Search results with tag "Lodging expenses"

Step-by-step guide for processing your DTS travel voucher

www.moody.af.millodging expenses not included in the nightly rate) - Select the appropriate sub-category/name. Adding Receipts and Other Expenses - Input the expense date or date range that the expense was incurred - Add expense amount - Lodging taxes all …

Computing Temporary Lodging Allowance (TLA)

www.defensetravel.dod.mil10/1/10 The Defense Travel Management Office 2 b. Receipts, invoices or statements from the lodging provider are required to verify lodging expenses.

Taxable Fringe Benefit Guide - IRS tax forms

www.irs.govMeal or lodging expenses that you reimburse on a per diem basis (discussed later), at a rate at or below the allowable maximum, under an accountable plan. 2. Individual expenditures (except for lodging) of less than $75. 3. Expenditures for transportation expense for which a receipt is not readily available.

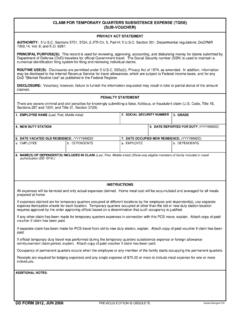

CLAIM FOR TEMPORARY QUARTERS SUBSISTENCE EXPENSE …

www.esd.whs.milNOTES: * Receipts are required for lodging expenses and any single expense of $75.00 or more to include any meal expense for one or more individuals.