Transcription of Finance - downloads.capta.org

1 Finance These Finance tools help financial officers of unit , council, and district PTAs gain a better understanding of their responsibilities, keep and maintain accurate records, and exercise proper control of all PTA monies. Sound financial procedure must be a prime concern of the treasurer as well as all officers and chairmen. Although fund-raising is not a Purpose of the PTA, funds must be raised to carry on the work of the organization. Each PTA should raise only the funds necessary to conduct annual activities and projects as outlined in the PTA's adopted budget. Fundraisers should be planned to meet all budget expenditures, including special projects and funds for emergencies.

2 Remember that providing adequate public school facilities, supplies, and programs is the responsibility of the taxpayers, not the PTA. Public officials must remain responsible for providing each and every student with the resources necessary for an equitable, quality education. TABLE OF CONTENTS. Policies and Procedures Fiduciary Responsibilities .. F5. Signs of Good Financial Procedures .. F5. Sample Financial Calendar of Activities .. F5. Records Retention and Destruction Policy .. F6. Commingling of Funds .. F7. Fiduciary Agreements and Gifts to School .. F7. Contracts .. F8. Home Harmless Agreements.

3 F8. Miscellaneous Operating Information .. F8. Special Request for Professional Opinion .. F8. PTA-Provided Babysitting Services .. F9. Handling Requests for Relief Assistance .. F9. School Bond and Other Ballot Measure Campaigns .. F9. Financial Officers Financial Officers .. F9. Treasurer Duties .. F10. Financial Secretary Duties .. F11. Auditor Duties .. F11. President Financial Duties .. F11. Secretary Financial Duties .. F11. Vice President/Chairman Financial Duties .. F12. Financial Officer Transition .. F12. Records, Reports and Forms Contents of the Treasurer's F12. Computer-Generated Financial Records.

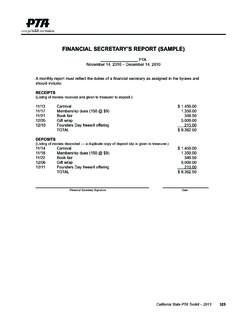

4 F13. Guidelines for Computer Use .. F13. Budget .. F13. Treasurer's Report .. F13. Financial Secretary's Report .. F14. Auditor's Report .. F14. Annual Financial Report .. F14. unit remittance Form .. F14. Cash Verification Form .. F14. Payment Authorization/Request for Reimbursement Form .. F14. Workers' Compensation Annual Payroll Report .. F14. Finance F1 California State PTA Toolkit June 2019. Banking Banking .. F15. Bank Statements .. F15. Outstanding Checks .. F16. Deposits .. F16. Bank Cards/ATM and Credit Cards .. F16. Petty Cash .. F16. Savings Account .. F16. Income and Expense Income.

5 F17. Handling PTA Funds .. F17. Providing Documentation to Donors .. F17. Returned Non-Sufficient-Funds Checks .. F18. NSF Checks Bookkeeping Procedures .. F18. Non-Dues Revenue .. F18. Financial Procedures for the Internet .. F19. Expenditures .. F19. Check Request System: Payment Authorization/Request for Reimbursement .. F19. Authorization Procedure Funds Budgeted But Not Authorized .. F19. Unbudgeted Expenditures .. F20. Financial Procedures for the Internet .. F20. Payment Via Electronic Funds Transfer/Bank Bill Pay Services .. F20. Request for Advance .. F21. Stale Dated Checks.

6 F21. Budgeting Developing the Budget .. F21. Recommended Budget Line Items .. F22. Funds Not Belonging to the unit .. F22. Approving the Budget .. F22. Amending the Budget .. F23. Protecting PTA Tax Exemption .. F23. Fundraising Local Requirements for F23. Standards for PTA Fundraising .. F23. Fundraising Committee Responsibilities .. F23. Committee Procedures .. F23. Fundraising Inventory Management .. F24. Noncommercial Policy .. F24. Sponsorship versus F24. Selecting Appropriate Fundraising Activities .. F25. Obtaining F27. Programs at Schools PTA Funds versus School Funds .. F28.

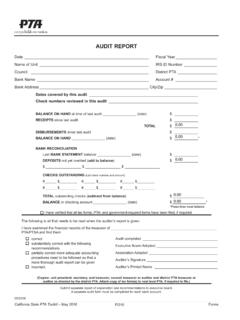

7 Field Trips .. F28. School Staff Positions .. F28. Computers, Technology and Other Major Purchases .. F29. Academic Enrichment Programs .. F29. Personal Gifts .. F30. Hospitality .. F30. Staff Appreciation .. F30. Volunteer Appreciation .. F30. PTA and Education Foundations .. F31. California State PTA Toolkit June 2019 F2 Finance PTA Audit Audit F31. Purpose of an Audit .. F31. Preparation for an Audit .. F31. Audit Procedure and Recommendations .. F32. Audit Report .. F33. Tax Filing Tax Requirements .. F33. Employer Identification Number (EIN) .. F33. Tax-Exempt Status and Letters of Determination.

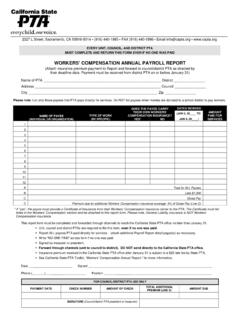

8 F33. Sales Tax .. F33. Federal Taxes .. F34. State Taxes and Government Forms .. F34. Gross Receipts .. F35. Unrelated Business Income F35. Filing Due Dates .. F35. Officer Responsibilities for Filing .. F35. Resources .. F36. Internal Revenue Service (IRS) Audit .. F36. PTA as an Employer Employee versus Independent Contractor .. F36. Approving Projects That Require Employees .. F36. Planning .. F36. Hiring Requirements .. F37. Comprehensive General Liability Insurance for Independent F37. Workers' Compensation Insurance .. F37. In Case of Employee Injury .. F37. Workers' Compensation Annual Payroll Report.

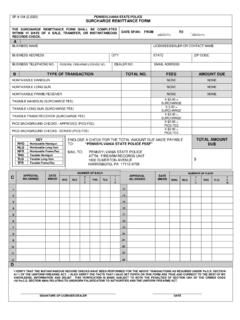

9 F37. Employer Tax and Withholding Requirements .. F38. Filing Requirements for Employers .. F38. Penalties .. F38. Filing Requirements for Independent Contractors .. F38. Insurance Insurance Claims .. F39. Mismanagement of Funds/Embezzlement .. F39. Glossary ..39. FIGURES. F-1 Budget (Sample) .. F42. F-2 Treasurer's Report (Sample) .. F43. F-3 Financial Secretary's Report .. F44. F-4 Audit Report .. F45. F-5 Audit Checklist .. F46. F-6 Annual Financial Report (Sample) .. F47. F-7 unit remittance Form .. F48. F-8 Cash Verification Form .. F49. F-9 Payment Authorization/Request for Reimbursement.

10 F50. F-10 Workers' Compensation Annual Payroll Report (Sample) .. F51. F-11 Authorization for Payment Via EFT/Bank Bill Pay Services .. F52. Finance F3 California State PTA Toolkit June 2019. California State PTA Toolkit June 2019 F4 Finance Has the bank statements reviewed monthly by a non- Policies and Procedures check signer; may be the auditor. Fiduciary Responsibilities Conducts at least two audits per year, in accordance with the bylaws. The responsibilities of financial officers are specified in the association bylaws and are also established in Files the appropriate IRS Form 990 annually and any California State PTA policies and procedures.