Transcription of 2016 Publication 17

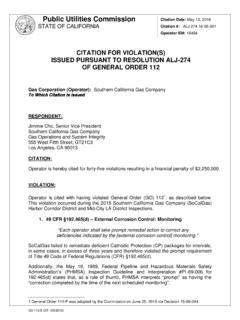

1 Userid: CPMS chema: tipxLeadpct: 100%Pt. size: 8 Draft Ok to PrintAH XSL/XMLF ileid: .. ations/P17/ 2016 /A/XML/Cycle01/source(Ini t. & Date) _____Page 1 of 293 14:30 - 27-Dec- 2016 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before of the TreasuryInternal Revenue ServiceTAX GUIDE2016 Get forms and other information faster and easier at: (English) (Espa ol) ( ) ( ) (Pусский) (Ti ngVi t) Your FederalIncome TaxFor IndividualsPublication 17 Catalog Number 10311 GFor use in preparing2016 ReturnsDec 27, 2016 Page 2 of 293 Fileid.

2 Ations/P17/ 2016 /A/XML/Cycle01/source14:3 0 - 27-Dec- 2016 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before FederalIncome TaxFor IndividualsContentsWhat's One. The Income Tax Exemptions and Withholding and Estimated Two. , Salaries, and Other and Other Income and Plans, Pensions, and Security and Equivalent Railroad Retirement Three. Gains and of of Your Gains and Losses ..115 Part Four. Adjustments to Retirement Arrangements (IRAs).. Five. Standard Deduction and Itemized and Dental Casualty and Theft Expenses and Other Employee Business Benefits for Work-Related on Itemized Six.

3 Figuring Your Taxes and To Figure Your on Unearned Income of Certain and Dependent Care for the Elderly or the Tax Income Credit (EIC)..23137 Premium Tax Credit (PTC)..24638 Other Tax Tax Computation Tax Rate Rights as a To Get Tax To explanations and examples in this Publication reflect the interpretation by the Internal Revenue Service (IRS) of:Tax laws enacted by Congress,Treasury regulations, andCourt , the information given does not cover every situation and is not intended to replace the law or change its material in this Publication may be reprinted freely.

4 A citation to Your Federal Income Tax ( 2016 ) would be Publication covers some subjects on which a court may have made a decision more favorable to taxpayers than the interpretation by the IRS. Until these differing interpretations are resolved by higher court decisions or in some other way, this Publication will continue to present the interpretations by the taxpayers have important rights when working with the IRS. These rights are described in Your Rights as a Taxpayer in the back of this of the TreasuryInternal Revenue ServicePage 3 of 293 Fileid: .. ations/P17/ 2016 /A/XML/Cycle01/source14:3 0 - 27-Dec- 2016 The type and rule above prints on all proofs including departmental reproduction proofs.

5 MUST be removed before 's NewThis section summarizes important tax changes that took effect in 2016 . Most of these changes are discussed in more detail throughout this developments. For the latest information about the tax law topics covered in this Publication , such as legislation enacted after it was published, go to date of return. File your tax return by April 18, 2017. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Colum-bia even if you do not live in the District of Columbia. See chap-ter at local IRS offices by appointment.

6 Many issues can be resolved conveniently on with no waiting. However, if you need help from an IRS Tax-payer Assistance Center (TAC), you need to call to schedule an ap-pointment. Go to to find the location and telephone number of your local refunds for returns claiming certain credits. Due to changes in the law, the IRS can't issue refunds before February 15, 2017, for returns that claim the earned income credit or the addi-tional child tax credit. This delay applies to the entire refund, not just the portion associated with these credits.

7 Although the IRS will begin releasing refunds for returns that claim these credits on February 15, because of the time it generally takes banking or financial systems to process deposits, it is unlikely that your refund will arrive in your bank account or on a debit card before the week of February 27 (assuming your return has no pro-cessing issues and you elect direct deposit).If you filed your return before February 15, you can check Where's My Refund on ( ) a few days after February 15 for your projected de-posit date. Where's My Refund and the IRS2Go phone app remain the best ways to check the status of any services.

8 Eight delivery services have been added to the list of designated private delivery services. For the complete list, see chapter payment option. There is a new option for taxpayers who want to pay their taxes in cash. For de-tails, see chapter expenses. You may be able to deduct certain expenses for professional development courses you have taken related to the cur-riculum you teach or to the stu-dents you teach. See chapter and Paralympic medals and USOC prize money. If you receive Olympic and Paralympic medals and United States Olympic Committee prize money, the value of the medals and the amount of the prize money may be nontaxa-ble.

9 See the instructions for Form 1040, line 21, for more tax credit and additional child tax credit may be disal lowed. If you take the child tax credit or the additional child tax credit even though you aren t eligi-ble, you may not be able to take these credits for up to 10 years. For more information, see chap-ter opportunity credit may be disallowed. If you take the American opportunity credit even though you aren t eligible, you may not be able to take this credit for up to 10 years. For more information, see chapter coverage tax credit (HCTC).

10 The HCTC is a tax credit that pays a percentage of health in-surance premiums for certain eligi-ble taxpayers and their qualifying family members. The HCTC is a separate tax credit with different el-igibility rules than the premium tax credit. You may have received monthly advance payments of the HCTC beginning in July 2016 . For information on how to report these payments or on the HCTC gener-ally, see the Instructions for Form Transcript Online. The Get Transcript Online tool on is available again to get a copy of your tax transcripts and similar documents.