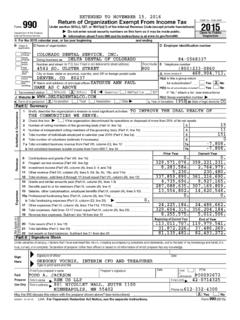

Transcription of EXTENSION GRANTED TO 2/15/2011 990 Return of …

1 EXTENSION GRANTED TO 2/15/2011 . 990. OMB No. 1545-0047. Return of Organization Exempt From Income Tax Form Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation). 2009. Department of the Treasury Open to Public Internal Revenue Service | The organization may have to use a copy of this Return to satisfy state reporting requirements. Inspection A For the 2009 calendar year, or tax year beginning JUL 1, 2009 and ending JUN 30, 2010. B Check if Please C Name of organization D Employer identification number applicable: use IRS. label or Address change print or OPPORTUNITY HOUSE. Name change type. Doing Business As 23-2543677. Initial Return See Number and street (or box if mail is not delivered to street address) Room/suite E Telephone number Specific Termin- ated Instruc- 430 N 2ND ST (610) 374-4696. Amended tions. Return City or town, state or country, and ZIP + 4 G Gross receipts $ 5,922,026.

2 Applica- tion 19601 READING, PA H(a) Is this a group Return F Name and address of principal officer:MODESTO FIUME Yes X No pending for affiliates? SAME AS C ABOVE H(b) Are all affiliates included? Yes No I Tax-exempt status: X 501(c) ( 3 ) (insert no.) 4947(a)(1) or 527 If "No," attach a list. (see instructions). J Website: | H(c) Group exemption number |. K Form of organization: X Corporation Trust Association Other | L Year of formation: 1984 M State of legal domicile: PA. Part I Summary 1 Briefly describe the organization's mission or most significant activities: OPPORTUNITY HOUSE IS A. Activities & Governance MULTI-SERVICE ORGANIZATION THAT IMPROVES THE QUALITY OF LIFE FOR. 2 Check this box | if the organization discontinued its operations or disposed of more than 25% of its net assets. 3 Number of voting members of the governing body (Part VI, line 1a) ~~~~~~~~~~~~~~~~~~~~ 3 23. 4 Number of independent voting members of the governing body (Part VI, line 1b) ~~~~~~~~~~~~~~ 4 23.

3 5 Total number of employees (Part V, line 2a) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 5 126. 6 Total number of volunteers (estimate if necessary) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 6 3500. 7a Total gross unrelated business revenue from Part VIII, column (C), line 12 ~~~~~~~~~~~~~~~~~ 7a 0. b Net unrelated business taxable income from Form 990-T, line 34 7b 0. Prior Year Current Year 8 Contributions and grants (Part VIII, line 1h) ~~~~~~~~~~~~~~~~~~~~~ 2,923,395. 2,744,809. Revenue 9 Program service revenue (Part VIII, line 2g) ~~~~~~~~~~~~~~~~~~~~~ 1,991,803. 1,941,131. 10 Investment income (Part VIII, column (A), lines 3, 4, and 7d) ~~~~~~~~~~~~~ 18,439. 11,909. 11 Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e) ~~~~~~~~ 115,358. 128,438. 12 Total revenue - add lines 8 through 11 (must equal Part VIII, column (A), line 12) 5,048,995. 4,826,287. 13 Grants and similar amounts paid (Part IX, column (A), lines 1-3) ~~~~~~~~~~~.

4 14 Benefits paid to or for members (Part IX, column (A), line 4) ~~~~~~~~~~~~~. 15 Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10) ~~~ 2,400,937. 2,343,140. Expenses 16 a Professional fundraising fees (Part IX, column (A), line 11e)~~~~~~~~~~~~~~ 11,000. b Total fundraising expenses (Part IX, column (D), line 25) | 262,975. 17 Other expenses (Part IX, column (A), lines 11a-11d, 11f-24f) ~~~~~~~~~~~~~ 1,395,263. 1,731,435. 18 Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25) ~~~~~~~ 3,796,200. 4,085,575. 19 Revenue less expenses. Subtract line 18 from line 12 1,252,795. 740,712. Fund Balances Beginning of Current Year Net Assets or End of Year 20 Total assets (Part X, line 16) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 6,813,638. 7,594,568. 21 Total liabilities (Part X, line 26) ~~~~~~~~~~~~~~~~~~~~~~~~~~~ 984,659. 1,000,684. 22 Net assets or fund balances. Subtract line 21 from line 20 5,828,979.

5 6,593,884. Part II Signature Block Under penalties of perjury, I declare that I have examined this Return , including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge. =. Sign Here Signature of officer Date =. MODESTO FIUME, EXECUTIVE DIRECTOR. Type or print name and title = 9. Preparer's Date Check if Preparer's identifying number self- (see instructions). Paid 9. signature LARRY S. SHAUB employed Preparer's Firm's name (or REINSEL KUNTZ LESHER LLP. =. EIN. Use Only yours if 9 610-376-1595. self-employed), 1330 BROADCASTING ROAD, BOX 7008. address, and ZIP + 4 WYOMISSING, PA 19610-6008 Phone no. May the IRS discuss this Return with the preparer shown above? (see instructions) X Yes No 932001 02-04-10 LHA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

6 Form 990 (2009). SEE SCHEDULE O FOR ORGANIZATION MISSION STATEMENT CONTINUATION. Form 990 (2009) OPPORTUNITY HOUSE 23-2543677 Page 2. Part III Statement of Program Service Accomplishments 1 Briefly describe the organization's mission: OPPORTUNITY HOUSE IS A MULTI-SERVICE ORGANIZATION THAT IMPROVES THE. QUALITY OF LIFE FOR CHILDREN, FAMILIES, AND ADULTS WHO FACE VARIOUS. OBSTACLES TO INDEPENDENCE, AND SUPPORTS THEIR EFFORTS TO ACHIEVE AND. MAINTAIN SELF-SUFFICIENCY AND WELL-BEING. 2 Did the organization undertake any significant program services during the year which were not listed on the prior Form 990 or 990-EZ? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ~~~~~ X Yes No If "Yes," describe these new services on Schedule O. 3 Did the organization cease conducting, or make significant changes in how it conducts, any program services?~~~~~~ Yes X No If "Yes," describe these changes on Schedule O. 4 Describe the exempt purpose achievements for each of the organization's three largest program services by expenses.

7 Section 501(c)(3) and 501(c)(4) organizations and section 4947(a)(1) trusts are required to report the amount of grants and allocations to others, the total expenses, and revenue, if any, for each program service reported. 4a (Code: ) (Expenses $ 1,925,909. including grants of $ ) (Revenue $ 1,830,612. ). LEARNING CENTER - SINCE 1996, THE SECOND STREET LEARNING CENTER HAS. PROVIDED PARENTS WHO WORK WITH THE FIRST CHILDCARE CENTER TO BE. RECOGNIZED BY THE STATE AS A 24/7 PROGRAM. CARE IS PROVIDED ON-SITE. FOR OVER 280 CHILDREN PER WEEK WHO LIVE AT THE SHELTER AND IN THE. COMMUNITY. THE CHILDREN RANGE FROM INFANCY THROUGH SCHOOL-AGE. INCLUDING THOSE WITH SPECIAL NEEDS. THE LEARNING CENTER ALSO MEETS. TRANSPORTATION NEEDS TO AND FROM ALL READING ELEMENTARY AND MIDDLE. SCHOOLS. IN FYE 2010, THE CENTER SERVED AN AVERAGE OF 13 INFANTS, 56. TODDLERS, 78 PRE-SCHOOLERS, AND 140 SCHOOL-AGED CHILDREN EACH WEEK. 4b (Code: ) (Expenses $ 795,282.)

8 Including grants of $ ) (Revenue $ 39,445. ). SHELTER - SINCE 1984, THE SHELTER HAS BEEN OPERATIONAL 24 HOURS A DAY, 7 DAYS A WEEK TO MEET THE IMMEDIATE PHYSICAL NEEDS OF THE HOMELESS. WHILE ALSO OFFERING INTENSIVE COUNSELING, GOAL-PLANNING, LIFE-SKILLS. EDUCATION, COMMUNITY SERVICE, MONEY MANAGEMENT TRAINING, AFTER-CARE. SERVICES, ADDICTION AWARENESS, PARENTING, SELF-ESTEEM, AND NUTRITION. AND HEALTH EDUCATION. IN FYE 2010, THE SHELTER SERVED AN AVERAGE OF. 104 HOMELESS MEN, WOMEN, AND CHILDREN EACH EVENING. 4c (Code: ) (Expenses $ 332,486. including grants of $ ) (Revenue $ 0. ). HOMELESSNESS PREVENTION AND RAPID RE-HOUSING (HPRP) - THE GOAL OF THE. PROGRAM IS TO PROVIDE HOMELESS PREVENTION ACTIVITIES TO HOUSEHOLDS THAT. WOULD OTHERWISE BECOME HOMELESS AND TO PROVIDE ASSISTANCE TO RAPIDLY. RE-HOUSE PERSONS WHO ARE CURRENTLY HOMELESS. THIS WILL BE ACCOMPLISHED. BY DETERMINING ELIGIBILITY OF APPLICANTS, ASSESSING BARRIERS TO. HOUSING, PROVIDING APPROPRIATE INTERVENTIONS, LINKING TO OTHER.

9 SERVICES/RESOURCES IN THE COMMUNITY, AND TRACKING OUTCOMES FOR THOSE. PERSONS PARTICIPATING IN THE PROGRAM. IN FYE 2010, OPPORTUNITY HOUSE. ASSISTED 135 PERSONS/FAMILIES THROUGH HOMELESS PREVENTION AND 79. PERSONS/FAMILIES THROUGH RAPID RE-HOUSING. 4d Other program services. (Describe in Schedule O.). (Expenses $ 476,837. including grants of $ ) (Revenue $ 85,977. ). 4e Total program service expenses J $ 3,530,514. Form 990 (2009). 932002. 02-04-10. Form 990 (2009) OPPORTUNITY HOUSE 23-2543677 Page 3. Part IV Checklist of Required Schedules Yes No 1 Is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? If "Yes," complete Schedule A ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ~~~~~~~ 1 X. 2 Is the organization required to complete Schedule B, Schedule of Contributors? ~~~~~~~~~~~~~~~~~~~~~~ 2 X. 3 Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates for public office?

10 If "Yes," complete Schedule C, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 3 X. 4 Section 501(c)(3) organizations. Did the organization engage in lobbying activities? If "Yes," complete Schedule C, Part II ~ 4 X. 5 Section 501(c)(4), 501(c)(5), and 501(c)(6) organizations. Is the organization subject to the section 6033(e) notice and reporting requirement and proxy tax? If "Yes," complete Schedule C, Part III ~~~~~~~~~~~~~~~~~~~~~~~~ 5. 6 Did the organization maintain any donor advised funds or any similar funds or accounts where donors have the right to provide advice on the distribution or investment of amounts in such funds or accounts? If "Yes," complete Schedule D, Part I 6 X. 7 Did the organization receive or hold a conservation easement, including easements to preserve open space, the environment, historic land areas, or historic structures? If "Yes," complete Schedule D, Part II~~~~~~~~~~~~~~ 7 X. 8 Did the organization maintain collections of works of art, historical treasures, or other similar assets?