Transcription of AMENDMENT No. - Hasil

1 AMENDMENT No. Subject Page 1. Items N5, N6, N11 and N12 27 AMENDMENT to the wording of the Subject (no change to the Explanation) 2. Appendix D LD : 2/4 Addition of claim codes 147 and 148 Code 119 cannot be claimed with effect from Year of Assessment 2012 Addition of claim codes 149 and 150 Addition of claim codes 220, 313 and 314 Addition of claim code 315 Addition of claim codes 151 and 152 Addition of claim code 153 30 March 2012 Updated: 2012 Updated: 6 Nov 2012 Updated: 22 Jan 2013 Updated: 6 Mar 2013 Updated: 2012 Updated: 29 Mar 2013 iForm C 2012 GuidebookSelf Assessment SystemCONTENTS OF GUIDEBOOKITEMPageFOREWORD1 PART I Form CBasic Particulars2 Part AStatutory Income, Total Income And Chargeable Income5 Part BTax Payable10 Part CStatus Of Tax For Year Of Assessment 201213 Part DSpecial Deduction.

2 Double Deduction And Further Deduction14 Part EClaim For Schedule 3 Allowance14 Part FClaim For Losses16 Part GIncentive Claim17 Part HIncome Transferred To Exempt Account20 Part IExempt Account20 Part JIncome Of Preceding Year Not Declared20 Part KDisposal Of Asset Under The Real Property Gains Tax Act 197620 Part LFinancial Particulars Of Company21 Part MParticulars Of Withholding Taxes24 Part NTransaction Between Related Companies26 Part PParticulars Of Company28 Part QParticulars Of Five Major Shareholders Of Controlled Company29 Part ROther Particulars29 Part SParticulars Of Auditor30 Part TParticulars Of The Firm And Signature Of31 The Person Who Completes This Return FormDeclaration31 Reminder31 PART II Appendices and Working SheetsAppendix-Introduction32-Separation of Income by Source33 Appendix A1-Computation of Adjusted Income for Business34 List of legal provisions relating to.

3 -Gross Business Income36 Allowable Expenses36 Non-allowable Expenses37 Reminder-Adjustment of Income or Expenses39 Contract/Subcontract payments, commission and39rental and other contractual payments for servicesto residentsContract payments to non-residents (receipts by non-resident39contractors section 107A applies)Management fees to residents39 Professional, technical or management fees39and rents to non-residents (section 4A income)Expenses charged or allocated by parent company40to subsidiary or headquarters to branch in MalaysiaOverseas trips40 Housing developers40 Transfer pricing41 Leasing41 Non-resident company carrying out a contractual project in Malaysia41 Investment holding41 Reinvestment allowance41 Guidelines and application forms for incentive claims41 Appendix A2 - COMPUTATION OF ADJUSTED INCOME FOR LIFE INSURANCE BUSINESSS eparation of income by source42 Usage of business identity42 Usage of Appendix A242 Appendix A2A - COMPUTATION OF ADJUSTED INCOME FOR FAMILY TAKAFUL BUSINESSS eparation of income by source43 Usage of business identity43 Usage of Appendix A2A43 Appendix A3 - COMPUTATION OF ADJUSTED INCOME FOR GENERAL INSURANCE BUSINESSS eparation of income by source44 Usage of business identity44 Business identity for composite insurance business44 Usage of Appendix A344 Appendix A3A.

4 COMPUTATION OF ADJUSTED INCOME FOR GENERAL TAKAFUL BUSINESSS eparation of income by source45 Usage of business identity45 Business identity for composite takaful business45 Usage of Appendix A3A45 Appendix A4 - COMPUTATION OF TAKAFUL SHAREHOLDERS FUND45 OTHER APPENDICES46 WORKING SHEETS47 ITEMP ageiiForm C 2012 GuidebookSelf Assessment System1 Form C 2012 GuidebookSelf Assessment SystemFOREWORDL embaga Hasil Dalam Negeri Malaysia (LHDNM) appreciates the consistent performance of your duty as aresponsible taxpayer in the settlement of your annual income tax. Your tax contribution have assisted in thedevelopment and improvement of the national socio-economic expedite and facilitate the performance of your tax responsibility, the government has entrusted its faithin you to assess and settle your respective tax with the introduction the Self Assessment System (SAS)commencing from the Year of Assessment (Y/A) 2001 for corporate the implementation of SAS, companies resident in Malaysia (including companies resident in Singaporepaying Malaysian tax) are responsible for furnishing the Form C to the Director General of Inland Revenueas required under the provisions of the Income Tax Act (ITA)

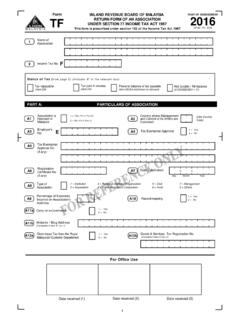

5 Forms with explanations and guides on how to fill out those forms and compute the chargeableincome and income tax have been prepared to assist C GuidebookThe following are contents of the Form C Guidebook:-1.(a)Guide on how to fill out Form C.(b)Reminder before filling out the form:OUse black ink the relevant box in block one box for each alphabet or numeral (a)Working Sheet29 Working Sheets (HK-PC1 to HK-P) are provided to assist in the computation before thetransfer of relevant information to the Form for each Working Sheet can be found in Part II of the Guidebook.(b)Appendix19 Appendices (Appendix A1 to J) are prepared as a guide in the computation andpreparation of information required to complete the Form are given in Part II of the Guidebook and relevant ia always ready to assist you in complying with self assessment or provide explanation in completingthe Form C, Working Sheets and Appendices.

6 A completed Form C must be submitted to LHDNM within thestipulated C 2012 GuidebookSelf Assessment System2 BASIC PARTICULARSItemSubjectExplanationWorking AppendixSheetIName ofName of company as registered with the Companies--companyCommission of Malaysia. if there is a change in nameindicate the former name in parenthesis and furnishForm as registered with the Companies Commission--(registration no.)of sEmployer s income tax reference : E 202154402 IVResidentRefer to the provision of section 8 ITA 1967 to determine--in Malaysiathe resident status in ofRefer to Appendix E for the country tax tax reference number of the : C 250236501 VIIO pening dateOpening date of company s financial year for current--of accountsyear of assessment. Refer to the examples in item dateClosing date of company s financial accountsIf the closing date of accounts is changed, enter thecorrect closing date of accounts in item 1:Accounting period from till been changed to till , the opening and closing date ofaccounts to be entered in items VII and VII areas follows:-Year of AssessmentOpening Date of AccountsClosing Date of Accounts201101/01/201131/03/2012201201/0 4/201231/03/2013 Example 2:The company changed its accounting periodfrom till till , till subsequently till 30th September the basis period from is still taken into account for taxcomputation, the company is still requiredto enter the opening and closing date ofaccounts as follows:-Year of AssessmentOpening Date of AccountsClosing Date of Accounts201201/01/201230/09/2013201301/1 0/201230/09/2013 Example 3.

7 A company commenced operation on its accounts are prepared until subsequently till 30th April every I : Form C 5 4 4 0 2 1 2 0 2 3 6 5 0 1 2 0 5 2 C EForm C 2012 GuidebookSelf Assessment System3 ItemSubjectExplanationWorkingAppendixShe etAlthough the basis period from and till still taken into account for taxcomputation, the company is still requiredto enter the following opening and closingdate of accounts:-Year of Assessment Opening Date of AccountsClosing Date of Accounts201101/06/201130/04/2012201201/0 5/201230/04/2013 Example 4:Winding-up of CompanyA company with accounting period till , commences itswinding-up on The first andsecond Form 75 are prepared as to to the basis period from to still taken into account for tax computation, thecompany is still required to enter the opening andclosing date of accounts as follows:-Year of Assessment Opening Date of AccountsClosing Date of Accounts201215/09/201214/03/2013201315/0 9/201214/03/2013 IXCompliancePublic Ruling is a guide for the public which sets out-Hwith Publicthe interpretation of the Director General of InlandRulingsRevenue in respect of a particular tax law, policy andprocedure that are to be to the list of Public Rulings in Appendix further details, surf the LHDNM website at.

8 X in the box for Yes for full compliance withPublic X in the box for No for non-compliance withone Public Ruling or refers to the keeping of sufficient records as--required under the provisions of ITA X in the box for Yes for full compliance or No for effect from year of assessment 2006, a company--Surrenderis allowed to surrender not more than 70% of itsloss underof its adjusted loss in the basis period of a year ofthe Groupassessment to one or more related provisionThe surrendering company and the claimant companymust be incorporated and resident in Malaysia; andwithin the same group of to section 44A ITA 1967 for conditions on eligibilityto surrender or claim. Election made shall be finaland cannot be provision does not apply to a company whichenjoys any of the incentives listed in subsection44A(10).Form C 2012 GuidebookSelf Assessment System4 Enter 1 in the box provided if there is a claim forloss under this provision and submit Form C (RK-T)together with the Form surrendering loss under the provision of thissection, enter 2 in the relevant box and submitForm C (RK-S) together with the Form C (RK-T) and C (RK-S) are available fromthe LHDNM 3 if there is no surrender or claim for lossunder this to the relevant legal provisions, principles and--change inguidelines as follows-shareholdingzsubsection 44(5A), 44(5B), 44(5C) and 44(5D);and subsectionzspecial provision relating to section 44;44(5A) applieszparagraph 75A, 75B and 75C Schedule 3;zspecial provision relating to paragraph 75 ASchedule 3 ACP 1967.

9 Andzprinciples and guidelines which allow unabsorbedaccumulated losses and capital allowances toto be carried forward (from the LHDNM website, )Substantial change in shareholding occurs if 50%or more of the shareholding on the last day of thebasis period for a year of assessment in which theadjusted loss and capital allowance are ascertainedis not the same as the shareholding on the first dayof the basis period for the year of assessment inwhich that adjusted loss and capital allowance areallowable as company with substantial change in shareholding(50% or more) may carry forward its accumulatedadjusted business losses and capital allowancesnot absorbed, to be absorbed in the relevant yearof assessment and subsequent years of assessmentEXCEPT for a dormant company with substantialchange in stage at which to determine the shareholdingis the stage of direct holding between the dormantcompany taken over and the person taking of dormant company A company is considered dormant if it does nothave any significant accounting transaction for onefinancial year before the occurrence of substantialchange ( 50% or more) in its equity means that there is no recording entry in thecompany accounts other than the minimum expensesfor compliance with stipulated statutory minimum expenses referred to are as follows:-(i)filing of the company s annual return to theCompanies Commission of Malaysia.

10 (ii)secretarial fee for filing of company s annualreturn;ItemSubjectExplanationWorki ngAppendixSheetForm C 2012 GuidebookSelf Assessment System5(iii) tax filing fee;(iv)audit fee; and(v)accounting provisionWhere the basis period of a company for year ofassessment 2005 ends on or after 1st October 2005,the last day of the basis period for that company foryear of assessment 2005 shall be deemed to be30th September 1 in the box for Yes if there is substantialchange in shareholding and subsection 44(5A) there is substantial change but subsection44(5A) does not apply or there is no substantialchange, enter 2 in the box for No .Enter 3 if not andEnter 1 in the box provided if the company is a--mediumsmall and medium enterprise (as per paragraphs 2A,enterprise2B and 2C Schedule 1 of ITA 1967), and not a specialpurpose vehicle established for the issuance ofasset-backed securities in a securitization transactionapproved by the Securities Commission [subsection2(9) of ITA 1967].