Transcription of Alternate Retirement Program (ARP) - California

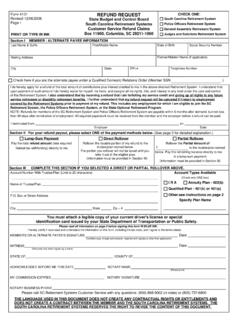

1 (11/11) State of CaliforniaThe Alternate Retirement Program (ARP) is a Retirement savings Program for certain employees hired on or after August 11, 2004. Eligible employees are automatically enrolled for their fi rst two years of employment with the State of California . ARP provides up to two years of Retirement savings in lieu of Retirement service credit under the California Public Employees Retirement system (CalPERS). The Department of Personnel Administration s Savings Plus Program (Savings Plus) administers Does ARP Work?What is ARP?Phase IAll information contained in this booklet was current as of the print date. The Plan reserves the right to amend any of the procedures or plan provisions as outlined in this booklet or in the Plan Document.

2 Such changes may be enacted without prior announcement or the express consent or agreement of plan participants. The Plan Document will govern if any contradiction arises between the terms of the Plan Document and this Retirement Program (ARP)FACT SHEETM onths 1-24 - ARP contributions begin. You ll contribute to ARP during the fi rst 24 months of your CalPERS membership. The amount deducted from your check for Retirement benefi ts depends on whether you re an excluded, exempt, or represented employee and the bargaining terms therein. Savings Plus Contact Information Service Hours5:00 - 8:00 (866) 566-4777, 4 Voice Response system (866) 566-4777 TTY(800) 848-0833 FAX(877) 677-4329 Lobby Hours8:00 4:30 15th StreetSacramento, CA 95811-6614 Even though you don t receive Retirement service credit with CalPERS during this period, you re a CalPERS member and entitled to all other CalPERS benefi ts such as health insurance.

3 Your ARP account is set up automatically as part of a 401(a) Plan, a type of Retirement savings plan governed by IRS rules Savings Plus invests your ARP funds in the STIF-ARP which is a short-term investment fund that earns interest Employer contributions or matching funds are not allowed; your account consists entirely of money you ve contributed via payroll deductions and any attributable earnings or losses While you re contributing, your employer pays the administrative fees on your account You ll receive an annual statement and an ARP Newsletter each August You can view your ARP balance at by logging in under Account Access If you separate from state employment, you re eligible to take a distribution from your ARP account.

4 For details go to ( Alternate Retirement Program , leaving employment) You can contribute to a 401(k) and/or to a 457 plan while in ARP. Go to and select the 401(k)/457 tab to learn more about these plansBasic Facts2 How Does ARP Work?( )Phase II Month 25 - CalPERS service credit begins to accrue. After your fi rst 24 months of CalPERS membership, your paycheck deductions stop going to ARP and begin going to CalPERS. Under IRS rules, the money you contributed to ARP must remain in your ARP account for two additional III Months 47-49 - Decision period begins. You ll have three months to decide what to do with the money in your ARP account between months 47 - 49.

5 You ll have three options: Option 1: Transfer your ARP funds to CalPERS for service credit equal to your time worked during phase I. Option 2: Take a distribution of your ARP account. Option 3: Transfer your ARP funds to a Savings Plus 401(k) ll receive a post card at month 45 notifying you that you re approaching your decision period (Phase III). Prior to your decision period, you ll receive your ARP Payout Selection kit in the s Excluded?You re also not in ARP if you meet any of the following conditions, even if you were hired on or after August 11, 2004.

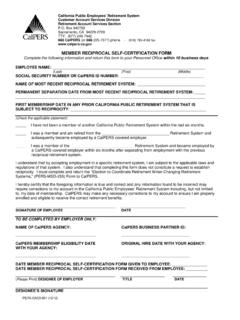

6 Eligible for CalPERS membership in the State Safety, State Patrol, or State Peace Offi cer/Firefi ghter categories Current or prior member of CalPERS Member of CalPERS reciprocal Retirement system within the prior six months Member of the judges Retirement system , judges Retirement system II, Legislators Retirement system , California State Teachers Retirement system , or the University of California Retirement Plan Employed by California State University (CSU Student Assistant employment doesn t count) Employed by the California legislative or judicial branch of government Employed as a California Highway Patrol cadet Part-time California National Guard member who elects CalPERS membership Non-resident alien on a F-1, J-1, M-1, or Q-1 visa and not coordinated with Social Security3 Who Must Participate?

7 You re automatically in ARP if you meet all the conditions listed below: First hired by the State on or after August 11, 2004; Eligible for CalPERS membership in the State Miscellaneous or State Industrial category (ask your Personnel Offi ce if you need this point explained); and Meet the defi nition of State employee in Government Code section 19815 (includes all Executive branch employees not elected to offi ce).Participation in ARP is mandatory; you can t opt re not in ARP if you where hired by the State prior to August 11, 2004. This includes: Part-time, Seasonal, or Temporary (PST) experience Student Assistance experience at a State agency Youth Aid experience4 AddressUpdatesIt s important that Savings Plus has your current mailing address on record to ensure you receive your annual statement, ARP Newsletter and importantcommunications for Phase your address changes and you re still employed with the State and contributing to ARP, notify your departmental personnel or payroll offi ce of the new you re no longer contributing to ARP, or are no longer employed with the State, you have three ways to change your address with Savings Plus.

8 Online at Log onto your account, select Online Profi le and then Change Personal Information. Call Savings Plus toll-free at 1-866-566-4777; press 4 to reach customer service Monday - Friday; 5:00 - 8:00 Pacifi c Time, or Send a letter to Savings Plus. Include your full name, Social Security number, daytime phone number (including area code), your former address, and a new address. Be sure to sign and date your letter. Mail to:Nationwide Retirement Box 182797 Columbus, OH 43218-2797 ORfax to (877) 677-4329 For additional details about ARP visit our web site