Search results with tag "900q"

Instructions for FR-900Q - Washington, D.C.

otr.cfo.dc.govFR-900Q (REV. 01/2018) Government of the District of Columbia Office of the Chief Financial Officer Office of Tax and Revenue 2018 FR-900Q Employer/Payor Withholding Tax - Quarterly Return/Wage Reporting Instructions. P a g e | 1 Instructions for FR-900Q (Rev. January 2018)

2010FR-900Q Employer’s Withholding Tax Booklet

does.dc.govFR-900Q (REV. 10/09) 2010 FR-900Q FR-900Q Employer’s Withholding Tax Booklet Secure - Accurate - Convenient ... DISTRICT OF COLUMBIA ELECTRONIC TAXPAYER SERVICE CENTER File Electronically Today! ... This booklet has all the forms and instructions you need to file your returns.

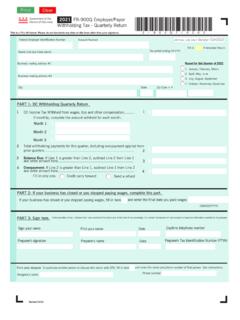

FR-900Q Employer/Payor *21900Q710002 - Washington, D.C.

otr.cfo.dc.gov2021 FR-900Q Employer/Payor Withholding Tax - Quarterly Return Account Number Tax period ending (MMYY) Report for this Quarter of 2021 1. January, February, March 2. April, May, June 3. July, August, September 4. October, November, December PART 1: DC Withholding Quarterly Return 2 DC Income Tax Withheld from wages, tips and other compensation.....

2012FR-900Q Employer’s/Payor’s Withholding Tax Booklet

doh.dc.govWho must fi le a Form FR-900Q? Every employer who pays wages to a DC resident or payor of certain distribu-tions who withholds DC income tax must fi le a DC Withholding tax return.

District of Columbia 2010 FR-900Q SUB Employer Withholding ...

ddot.dc.govFR-900Q SUB Employer Withholding Tax - Quarterly Return *109000810001* 2010 Account Number Government of the District of Columbia Mark if: FEIN Mark if: SSN X X MMYY ... com for instructions. • For electronic filers, in order to comply with new banking rules, you will be asked the question ...

2014 FR-900Q SUB Employer/Payor Withholding Tax ...

dmhhs.dc.govInstructions • Enter your Taxpayer Identification Number. Detach at perforation before mailing ... • Write your FEIN/SSN, tax period and FR-900Q on your check or money order. Mail your payment with your tax return to: Office of Tax and Revenue PO Box 96385 Washington, DC 20090-6385

2012 FR-900Q SUB Employer/Payor Withholding Tax ...

does.dc.gov2012 FR-900Q SUB Employer/Payor Withholding Tax - Quarterly Return *129000810001* Account Number Government of the District of Columbia Mark if: FEIN ... Visit www.taxpayerservicecenter.com for instructions. • For electronic filers, in order to comply with new …

2013 FR-900Q SUB Employer/Payor Withholding Tax ...

dcoa.dc.govInstructions • Enter your Taxpayer Identification Number. Detach at perforation before mailing ... • Write your FEIN/SSN, tax period and FR-900Q on your check or money order. Mail your payment with your tax return to: Office of Tax and Revenue PO Box 96385 Washington, DC 20090-6385

1 2 3 4 2015 FR-900Q SUB Employer/Payor 4 5 Withholding ...

os.dc.govFR-900Q SUB Employer/Payor Withholding Tax - Quarterly Return * 159000810001* Government of the District of Columbia. Mark if: FEIN Mark if: SSN. X X. 12345ABCDEFGHIJKLABCDEFGH ... Instructions • Enter your Taxpayer Identification Number. Detach at perforation before mailing.

Instructions for FR-900Q - otr | Office of Tax and Revenue

otr.cfo.dc.govInstructions for FR-900Q (Revised January 2017) Employer/Payor Withholding Tax – Quarterly Return Wage Reporting _____ _ F uture Developments

Government of the District of Columbia Office of Tax and ...

dhcd.dc.gov• Instructions • FR-900A — Employer Withholding Tax Annual Return • Form W-2T — Transmittal for Paper W-2 forms • FR-900C — Change of Name or Address ... to $1201 per period, file a quarterly withholding return, FR-900Q. If your DC withholding is greater than or equal to $1201 per period, file a monthly withholding return, FR-900M ...

2011 FR-900A Employer’s/Payor’s Withholding Tax Booklet

dcps.dc.govSee FR-230, 2012 District of Columbia (DC) Income Tax Withholding Instructions and Tables. • Employers or payors must fi le Forms W-2 electronically if the number of W-2 forms is greater than 25. If 25 or fewer, the employer or payor may fi le ... FR-900Q. If your withholding tax liability is greater than or equal to $1201 per period, fi ...

Office of the Chief Financial Officer Office of Tax and ...

cfo.dc.govYou must file your FR-900Q returns and the FR-900B even if you withheld no tax or no payment is due. If your withholding tax liability is less than or equal to $200 per period, file an ... General Instructions. If your tax liability is $5,000 per period, you shall file and pay electronically.

Office of the Chief Financial Officer Office of Tax and ...

cfo.dc.govFR-900Q Employer Withholding Tax Quarterly Return (Voucher) Substitute Forms Guidelines for Software Developers Revised October 2013 NEW ... Refund Options: For information on the tax refund card and program limitations, see instructions or visit our website otr.dc.gov/refundprepaidcards

Government of the District of Columbia Office of Tax and ...

www.zillionforms.comFR-900Q. If your withholding tax liability is greater than or equal to $1201 per period, file a monthly return, FR-900M. If you need to change your filing frequency, ... (FR-500) General Instructions Withholding Annual Tax Return-1-Before conducting business in the District of Columbia (“District”) you

W-2 REPORTING VIA ELECTRONIC TAXPAYER SERVICE

dcps.dc.govthe FR-900M or FR-900Q booklets. Beginning January 1, 2012, payers who are withholding from retirement accounts or plans for DC residents subject to federal withholding must file electronically if

FR-900B Employer/Payor Withholding This is a FILL-IN ...

dgs.dc.govForms FR-900M or FR-900Q $. Account Number DCW007B Tax Period Ending (MMYY) Preparer’s PTIN $. $. $. OFFICIAL USE ONLY Vendor ID#0002 This is a FILL-IN format. Please do not handwrite any data on this form other than your signature. Due Date Fill in if amended return

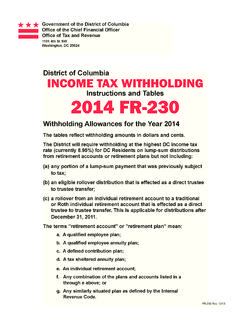

District of Columbia INCOME TAX WITHHOLDING 2014 FR-230

disb.dc.govDistrict of Columbia INCOME TAX WITHHOLDING Instructions and Tables 2014 FR-230 ... INSTRUCTIONS FOR EMPLOYERS OR PAYORS. 2 ... FR-900Q is due by the 20th day of the month following the close of the quar-terly withholding tax period being reported. If the tax liability

2014FR-900M Employer/Payor - dhcd.dc.gov

dhcd.dc.govto $201 and less than or equal to $1200 per period, fi le a quarterly return, FR-900Q. If your withholding tax liability is greater than or equal to $1201 per pe-riod, fi le a monthly return, FR-900M. If you need to change your fi ling frequency, ... Visit www.taxpayerservicecenter.com for instructions. General Instructions Withholding ...

2013 FR-900A Employer/Payor Withholding Tax Booklet

dhcf.dc.govFR-900Q. If your withholding tax liability is greater than or equal to $1201 per period, fi le a monthly return, FR-900M. If you need to change your fi ling frequency, ... (FR-500) General Instructions Withholding Annual Tax Return-1-Before conducting business in …

2013FR-900M Employer/Payor Withholding Tax Booklet …

dhs.dc.govFR-900MEmployer/Payor Withholding Tax Booklet Monthly Returns Secure - Accurate - Convenient ... DISTRICT OF COLUMBIA ... FR-900Q. If your withholding tax liability is greater than or equal to $1201 per pe-riod, fi le a monthly return, FR-900M. If you need to change your fi ling frequency, ... Visit www.taxpayerservicecenter.com for ...

Mailing Addresses for D.C. Tax Returns Form Mailing ...

otr.cfo.dc.govFR-900Q Withholding Quarterly FR-900B Withholding Annual Reconciliation Office of Tax and Revenue PO Box 96385 Washington, DC 20090-6385 FR-400M Motor Fuel Office of Tax and Revenue PO Box 556 Washington, DC 20024-0556 D-76 Estate Tax Office of …

Substitute Forms Guidelines for Software Developers ...

doh.dc.govFR-900Q Employer Withholding Tax Quarterly Return (Voucher) Substitute Forms Guidelines for Software Developers. Revised October 2011. NEW . ... cluded in the instructions. • The 6% rate now includes Armored Car Services, Investi-gative Services and Security Services.

2012 FR-900A Employer/Payor Withholding Tax Booklet

fems.dc.govFR-900Q. If your withholding tax liability is greater than or equal to $1201 per period, fi le a monthly return, FR-900M. If you need to change your fi ling frequency, ... (FR-500) General Instructions Withholding Annual Tax Return-1-Before conducting business in …

Government of the District of Columbia Office of Tax and ...

mpdc.dc.govSee FR-230, 2012 District of Columbia (DC) Income Tax Withholding Instructions and Tables. • Employers or payors must file Forms W-2 electronically if the number of W-2 forms is greater than 25. If 25 or fewer, the employer or payor may file ... FR-900Q. If your withholding tax liability is greater than or equal to $1201 per nd period, file a ...

*169000 - mpdc | Metropolitan Police Department

mpdc.dc.gov2016 FR-900Q SUB Employer/Payor . ... Visit www.taxpayerservicecenter.com for instructions. • For electronic filers, in order to comply with new banking rules, you will be asked the question “Will the funds for this payment come from an account outside of the United States?” If the answer

2014 FR-900A Employer/Payor Withholding Tax Booklet

osse.dc.govFR-900Q. If your withholding tax liability is greater than or equal to $1201 per period, fi le a monthly return, FR-900M. If you need to change your fi ling frequency, ... (FR-500) General Instructions Withholding Annual Tax Return-1-Before conducting business in the District of Columbia (“District”) you

2012 FR-900B SUB Employer/Payor Withholding Tax ...

webservicesfp.lscsoft.com2012 fr-900b sub state taxpayer identification number business name mailing address line #2 city zipcode + 4 mailing address line #1 ... total withholding tax paid to dc this year on forms fr-900m or fr-900q ..... paid preparer only firm name preparer’s signature (if …