Search results with tag "And trust"

Abandonments and Repossessions, Canceled Debts,

www.irs.gov225 Farmer's Tax Guide 334 Tax Guide for Small Business (For Individuals Who Use Schedule C) 523 Selling Your Home 525 Taxable and Nontaxable Income 536 Net Operating Losses (NOLs) for Individuals, Estates, and Trusts 542 Corporations 544 Sales and Other Dispositions of Assets. 225 334 523 525 536 542 544. 551 Basis of Assets 908 Bankruptcy Tax ...

includes additional financial and trust fund …

www.naic.orgQuarterly Listing of Alien Insurers includes additional financial and trust fund informatioQ-DQXDU\201

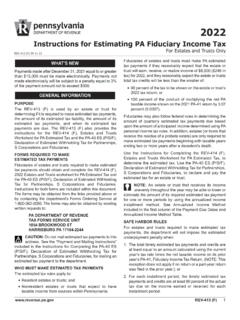

2022 Instructions for Estimating PA Fiduciary Income Tax ...

www.revenue.pa.govpersonal income tax rules. In addition, estates (or trusts that receive the residue of a probate estate) are only required to make estimated tax payments beginning with taxable years ending two or more years after a decedent's death. Use the Instructions for Completing the REV-414 (F), Estates and Trusts Worksheet for PA Estimated Tax, to

Go to www.irs.gov/Form4970 for the latest information 178

www.irs.govMinimum Tax—Individuals; or Schedule I (Form 1041), Alternative Minimum Tax—Estates and Trusts, to recompute the AMT for that year. Show any change in the AMT below the bottom margin of the appropriate form or schedule and enter the change on line 22.

1065 U.S. Return of Partnership Income - IRS tax forms

www.irs.govU.S. Return of Partnership Income Department of the Treasury ... Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year . ... Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) . . . . 4 5 .

2020 Publication 536 - IRS tax forms

www.irs.govextensions) for filing your income tax return for your first tax year ending after December 27, 2020. If you had previously filed an income tax return before December 27, 2020, for a tax Department of the Treasury Internal Revenue Service Publication 536 Cat. No. 46569U Net Operating Losses (NOLs) for Individuals, Estates, and Trusts For use in ...

2021 Form 8960 - IRS tax forms

www.irs.govForm 8960 Department of the Treasury Internal Revenue Service (99) Net Investment Income Tax— Individuals, Estates, and Trusts Attach to your tax return.