant, favoring the ‘all-inclusive’ income statement, threatens not to enforce the ARB. Comment: This difference …

LAW FIRM FINANCIAL REPORTING

www.cbalaw.orgIncome Statement: An income statement, otherwise known as a profit and loss statement, is a summary of a your firm’s profit or loss during any one given period of time, such as a month, three months, or one year. The income statement records all revenues for a business during this given period, as well as the operating expenses for the business.

Statement of Cash Flows Study Objectives

home.csulb.edu1. If comparative balance sheet numbers are used, the income statement numbers must be gleaned from the income statement. a. As noted above, insure that the RE number from the balance sheet is the beginning of the year balance to insure that nominal account balance changes are not counted twice (once on the income statement and once in RE). iii.

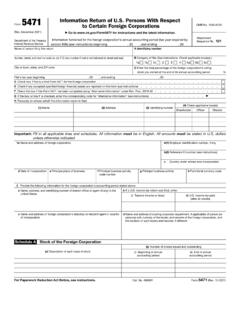

5471 Information Return of U.S. Persons With Respect

www.irs.govIncome Statement (see instructions) ... Net income or (loss) before unusual or infrequently occurring items, and income tax expense (benefit) (subtract line 18 from line 10) . . . . . 19: 20: ... Did any extraordinary reduction with respect to a controlling section 245A shareholder occur during the tax year

Intro to Income Statement PPT for PDF - The Kaplan …

www.kaplancollectionagency.comMore free videos and downloads on Financial Statement Analysis are available at www.kgaction.com/financial-statement-analysis ... Beginning Income Statement Analysis

QUICKBOOKS 2019 STUDENT GUIDE - Intuit

www.intuit.comA Profit and Loss statement or Income Statement shows income, expenses and net profit or loss-Statement of cash flows Shows receipts and payments during a specific accounting period General Journal transactions: Traditional accounting method Known as double-entry accounting Total amount in the Debit column equals the total amount in the Credit ...

Chapter 6 – Statement of Cash Flows

darkwing.uoregon.eduABC Co.’s Income Statement 2000 Sales $5,000,000 Cost of Goods Sold 3,500,000 Gross Margin $1,500,000 Rent Expense $240,000 Wage Expense 800,000 Depreciation Expense 150,000 Net Income $310,000. Statement of Cash Flows Direct Method Example Assume that accounts payable was only used to acquire

Technical Analysis: Introduction

www.ocf.berkeley.eduand Advanced Financial Statement Analysis.) By looking at the balance sheet, cash flow statement and income statement, a fundamental analyst tries to determine a company's value. In financial terms, an analyst attempts to measure a company's intrinsic value. In this approach, investment decisions are fairly easy to make - if the price of a ...

Lease modifications ten comprehensive examples - Deloitte

www2.deloitte.comIFRS 16 Leases contains detailed guidance on how to account for lease modifications. A lease modification is defined as a change in the scope of a lease, or the consideration for a lease, that was ... we have created ten comprehensive numerical examples to illustrate how to account for ... P/L Profit or loss (income statement) RoU asset Right ...

Revenue - Free Accounting and Bookkeeping Training

www.dwmbeancounter.comIncome Statement Accounts The Chart of Accounts is normally arranged or grouped by the Major Types of Accounts. The Balance Sheet Accounts (Assets, Liabilities, & Equity) are

BUSINESS PLANning and Financial Forecasting - A Start-Up …

public-files.prbb.orgBusiness Planning and Financial Forecasting: A Guide for Business Start-Up. ... Starting Balance Sheet Pro-forma Income Statement Cash Flow Forecast Program and Finance. 4 | Business Planning and Financial Forecasting Elements of a Business Plan

Income Statement—Reporting Comprehensive Income …

asc.fasb.orgStatement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income 220-10-65-4 The following represents the transition and effective date information related to Accounting Standards Update No. 2018-02, Income Statement ...

Income Statement—Reporting Comprehensive Income ... - …

asc.fasb.orgAccounting Standards Update 2017-14 Income Statement—Reporting Comprehensive Income (Topic 220), Revenue Recognition (Topic 605), and Revenue from Contracts with Customers (Topic 606)

Income Statement—Extraordinary and Unusual Items …

www.fasb.orgIncome Statement—Extraordinary and Unusual or Infrequently Occurring Items General Note on Income Statement—Extraordinary and Unusual Items: Upon the effective date of Accounting Standards Update 2015-01, the title of this Subtopic will change to Income Statement—Unusual or Infrequently Occurring Items. 6.

Similar queries

2: Introduction to Income Statements Chapter, Comprehensive Income, Income, Income Statement, COMPREHENSIVE INCOME Comprehensive income, STATEMENT OF COMPREHENSIVE INCOME, Upload Income Statements, Michigan, Income statements, Statement, Balance, Financial Statements 2016, Nestlé, FINANCIAL STATEMENTS, CHAPTER, The income statement, Illustrative financial statements, Financial Reporting Standard, Consolidated Financial Statements, Consolidated statement of comprehensive income, Financial Forecasting Pro Forma Financial Statements, Forecasting, CONSOLIDATED STATEMENT OF COMPREHENSIVE, Sheets, Balance sheets, Accounting, Radical change to financial statement, An income statement, CHAPTER The Income Statement and Statement, Statement of comprehensive income and, Statement of Comprehensive Income and Income Statement, Analysis, US Generally Accepted Accounting Principles, Unusual, Extraordinary, Items, And Loss statement, Loss, Account, 5471, Financial Statement Analysis, Income Statement Analysis, QUICKBOOKS 2019 STUDENT GUIDE, Intuit, Expense, Statement Analysis, Lease modifications ten comprehensive examples, Comprehensive, Revenue - Free Accounting and, Balance Sheet, Income Statement—Reporting Comprehensive Income, Income Statement—Extraordinary and Unusual Items, Extraordinary and Unusual